Last Update01 May 25Fair value Increased 25%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Success of the iQ3 device and international expansion enhances market position and boosts revenue growth through higher ASPs and increased unit sales.

- Strategic initiatives in AI applications, HomeCare, and partnerships broaden revenue streams and diversify income, strengthening competitive advantage.

- High losses and increasing costs pose profitability challenges, with growth dependent on new partnerships and AI, while scaling difficulties and funding needs impact stability.

Catalysts

About Butterfly Network- Develops, manufactures, and commercializes ultrasound imaging solutions in the United States and internationally.

- The launch and success of the iQ3 device have significantly enhanced Butterfly Network’s market position, resulting in higher ASPs and driving increased revenue growth through improved technology and customer adoption. (Revenue impact)

- The expansion into international markets with EU MDR approval and additional certifications for iQ3 and iQ+ positions Butterfly Network for increased unit volume and ASPs internationally, propelling growth in the coming year. (Revenue impact)

- The development of Butterfly Garden with AI applications going commercial and obtaining FDA clearance provides Butterfly Network a competitive advantage, enhancing their software ecosystem, which could boost recurring revenue streams. (Revenue impact)

- Strategic focus on the HomeCare channel through training nurses to use portable ultrasound devices and AI-guided tools indicates a substantial opportunity to reduce costs and generate new revenue streams as the pilot programs potentially convert to commercial revenues. (Net margins and earnings impact)

- The advancement of partnerships through their subsidiary Octiv into new market segments like neuroscience and generative AI, along with the commercialization of ultrasound on a chip technology, anticipates additional revenue streams and diversification of income. (Revenue and earnings impact)

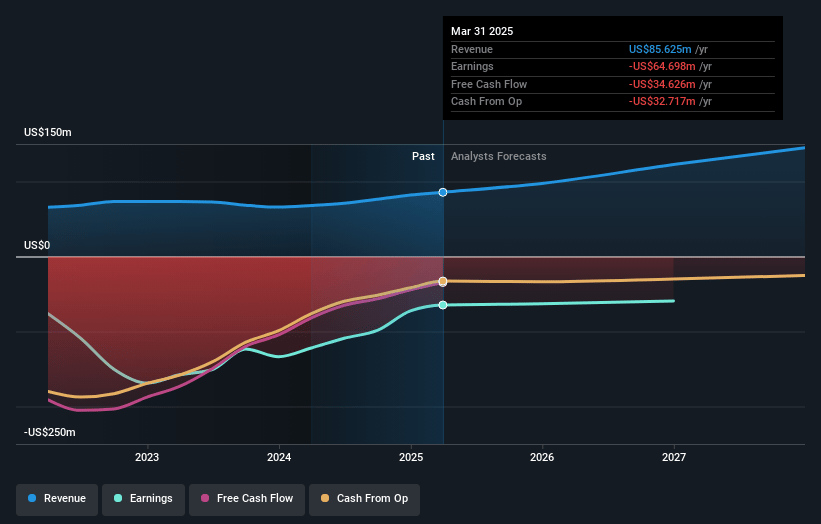

Butterfly Network Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Butterfly Network's revenue will grow by 19.5% annually over the next 3 years.

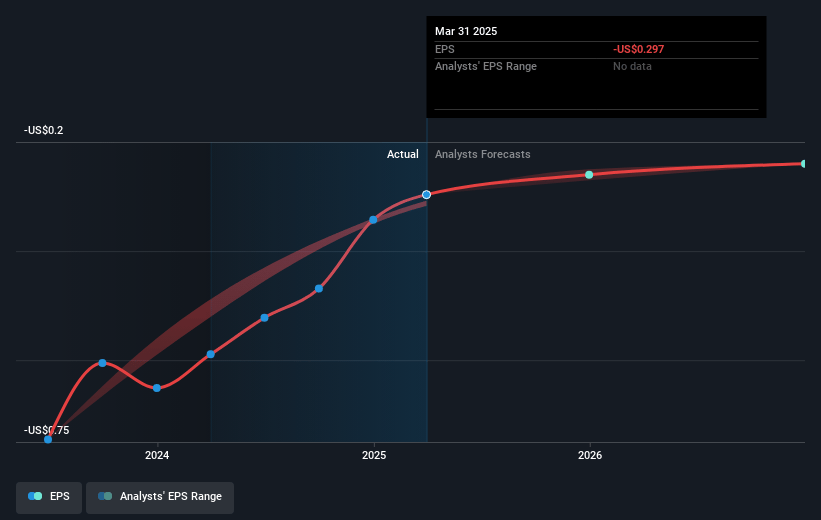

- Analysts are not forecasting that Butterfly Network will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Butterfly Network's profit margin will increase from -88.3% to the average US Medical Equipment industry of 12.9% in 3 years.

- If Butterfly Network's profit margin were to converge on the industry average, you could expect earnings to reach $18.1 million (and earnings per share of $0.06) by about May 2028, up from $-72.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 100.6x on those 2028 earnings, up from -8.0x today. This future PE is greater than the current PE for the US Medical Equipment industry at 31.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.98%, as per the Simply Wall St company report.

Butterfly Network Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High adjusted EBITDA losses and continued operating losses could indicate difficulty achieving profitability, impacting net margins and future earnings.

- Increasing production and warranty costs for newer products like iQ3, despite higher revenues, may strain gross margins and profitability.

- Challenges in scaling international operations, including regulatory approvals and geographic expansions, may hinder expected international revenue growth.

- Dependence on new partnerships and AI applications for growth introduces risk, as delays or regulatory hurdles with partners like Octiv could impact expected future revenue.

- Butterfly’s capital raise indicates a need for additional funding to achieve growth targets, suggesting potential challenges in achieving cash flow independence, impacting financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.0 for Butterfly Network based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $139.9 million, earnings will come to $18.1 million, and it would be trading on a PE ratio of 100.6x, assuming you use a discount rate of 7.0%.

- Given the current share price of $2.4, the analyst price target of $5.0 is 52.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.