Narratives are currently in beta

Key Takeaways

- The acquisition of Inari Medical and divestment of the Spinal Implants business aim to realign Stryker’s focus towards high-growth, high-margin segments.

- Ongoing technological investments and international expansion, particularly in emerging markets, are key strategies for revenue and margin growth enhancement.

- Stryker's growth strategy through M&A poses execution risks, with integration challenges potentially impacting margins, earnings, and operational efficiency amidst competitive pressures.

Catalysts

About Stryker- Operates as a medical technology company.

- The acquisition of Inari Medical is expected to position Stryker as a leader in the fast-growing mechanical thrombectomy market, addressing a $15 billion global opportunity. This expansion is expected to accelerate revenue growth as Inari has historically grown its revenues over 20% annually with a gross margin profile of approximately 85%.

- The sale of the Spinal Implants business, which has not met performance expectations, may allow Stryker to reallocate resources to higher-growth areas. By divesting this slower-growing segment, Stryker can potentially enhance net margins as they focus on more profitable segments.

- Stryker's ongoing investment in technological advancements like the Mako robotic systems for knee, hip, and now shoulder and spine surgeries, is anticipated to drive increased utilization and expand market presence, potentially boosting both revenue and operating margins.

- Stryker's international sales, which grew by 8.8% in 2024, signify substantial opportunities for expansion, particularly in emerging markets. As these regions continue to develop, they could significantly contribute to revenue growth.

- The momentum in Stryker’s MedSurg and Neurotechnology divisions, driven by robust demand for capital products and new product launches like LIFEPAK 35, is expected to continue, supporting both top-line growth and improvements in adjusted operating margins.

Stryker Future Earnings and Revenue Growth

Assumptions

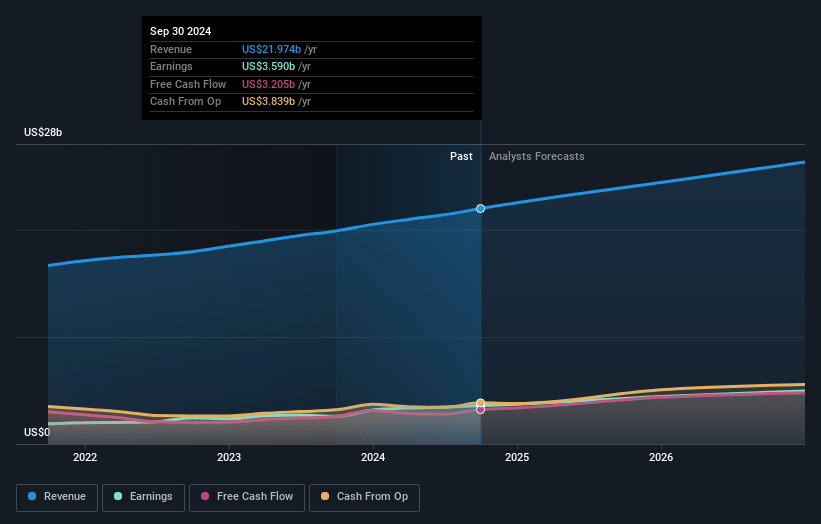

How have these above catalysts been quantified?- Analysts are assuming Stryker's revenue will grow by 8.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.3% today to 17.6% in 3 years time.

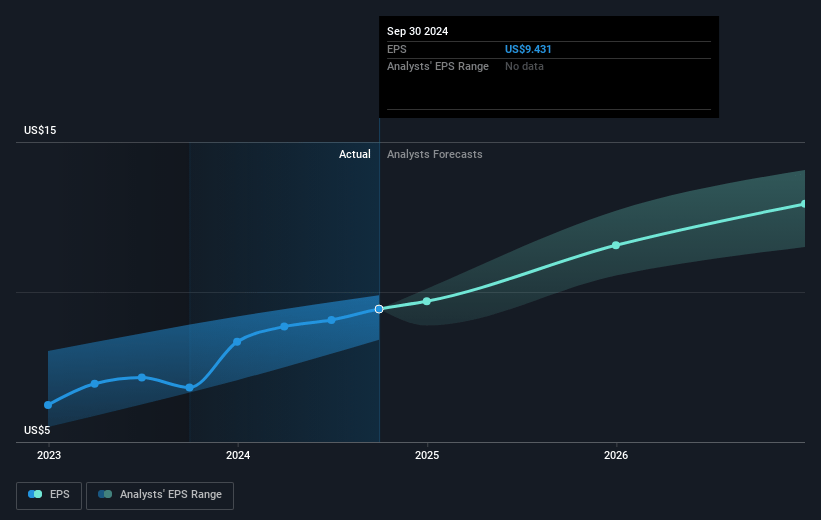

- Analysts expect earnings to reach $4.9 billion (and earnings per share of $12.94) by about January 2028, up from $3.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.4 billion in earnings, and the most bearish expecting $4.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.3x on those 2028 earnings, down from 42.0x today. This future PE is greater than the current PE for the US Medical Equipment industry at 34.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.67%, as per the Simply Wall St company report.

Stryker Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The divestiture of Stryker's Spinal Implants business, which has underperformed, could lead to a temporary decrease in total revenue until re-investment areas ramp up.

- The acquisition of Inari Medical, while strategically complementary, is initially dilutive to operating margins and EPS due to integration costs and the need to absorb additional interest expenses, potentially affecting net earnings.

- The reliance on multiple M&A deals to drive growth presents execution risk, as missteps in integration could affect operational efficiency and revenue outcomes.

- The impact of foreign currency fluctuations, with an expected unfavorable effect on sales and earnings, represents an ongoing risk to revenue and potentially net margins.

- Stryker faces competitive pressures in various core markets; any underperformance or disruption could adversely impact revenue growth and market positioning.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $408.49 for Stryker based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $450.0, and the most bearish reporting a price target of just $276.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $28.0 billion, earnings will come to $4.9 billion, and it would be trading on a PE ratio of 38.3x, assuming you use a discount rate of 6.7%.

- Given the current share price of $395.15, the analyst's price target of $408.49 is 3.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

TO

Tokyo

Community Contributor

Investing in Stryker (SYK) should be an easy ride

Investing in Stryker (SYK) should be an easy ride Key “Take aways”: - Solid balance sheet - Earnings recovered, with positive outlook. - SYK is fair priced.

View narrativeUS$323.52

FV

20.9% overvalued intrinsic discount6.00%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

3users have followed this narrative

7 months ago author updated this narrative