Key Takeaways

- Regulatory changes and competitive pressures threaten revenue stability, profitability, and enrollment growth across Centene’s core insurance markets.

- Rising medical and drug costs outpace government reimbursements, leading to sustained margin compression and increased financial risk.

- Expansion in government-sponsored programs, geographic diversification, and operational efficiency position Centene for sustained growth, margin improvement, and increased long-term profitability.

Catalysts

About Centene- Operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, and commercial organizations in the United States.

- Looming expiration of enhanced premium tax credits and the impending implementation of stricter Marketplace integrity rules in 2026 create significant risk to Marketplace membership and revenue, while higher pricing may not fully offset member attrition due to affordability constraints, which could result in both top-line contraction and margin pressure.

- Persistent upward pressure on medical and prescription drug costs—especially from high-cost specialty medications and rapidly rising utilization in Medicaid and Medicare drug programs—are unlikely to be matched by government reimbursement increases, leading to elevated medical loss ratios and compressing net margins for the foreseeable future.

- Centene’s heavy reliance on unpredictable state Medicaid contracts means ongoing revenue volatility as states face budgetary shortfalls, greater political scrutiny of healthcare spending, and unpredictable policy changes, which could reduce contract renewals, lower reimbursement rates, and undermine revenue growth even as managed care enrollment trends upwards.

- Disruptive innovation from new technology-led healthcare models and digital-first competitors threaten to erode Centene’s traditional managed care market share, limiting its ability to grow enrollment at historical rates and diminishing its pricing power, placing long-term pressure on both revenue and earnings.

- More aggressive federal and state regulatory oversight—including stricter medical loss ratio enforcement, increased transparency mandates, and reduced protective risk corridors in Medicare Part D—will increase compliance costs and remove key financial buffers, further constraining profitability and exacerbating downside risk to long-term earnings growth.

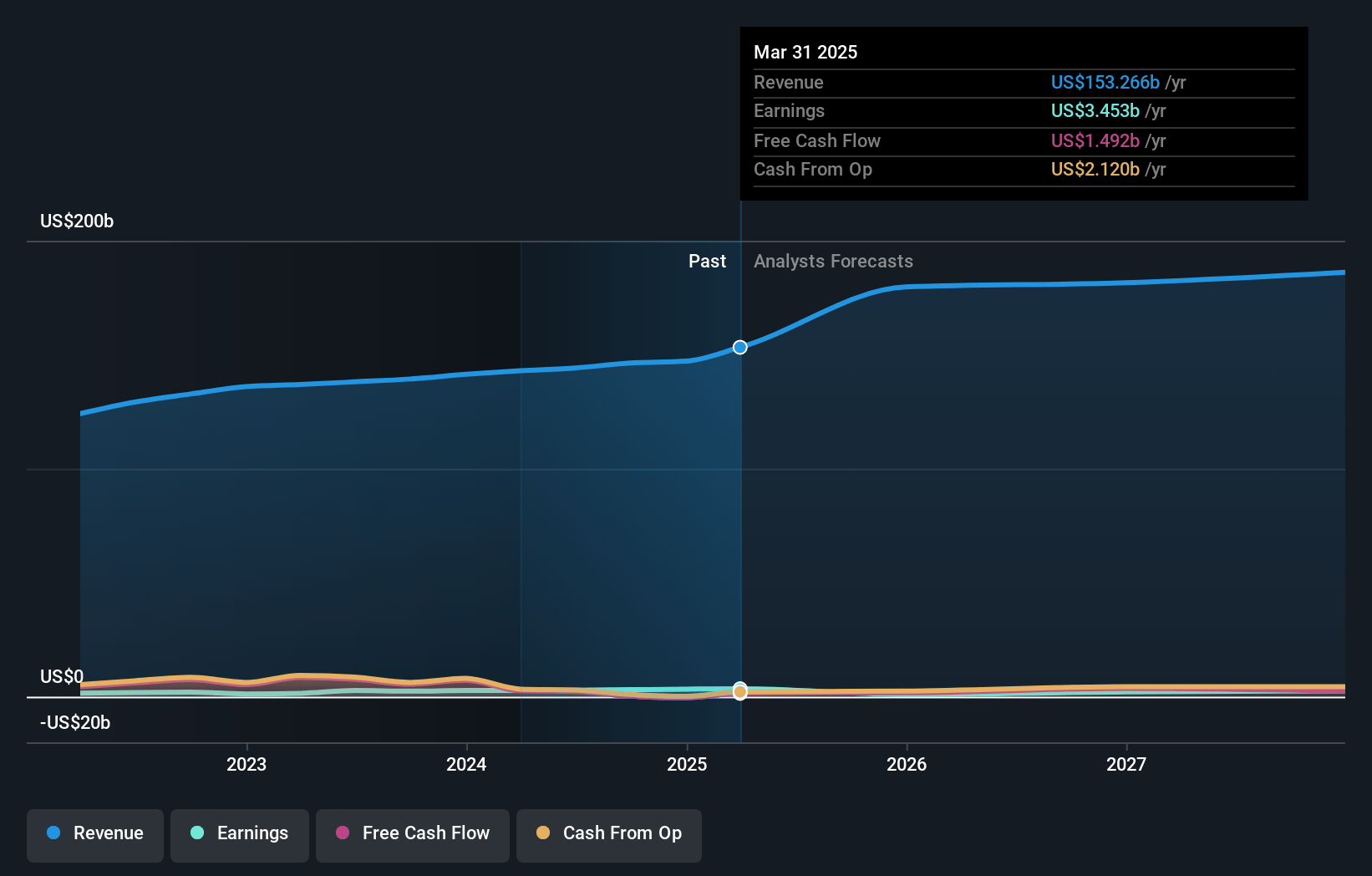

Centene Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Centene compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Centene's revenue will grow by 5.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 2.3% today to 1.8% in 3 years time.

