Narratives are currently in beta

Key Takeaways

- Expansion into new medical specialties and personalized solutions are expected to drive broad consumer attraction and future revenue growth.

- Technological advancements and operational efficiency improvements aim to enhance margins and optimize resource allocation.

- Significant marketing expenses and regulatory uncertainties could strain net margins, while reliance on personalized treatments and capital investments could impact revenue growth and liquidity.

Catalysts

About Hims & Hers Health- Operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally.

- The integration of personalized solutions into the Hims & Hers platform and the expansion into new specialties such as weight management are likely to drive future revenue growth by attracting a broader set of consumers.

- Increasing efficiency in operations, notably through technological advancements and vertical integration at affiliated facilities, is expected to improve adjusted EBITDA margins by optimizing resource allocation and reducing costs.

- Strategic investments in capacity expansion and automation across 503(a) and 503(b) facilities will allow the company to meet increased demand for personalized solutions, potentially enhancing revenue and margins as production scales.

- Expanding multi-condition solutions and increasing customer retention through high levels of customization can drive higher revenue per user, thereby positively impacting future earnings.

- Continued success in attracting and retaining subscribers from diverse demographic backgrounds, including less affluent communities, indicates strong demand for the platform, supporting sustained revenue growth over time.

Hims & Hers Health Future Earnings and Revenue Growth

Assumptions

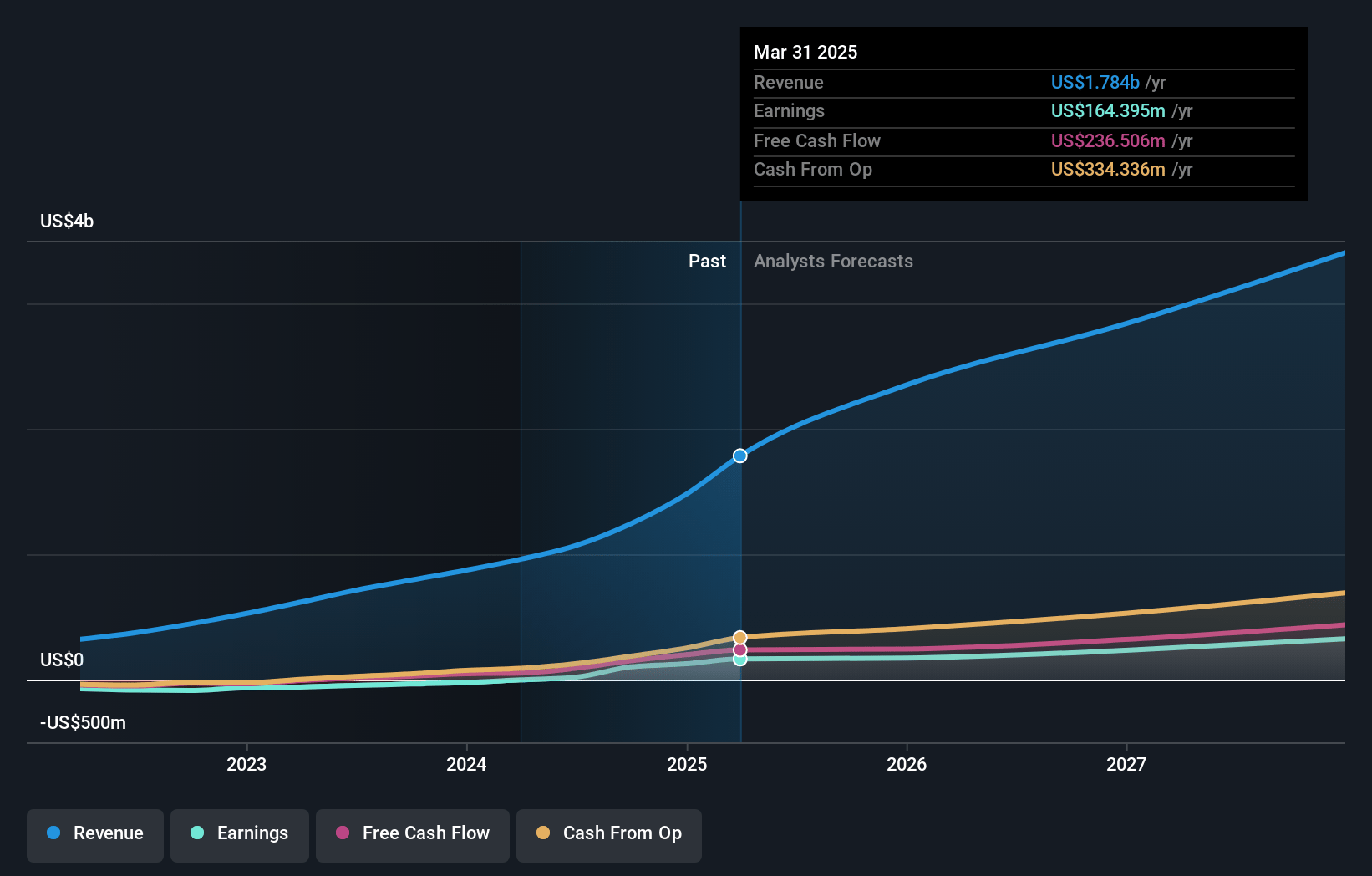

How have these above catalysts been quantified?- Analysts are assuming Hims & Hers Health's revenue will grow by 29.7% annually over the next 3 years.

- Analysts are assuming Hims & Hers Health's profit margins will remain the same at 8.2% over the next 3 years.

