Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and collaborations in genetic and oncology testing are expected to boost revenue growth and earnings.

- The LaunchPad initiative aims to improve net margins by delivering significant savings, offsetting higher personnel costs.

- Acquisition-driven growth faces challenges from competitive pressures and changing market conditions, while debt leverage and weather risks threaten financial flexibility and performance.

Catalysts

About Labcorp Holdings- Provides laboratory services.

- The acquisition of Invitae and its genetic testing solutions is expected to be slightly accretive to earnings for 2025, contributing to top line growth of approximately 10%, which can positively impact revenue and earnings.

- The LaunchPad initiative aims to deliver $100 million to $125 million in savings this year, expected to help improve net margins by offsetting higher personnel costs.

- Strategic acquisitions, including partnerships with health systems and regional labs, are projected to increase inorganic growth by 1.5% to 2.5%, enhancing revenue growth.

- The completion of new collaborations and FDA approvals, particularly in the oncology testing sector, should widen the company's advanced testing offerings, supporting revenue growth.

- Recent postponement of the implementation of PAMA removes a potential $80 million revenue headwind in 2025, potentially benefiting future earnings and cash flow.

Labcorp Holdings Future Earnings and Revenue Growth

Assumptions

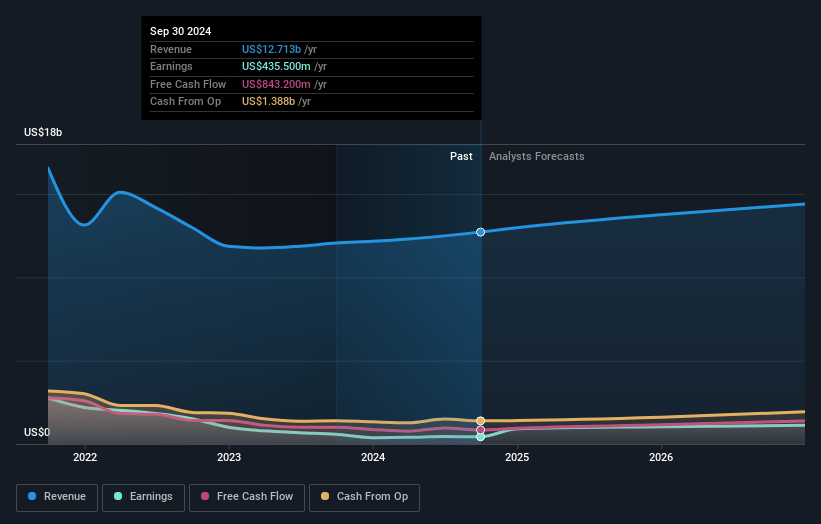

How have these above catalysts been quantified?- Analysts are assuming Labcorp Holdings's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.4% today to 8.9% in 3 years time.

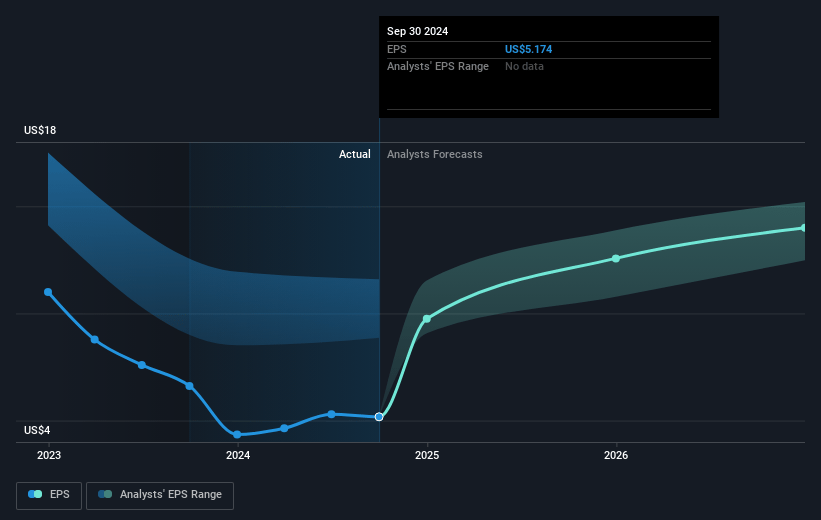

- Analysts expect earnings to reach $1.3 billion (and earnings per share of $15.88) by about January 2028, up from $435.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, down from 47.7x today. This future PE is lower than the current PE for the US Healthcare industry at 23.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.06%, as per the Simply Wall St company report.

Labcorp Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The integration of Invitae has caused a decline in enterprise margins by 40 basis points, with expectations for continued negative margin impact into the first half of 2025, potentially affecting net margins and earnings.

- There is mention of significant weather-related impacts on revenues and margins, with a notable $0.15 per share hit from weather in future earnings guidance, indicating potential operational risks impacting financial performance.

- Early development business within Biopharma Laboratory Services faced an 11% revenue decline, partly offset by expectations of future growth, yet reflecting susceptibility to high cancellations and competitive pressures potentially affecting revenues.

- There is a focus on acquisitions contributing to revenue growth, but competition and changing market conditions in the core diagnostic and laboratory industry might dilute the impact of these gains on overall revenue growth.

- Debt leverage stands at 2.4x net debt to trailing 12 months adjusted EBITDA, with significant upcoming debt maturities potentially impacting financial flexibility, thereby influencing net earnings and the ability to fund further growth initiatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $260.95 for Labcorp Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $291.0, and the most bearish reporting a price target of just $231.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.8 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 6.1%.

- Given the current share price of $248.51, the analyst's price target of $260.95 is 4.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives