Narratives are currently in beta

Key Takeaways

- Client Portal rollout might not sustain expected revenue growth despite positive early adoption, raising concerns about future revenues.

- Emphasis on agency partnerships over direct sales may hinder long-term growth if they don't yield expected market share gains.

- Strong client loyalty and revenue growth, coupled with strategic enhancements and share repurchases, position Doximity for improved market resilience and profitability.

Catalysts

About Doximity- Operates a cloud-based digital platform for medical professionals in the United States.

- Expectations for increased client engagement due to the Client Portal rollout may not sustain revenue growth at the anticipated levels, leading to concerns about future revenue despite positive early adoption.

- Emphasis on expanding agency partnerships over direct SMB sales might affect long-term revenue growth if these partnerships do not yield the expected market share gains.

- The company’s ongoing monetization of workflow tools and AI enhancements still being in early stages may lead to uncertainties in achieving the projected revenue growth, impacting future earnings if adoption does not accelerate.

- Potential delays in new product launch timelines could affect quarterly revenue targets due to longer implementation periods for new clients, possibly impacting expected revenue margins.

- Future revenue outlook remains cautious due to evolving digital marketing budgets in the pharmaceutical industry and possible macroeconomic uncertainties, which could compress expected net margins if market growth decelerates.

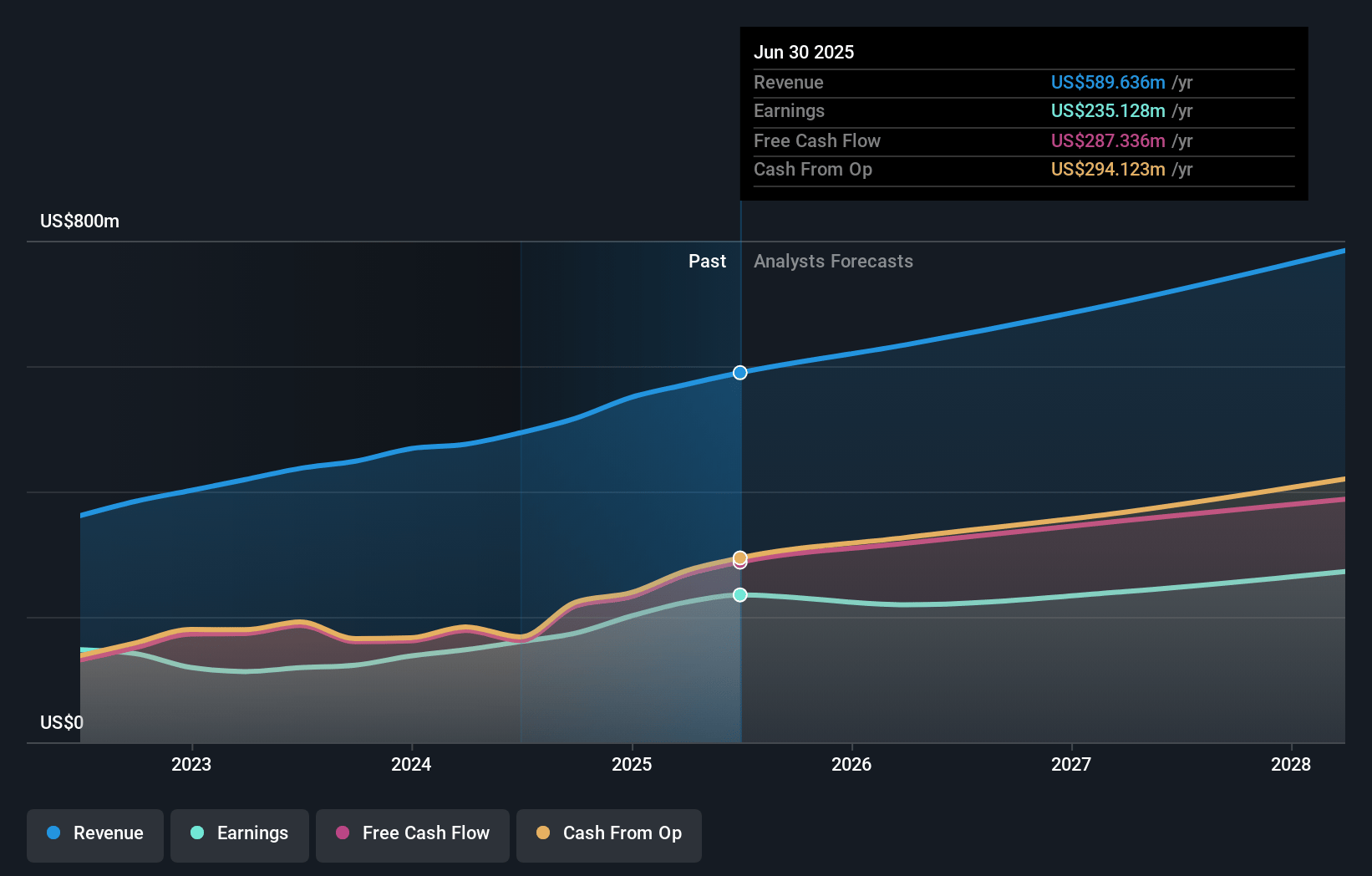

Doximity Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Doximity's revenue will grow by 10.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 33.7% today to 33.2% in 3 years time.