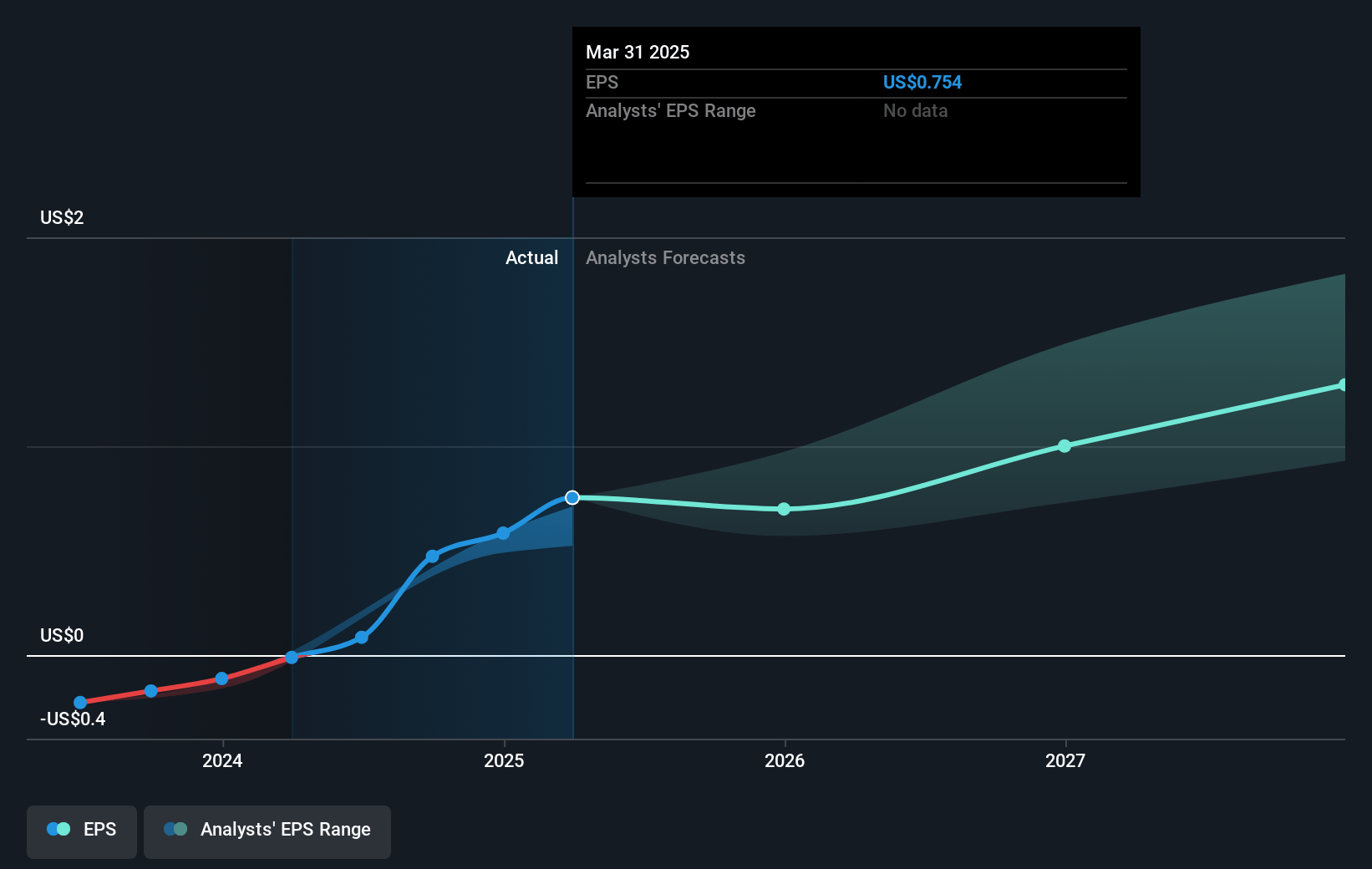

- Analysts expect earnings to reach $222.1 million (and earnings per share of $0.79) by about January 2028, up from $101.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.0x on those 2028 earnings, down from 59.7x today. This future PE is greater than the current PE for the US Healthcare industry at 23.7x.

- Analysts expect the number of shares outstanding to grow by 8.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.92%, as per the Simply Wall St company report.

Hims & Hers Health Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's marketing expenses are significant, consuming a large portion of revenue. While they have been reducing these expenses as a percentage of revenue, it remains a considerable cost that could impact net margins if not managed carefully.

- The company's gross margin has declined due to expanding their weight loss specialty offerings. While they expect future efficiency gains, continued degradation could affect overall profitability.

- There is regulatory uncertainty regarding the compounding and use of medications like GLP-1, which poses a risk to the revenue generated from these offerings if regulations become more restrictive or if shortages resolve and affect the demand for compounded medications.

- The company's reliance on expanding its subscriber base through personalization of treatments might falter if the demand for such tailored solutions wanes or if they fail to innovate at the current pace, impacting revenue growth.

- The financials predict substantial capital investments for increasing automation and capacity, which, while intended to support growth, could strain cash flow and impact liquidity if these investments do not yield anticipated returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.12 for Hims & Hers Health based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $38.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $222.1 million, and it would be trading on a PE ratio of 39.0x, assuming you use a discount rate of 5.9%.

- Given the current share price of $27.67, the analyst's price target of $26.12 is 5.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

WallStreetWontons

Community Contributor

Hims & Hers are taking grip on Telemedicine

Catalysts Financial Performance : In 2023 , Hims & Hers reported impressive financial results: Revenue : Reached $872.0 million , reflecting a 65% year-over-year increase. Net Income : Achieved $1.2 million in Q4 2023.

View narrativeUS$17.15

FV

98.0% overvalued intrinsic discount100.00%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

5users have followed this narrative

7 months ago author updated this narrative