Key Takeaways

- Strategic product experience improvements and clinical excellence initiatives aim to drive revenue growth, reduce system costs, and enhance profitability.

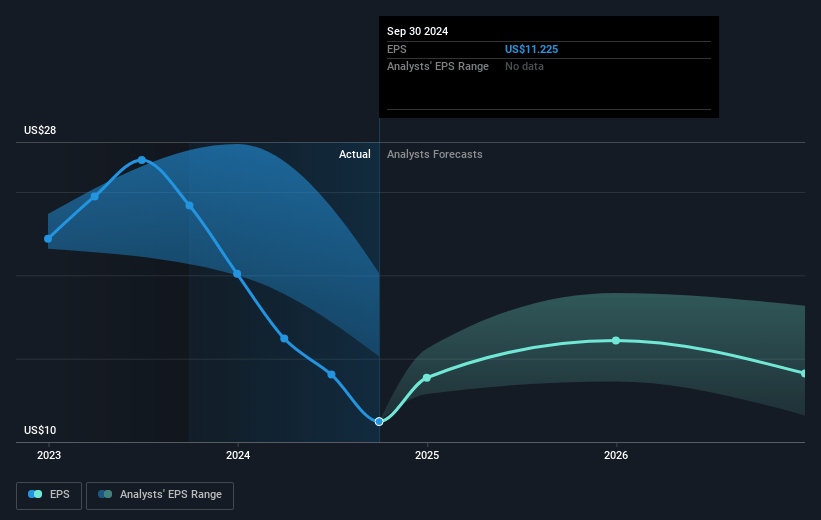

- Operational efficiencies, strategic capital allocation, and proactive cost management are set to improve earnings margins and support sustainable EPS growth.

- Regulatory transitions, sector volatility, and competitive pressures challenge Humana's financial performance, impacting Medicare Advantage margins and Medicaid expansion profitability.

Catalysts

About Humana- Provides medical and specialty insurance products in the United States.

- Humana is focused on optimizing customer growth, retention, and lifetime value through product experience improvements, which is set to drive future revenue growth.

- The emphasis on clinical excellence, closing care gaps, and improving Stars performance is designed to reduce system costs and thereby enhance product profitability, potentially boosting net margins.

- The company is successfully implementing operational efficiencies, reducing the operating expense ratio by 40 basis points, which is expected to contribute to better earnings margins.

- Strategic capital allocation and growth through expanded primary care footprint and Medicaid expansion are anticipated to enhance long-term earnings capacity.

- The focus on multiyear planning and proactive decision making around cost management, coupled with selective investment, is expected to lead to sustainable margin recovery and EPS growth over time.

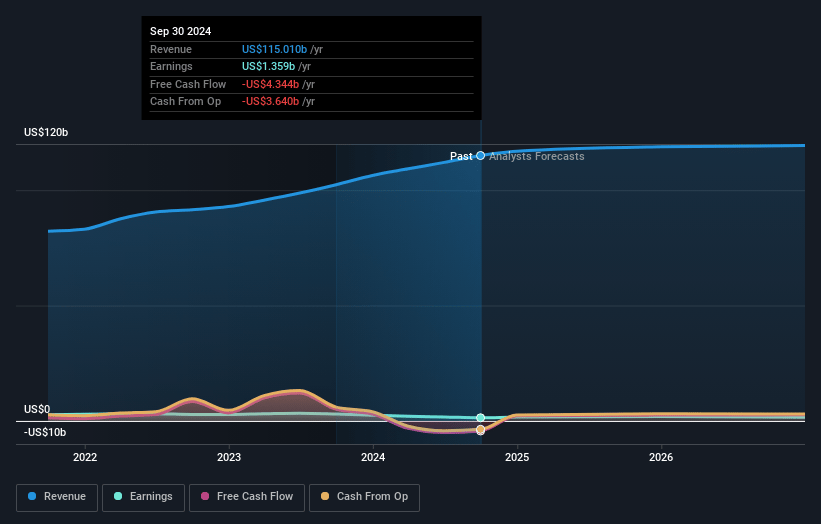

Humana Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Humana compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Humana's revenue will grow by 9.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.0% today to 2.2% in 3 years time.

- The bullish analysts expect earnings to reach $3.3 billion (and earnings per share of $27.24) by about April 2028, up from $1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, down from 28.6x today. This future PE is lower than the current PE for the US Healthcare industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.3%, as per the Simply Wall St company report.

Humana Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Humana is navigating regulatory transitions and sector-specific volatility which could impede its ability to consistently deliver compelling financial performance and maintain earnings growth.

- The company is under pressure to achieve a 3% margin in individual Medicare Advantage, contingent upon a competitive Stars position, effectively managed clinical excellence, and operating efficiency, all affecting net margins.

- Group MA margins are under pressure due to long-term contracts and competitive dynamics, potentially impacting profitability and the ability to achieve margin recovery in this segment.

- Investments in Medicaid expansion and the associated J-curve mean that new states are initially a financial drag, slowing earnings capacity and pressuring near-term financial performance.

- Humana is subject to fluctuations in the Medicare Advantage rate environment and uncertainties around Stars ratings thresholds, which could impact revenue forecasts and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Humana is $339.74, which represents one standard deviation above the consensus price target of $299.1. This valuation is based on what can be assumed as the expectations of Humana's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $402.23, and the most bearish reporting a price target of just $241.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $152.4 billion, earnings will come to $3.3 billion, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 6.3%.

- Given the current share price of $285.53, the bullish analyst price target of $339.74 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:HUM. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.