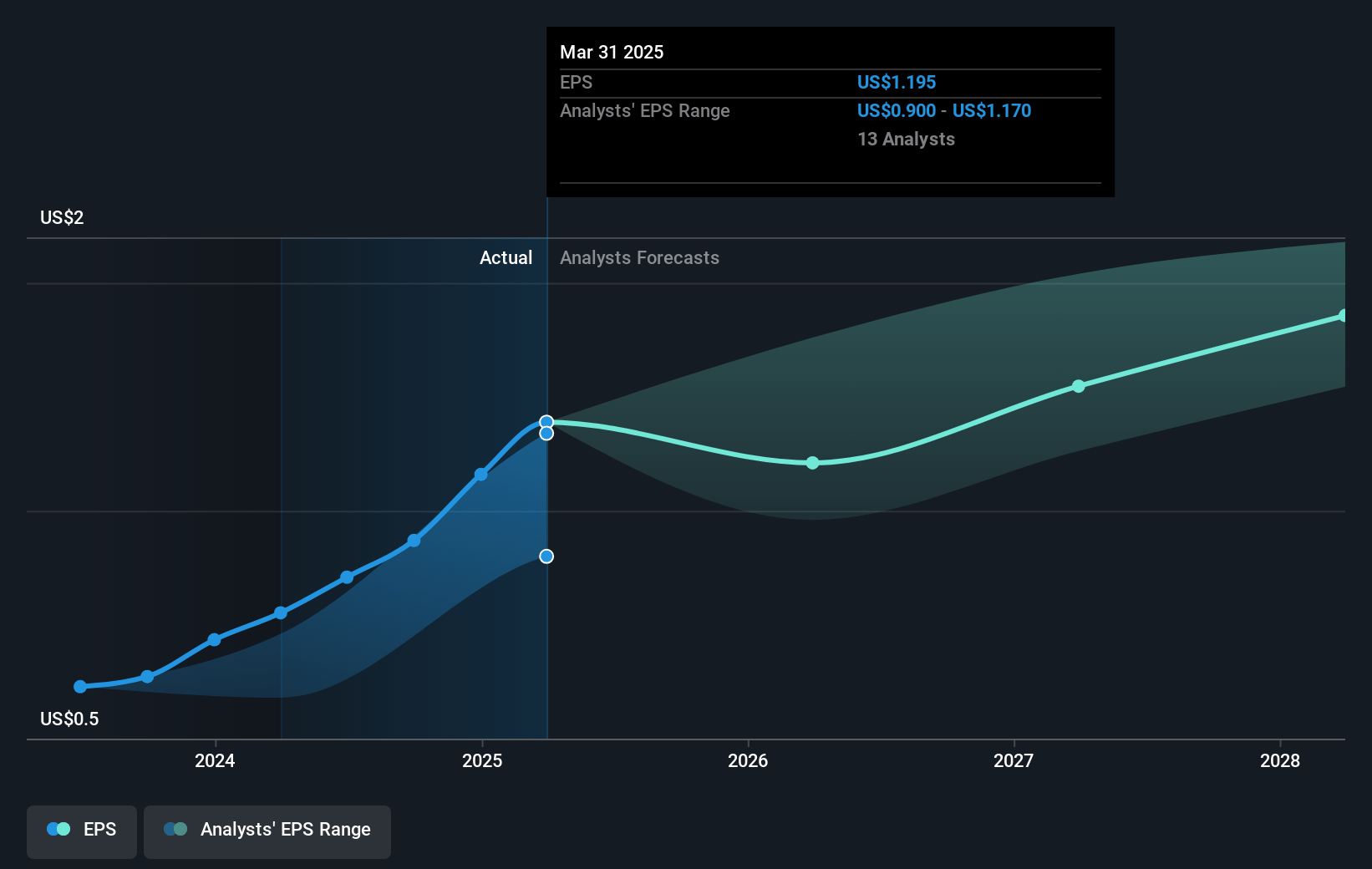

- Analysts expect earnings to reach $228.7 million (and earnings per share of $1.27) by about December 2027, up from $174.1 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $188.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 52.4x on those 2027 earnings, down from 56.3x today. This future PE is lower than the current PE for the US Healthcare Services industry at 56.7x.

- Analysts expect the number of shares outstanding to decline by 1.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.62%, as per the Simply Wall St company report.

Doximity Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Doximity's revenue has grown by 20% year-over-year, with a significant contribution from its top clients, indicating robust customer loyalty and satisfaction. This suggests potential resilience in revenue growth, contradicting a bearish outlook.

- The introduction and expansion of the Client Portal, which simplifies upsell opportunities and strengthens relationships with agency partners, demonstrates improved client engagement and could lead to increased revenues and client retention.

- Workflow tools and AI advancements are leading to increased user engagement and new revenue opportunities, which if successfully monetized, may significantly boost earnings and market position over the coming years.

- The company maintains a high adjusted EBITDA margin of 56%, indicating strong cost management and profitability, which may support stable or improving net margins despite an uncertain external environment.

- Doximity's ongoing share repurchase program reflects management's confidence in the company's value, which could positively impact earnings per share and shareholder returns if continued strategically.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $55.25 for Doximity based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $31.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $689.3 million, earnings will come to $228.7 million, and it would be trading on a PE ratio of 52.4x, assuming you use a discount rate of 6.6%.

- Given the current share price of $52.54, the analyst's price target of $55.25 is 4.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives