Key Takeaways

- Expanding the AirSense 11 platform and launching innovative CPAP products could boost revenue and market share significantly worldwide.

- Strategic investments in AI and digital health platforms are expected to improve patient outcomes, operational efficiencies, and long-term earnings growth.

- ResMed faces challenges from supply disruptions, competition, economic and regulatory pressures, while relying on new product uptake and innovations for future growth and earnings.

Catalysts

About ResMed- Develops, manufactures, distributes, and markets medical devices and cloud-based software applications for the healthcare markets.

- ResMed is expanding the availability of its AirSense 11 platform worldwide, which could drive significant revenue growth as regulatory approvals increase its market reach globally.

- The launch of the AirTouch N30i mask, with unique fabric technology, is expected to set a new standard in CPAP therapy, potentially boosting revenue and increasing market share by appealing to a broader customer base.

- ResMed's involvement in sleep health consumer wearables and integration with platforms like NightOwl could drive growth by increasing patient engagement and therapy adherence, positively impacting revenue and patient outcomes.

- Favorable macro trends such as the expanded use of GLP-1 medications may act as tailwinds, increasing the demand for ResMed's PAP devices, thus positively affecting revenue and adherence rates.

- Continued strategic investments in AI and digital health platforms are expected to enhance patient outcomes and operational efficiencies, potentially leading to improved net margins and long-term earnings growth.

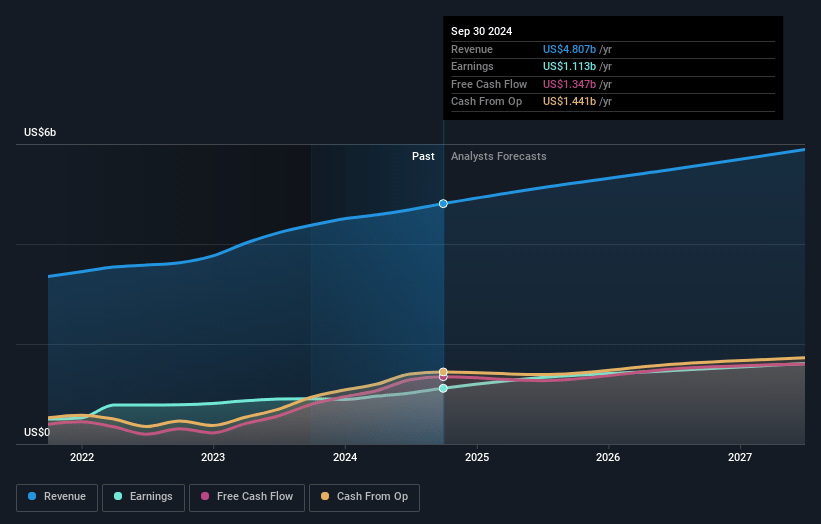

ResMed Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ResMed's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 23.1% today to 27.7% in 3 years time.

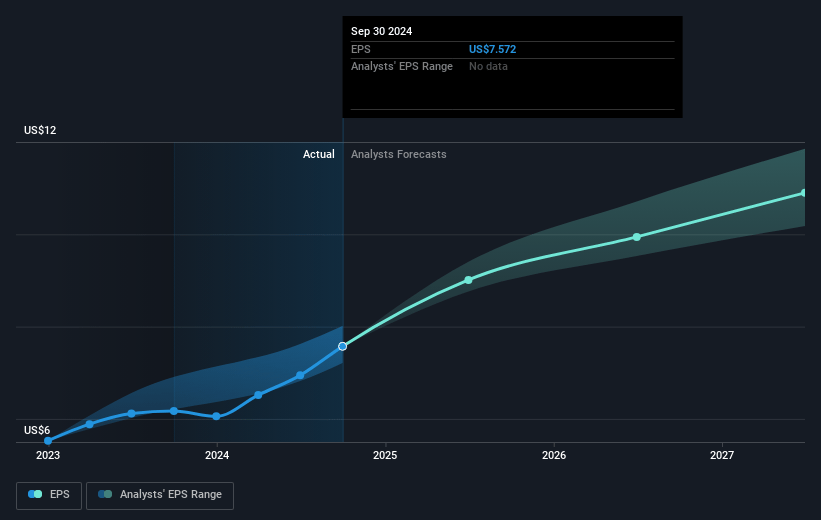

- Analysts expect earnings to reach $1.7 billion (and earnings per share of $11.23) by about January 2028, up from $1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.8x on those 2028 earnings, down from 33.0x today. This future PE is lower than the current PE for the AU Medical Equipment industry at 34.7x.

- Analysts expect the number of shares outstanding to grow by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.51%, as per the Simply Wall St company report.

ResMed Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ResMed faces potential supply chain disruptions, such as the Middle East conflict and Asian port congestion, which could increase costs and impact margins and earnings.

- A rising competitive environment, particularly in the European and broader Rest of World markets, may challenge ResMed's ability to sustain market share and device sales growth, affecting revenue.

- Economic and regulatory factors, including potential changes in reimbursement rates and macroeconomic conditions, could weigh on pricing strategies and pressure net margins.

- Dependence on successful market uptake of new product launches, like the AirTouch N30i, which may not achieve expected demand or pricing premiums, could affect future revenue growth.

- The reliance on technological innovations, such as AI-driven solutions and partnerships with wearable tech companies, requires substantial investment and successful execution to positively impact long-term financial performance, particularly earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $258.97 for ResMed based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $295.0, and the most bearish reporting a price target of just $190.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.0 billion, earnings will come to $1.7 billion, and it would be trading on a PE ratio of 27.8x, assuming you use a discount rate of 6.5%.

- Given the current share price of $249.94, the analyst's price target of $258.97 is 3.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives