Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and new product rollouts in healthcare IT and pain management are driving Stryker's revenue growth and market expansion.

- Increased operational efficiency and strategic pricing are boosting profitability, with significant margin expansion expected by 2025.

- Supply chain challenges, acquisition integration risks, and pricing pressures could impede Stryker's sales growth and pressure margins across various business segments.

Catalysts

About Stryker- Operates as a medical technology company.

- Stryker's acquisitions of care.ai, NICO Corporation, and Vertos Medical are expected to enhance their product offerings and drive future revenue growth, especially in the healthcare IT and pain management markets.

- The strong global demand for Stryker's capital products, highlighted by record Q3 installations of the Mako robotic-assisted surgery system, is expected to continue, potentially boosting Stryker’s revenue and market share.

- The rollout of new platforms like the Pangea plating system and the LIFEPAK 35 defibrillator is anticipated to contribute to revenue growth, with significant sales expected in US markets starting in late 2025.

- Initiatives in operational efficiency and pricing strategies have led to increased profitability, with Stryker targeting a 200 basis points margin expansion by the end of 2025, likely improving net margins.

- Upcoming installations and expanded utilization of spine offerings, such as Mako Spine and CoPilot software, along with Mako Shoulder launching at the end of the year, are projected to drive earnings and revenue growth for Stryker’s orthopedic segment.

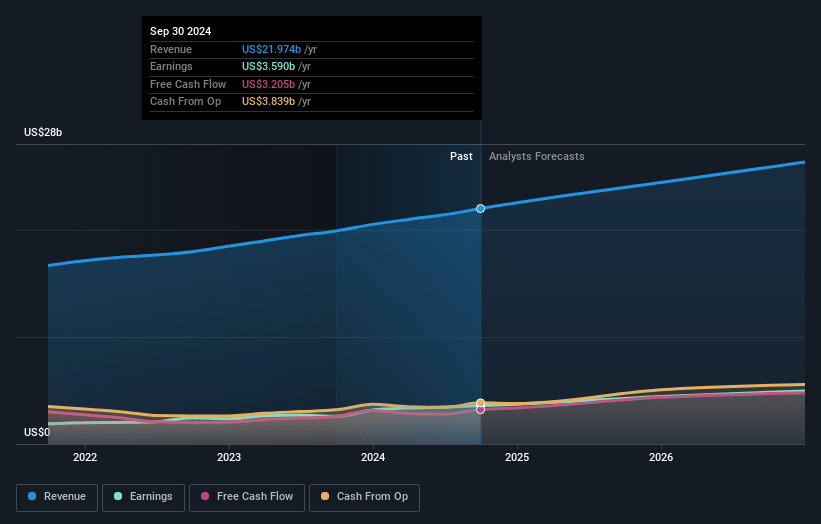

Stryker Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Stryker's revenue will grow by 8.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.3% today to 17.7% in 3 years time.

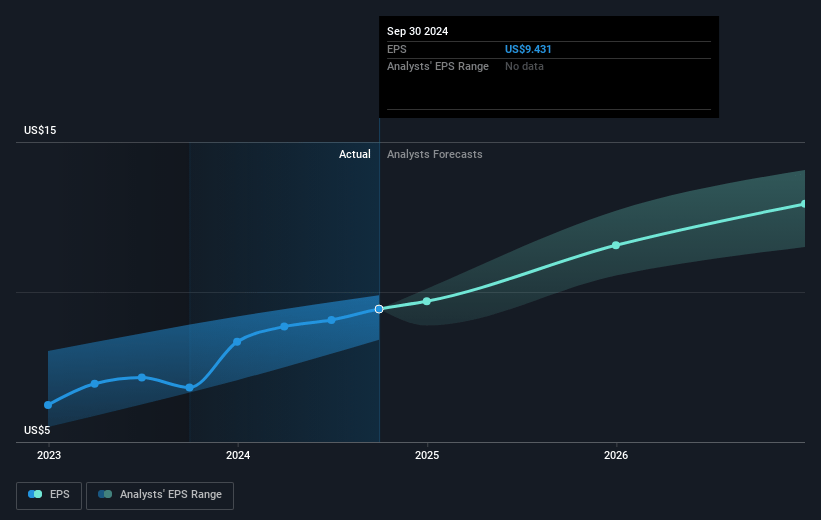

- Analysts expect earnings to reach $4.9 billion (and earnings per share of $12.91) by about December 2027, up from $3.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.4 billion in earnings, and the most bearish expecting $4.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.6x on those 2027 earnings, down from 40.6x today. This future PE is greater than the current PE for the US Medical Equipment industry at 37.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.66%, as per the Simply Wall St company report.

Stryker Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Supply chain issues earlier in the year, coupled with competitive pressures in the ischemic business, could hinder sales growth in the Neurovascular segment, potentially impacting overall revenue.

- High levels of recent acquisition activity, with about $1.6 billion spent and expectations of $300 million in sales contribution from these acquisitions, could lead to integration risks and might weigh on net margins if synergies aren't realized effectively.

- There is continued pricing pressure within orthopedics, particularly in the U.S., despite some international pricing improvements. This could limit improvements in net margins if competitive pricing dynamics persist.

- Foreign currency fluctuations remain a risk, potentially leading to slightly unfavorable impacts on sales and reducing adjusted EPS by approximately $0.10, affecting overall earnings.

- Seasonal variability and fluctuations in the deal mix of Mako installations could impact short-term revenues in the Orthopedics segment and could introduce uncertainties in forecasting quarterly performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $400.2 for Stryker based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $450.0, and the most bearish reporting a price target of just $276.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $27.8 billion, earnings will come to $4.9 billion, and it would be trading on a PE ratio of 37.6x, assuming you use a discount rate of 6.7%.

- Given the current share price of $382.68, the analyst's price target of $400.2 is 4.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

TO

Tokyo

Community Contributor

Investing in Stryker (SYK) should be an easy ride

Investing in Stryker (SYK) should be an easy ride Key “Take aways”: - Solid balance sheet - Earnings recovered, with positive outlook. - SYK is fair priced.

View narrativeUS$323.52

FV

16.3% overvalued intrinsic discount6.00%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

5 months ago author updated this narrative