Last Update07 May 25Fair value Decreased 4.93%

Key Takeaways

- The company’s product innovation and integration of digital tools are accelerating adoption, driving revenue growth, margin expansion, and operational efficiencies.

- Expanded reimbursement coverage and ongoing global market entry remove key adoption barriers, setting the stage for broader and more diversified long-term growth.

- Heavy US dependence, rising costs, and slow international adoption create vulnerability to reimbursement shifts, new competitors, and evolving healthcare delivery models.

Catalysts

About Inspire Medical Systems- A medical technology company, focuses on the development and commercialization of minimally invasive solutions for patients with obstructive sleep apnea (OSA) in the United States and internationally.

- Inspire Medical Systems is benefiting from rapid growth in the addressable market as awareness of obstructive sleep apnea rises alongside an aging and more health-conscious population, creating a strong long-term tailwind for procedure volumes, which directly supports recurring revenue growth.

- The full commercial launch of the Inspire V system represents a transformational product cycle, with procedural advantages such as simplified surgery and reduced operating room time, accelerating patient demand and center adoption, which is likely to drive outsized revenue growth and gross margin accretion as the product mix shifts.

- The successful integration of digital tools like SleepSync and digital scheduling is unlocking higher patient flow and provider throughput, enabling broader adoption and operational efficiencies that have a direct positive impact on earnings and net margins.

- Strong payer coverage, with approximately 80% of 300 million covered lives now eligible for reimbursement—including Medicare and major commercial payers—removes key adoption barriers, widening the funnel for both near-term and long-term growth in top-line revenue.

- Ongoing global expansion, including expected regulatory submissions for Inspire V in Europe and Asia, as well as label and indication expansion, stand to meaningfully increase future international sales, further diversifying revenue streams and providing potential for elevated earnings growth as new geographies come online.

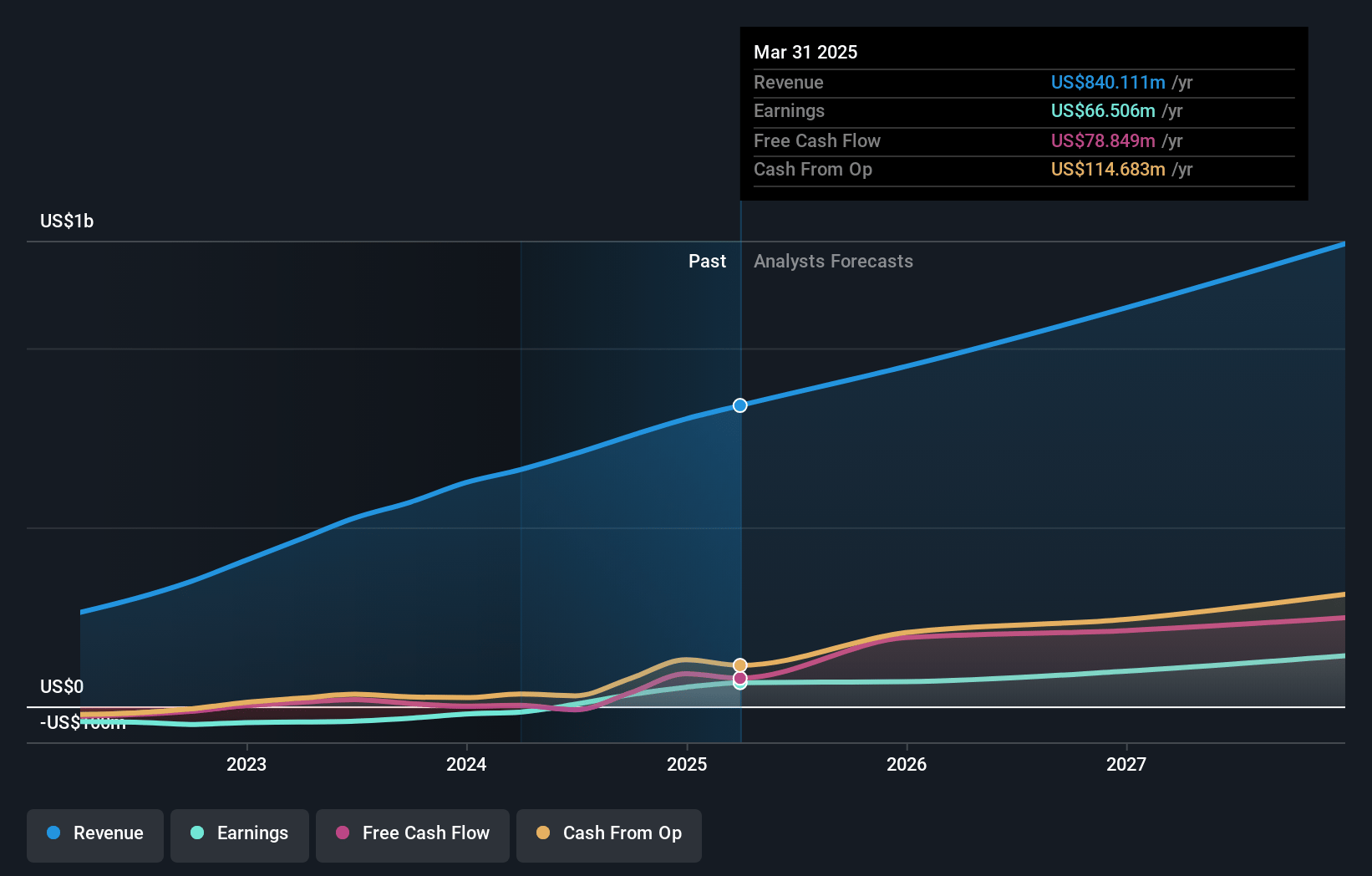

Inspire Medical Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Inspire Medical Systems compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Inspire Medical Systems's revenue will grow by 17.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.9% today to 13.2% in 3 years time.

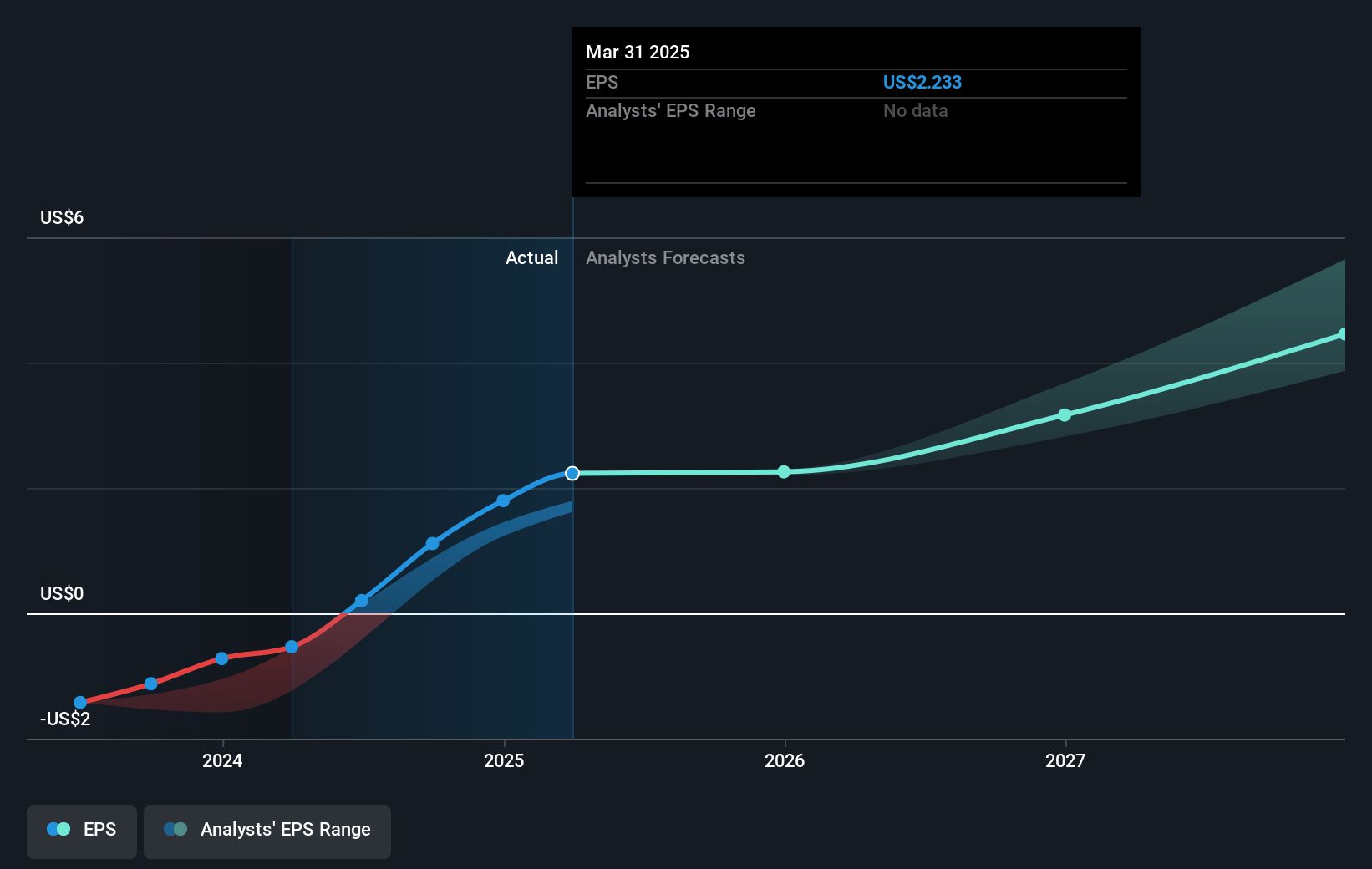

- The bullish analysts expect earnings to reach $177.0 million (and earnings per share of $5.65) by about May 2028, up from $66.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 52.2x on those 2028 earnings, down from 71.8x today. This future PE is greater than the current PE for the US Medical Equipment industry at 30.3x.

- Analysts expect the number of shares outstanding to decline by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

Inspire Medical Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite current US growth, international revenues declined by 6 percent year-over-year and face complex regulatory hurdles in Europe and Asia, suggesting that sluggish international adoption could constrain long-term revenue diversification and topline growth.

- The company’s heavy reliance on continued surgical intervention contrasts with broader healthcare trends prioritizing prevention and digital or remote solutions, which could reduce future procedural volumes and adversely affect both revenue growth and net margins.

- Long-term risk exists from new, non-implantable or minimally invasive sleep apnea treatments, such as pharmaceuticals or AI-driven diagnostics, which could disrupt the addressable market for Inspire Medical Systems and undermine sustained revenue expansion.

- Operating expenses continue to rise to support sales force, marketing, and medical education, and the company indicated these will increase further with the Inspire V launch; if revenue growth does not keep pace, this will place ongoing pressure on net margins and earnings.

- Inspire’s revenues remain highly concentrated in the US, with limited evidence of strong global demand, making the company vulnerable to US reimbursement changes or broader cost containment efforts by payers that could limit pricing power and depress revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Inspire Medical Systems is $270.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Inspire Medical Systems's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $270.0, and the most bearish reporting a price target of just $172.22.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $177.0 million, and it would be trading on a PE ratio of 52.2x, assuming you use a discount rate of 6.9%.

- Given the current share price of $161.88, the bullish analyst price target of $270.0 is 40.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.