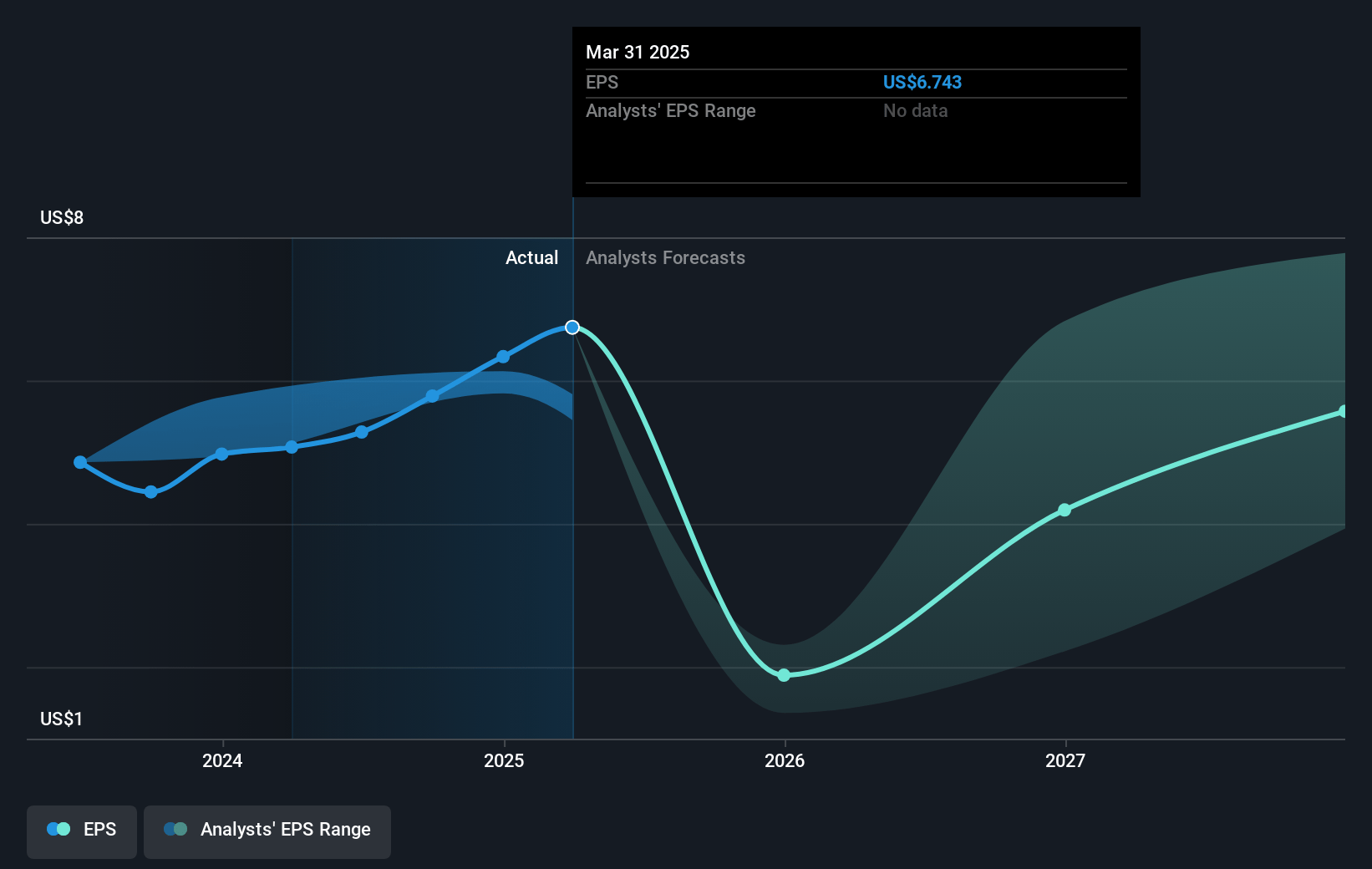

- The bearish analysts expect earnings to reach $3.4 billion (and earnings per share of $7.45) by about May 2028, down from $3.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.8x on those 2028 earnings, down from 9.0x today. This future PE is lower than the current PE for the US Healthcare industry at 20.4x.

- Analysts expect the number of shares outstanding to decline by 6.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.44%, as per the Simply Wall St company report.

Centene Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The aging U.S. population and rising life expectancy create a powerful long-term tailwind for demand in managed healthcare, increasing Centene’s total addressable market and potential for sustained revenue growth.

- Ongoing expansion of government-sponsored healthcare programs, especially Medicaid and Medicare Advantage, combined with bipartisan political resistance to significant benefit cuts, supports stability and growth in Centene’s core revenue streams.

- Centene's continued geographic diversification and recent Medicaid contract wins, such as expansions in Illinois and Nevada, allow the company to capture incremental revenues, bolstering top-line growth and offering scale-driven margin expansion.

- The company’s focus on operational efficiency—through SG&A reductions, integration of acquisitions like WellCare, and value-based care initiatives—positions Centene for net margin improvement and higher long-term earnings per share.

- Strong growth and retention in the Commercial (Marketplace) and Medicare segments, supported by favorable legislative dynamics like likely extensions of premium tax credits, could drive both higher membership and enhanced segment margins, improving long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Centene is $61.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Centene's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $92.0, and the most bearish reporting a price target of just $61.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $182.1 billion, earnings will come to $3.4 billion, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 6.4%.

- Given the current share price of $62.79, the bearish analyst price target of $61.0 is 2.9% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.