Narratives are currently in beta

Key Takeaways

- Expanding treatment options and introducing new valve sizes should drive revenue growth by covering more patient needs and increasing market adoption.

- Strategic acquisitions and restructuring efforts enhance focus on heart therapies, potentially boosting revenue and improving resource allocation.

- Intense competition in the TAVR space and potential new entrants could challenge revenue growth by eroding market share and pricing power.

Catalysts

About Edwards Lifesciences- Provides products and technologies for structural heart disease and critical care monitoring in the United States, Europe, Japan, and internationally.

- The upcoming launch of the SAPIEN M3 valve in Europe and continued expansion in the U.S. is expected to drive significant revenue growth in the TMTT segment by providing more treatment options for patients with complex conditions.

- The introduction of the fourth and larger-size EVOQUE valve is anticipated to expand the addressable patient population, supporting increased revenue through broader adoption.

- The acquisition of JC Medical and JenaValve could open new revenue streams in the treatment of aortic regurgitation, a largely untreated condition affecting over 100,000 patients in the U.S.

- The NTAP approval for EVOQUE should support revenue and margins by enabling additional payments beyond standard reimbursement, thus encouraging hospitals to adopt the new therapy.

- The sale of Critical Care and rightsizing efforts are designed to sharpen the company’s focus on structural heart therapies, which should enhance both net margins and earnings by optimizing resource allocation.

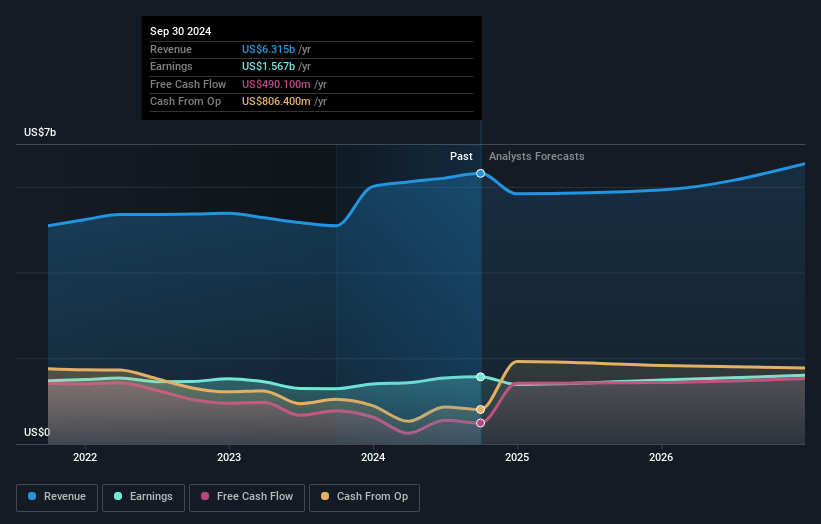

Edwards Lifesciences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Edwards Lifesciences's revenue will grow by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 24.8% today to 23.4% in 3 years time.

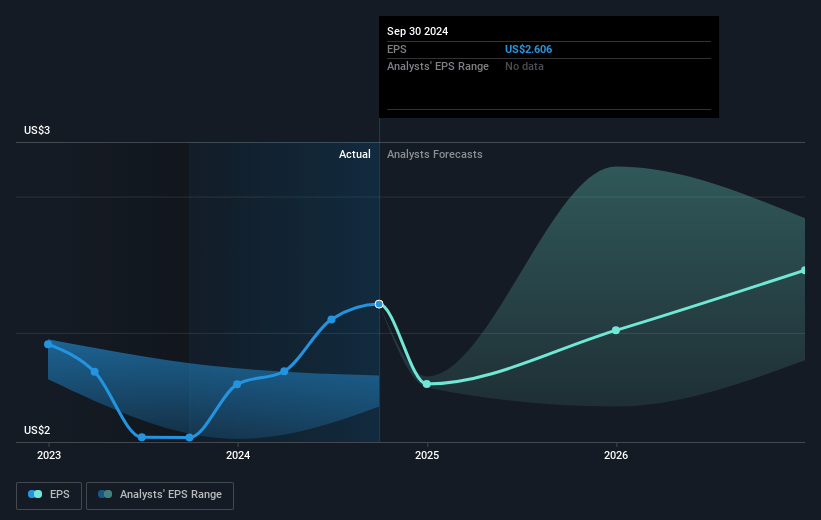

- Analysts expect earnings to remain at the same level they are now, that being $1.6 billion (with an earnings per share of $2.86). However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.4x on those 2028 earnings, up from 26.3x today. This future PE is lower than the current PE for the US Medical Equipment industry at 37.0x.

- Analysts expect the number of shares outstanding to decline by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.52%, as per the Simply Wall St company report.

Edwards Lifesciences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of the Critical Care division could lead to a decrease in revenue and a diversification risk, impacting overall profitability and earnings.

- The company's financial guidance indicates potential fourth-quarter sales growth affected by hurricanes, a China distributor rebate adjustment, and fewer selling days, potentially lowering revenue expectations.

- The integration of recent acquisitions and restructuring efforts involve additional expenses, which may pressure operating margins and net earnings.

- Intense competition in the TAVR space, along with possible new entrants, could erode Edwards' market share and pricing power, challenging revenue growth.

- Capacity constraints in structural heart teams could limit the ability to scale procedures, potentially restricting revenue growth despite existing patient demand.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $78.92 for Edwards Lifesciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $96.8, and the most bearish reporting a price target of just $60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.0 billion, earnings will come to $1.6 billion, and it would be trading on a PE ratio of 33.4x, assuming you use a discount rate of 6.5%.

- Given the current share price of $69.97, the analyst's price target of $78.92 is 11.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives