Key Takeaways

- Margin expansion and earnings growth are challenged by payer mix shifts, labor costs, fee pressures, and increasing reliance on lower-margin outpatient services.

- Geographic concentration and significant debt levels heighten vulnerability to policy shifts, regulatory changes, and operating disruptions.

- Sustained labor cost pressures, high financial leverage, and evolving care settings threaten margins and revenue, while regulatory reliance increases uncertainty around consistent profitability.

Catalysts

About Ardent Health- Owns and operates a network of hospitals and clinics that provides a range of healthcare services in the United States.

- While Ardent Health is benefiting from durable volume growth fueled by the aging U.S. population and a higher prevalence of chronic diseases, the company faces growing pressure from shifting payer mix as volumes associated with exchange-based and public plans (which typically reimburse at lower rates than commercial plans) are becoming a larger portion of revenue, which may constrain net margin expansion in future periods.

- Although operational initiatives such as regionalized transfer centers and supply chain optimization are delivering efficiency gains and are expected to contribute 100 to 200 basis points of margin improvement over the next 3 to 4 years, persistent increases in physician professional fees and continued labor cost pressures could offset these gains, posing a risk to both near-term and long-term earnings growth.

- While Ardent's strategic focus on expanding its outpatient and acute care footprint-particularly in high-growth, mid-sized urban markets-positions the company to capture more of the shift from inpatient to outpatient care, accelerating industry-wide outpatient migration may dilute revenue growth if lower-margin outpatient settings become a larger component of the business.

- Even though the company is leveraging strategic partnerships and M&A activity to expand its scale and create joint ventures with academic and non-profit institutions, the concentration of operations in certain geographies makes Ardent susceptible to regulatory changes, Medicaid policy shifts, or adverse payer negotiations within those regions, potentially impacting top-line revenue and occupancy rates.

- While current liquidity is robust and credit ratings have been recently upgraded thanks to improved leverage and cash flow profiles, Ardent's significant debt obligation from prior expansion efforts could restrict financial flexibility if operating trends weaken, interest rates rise, or acquisition synergies fail to materialize as projected, which would ultimately pressure net margins and future earnings.

Ardent Health Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ardent Health compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ardent Health's revenue will grow by 6.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.7% today to 4.5% in 3 years time.

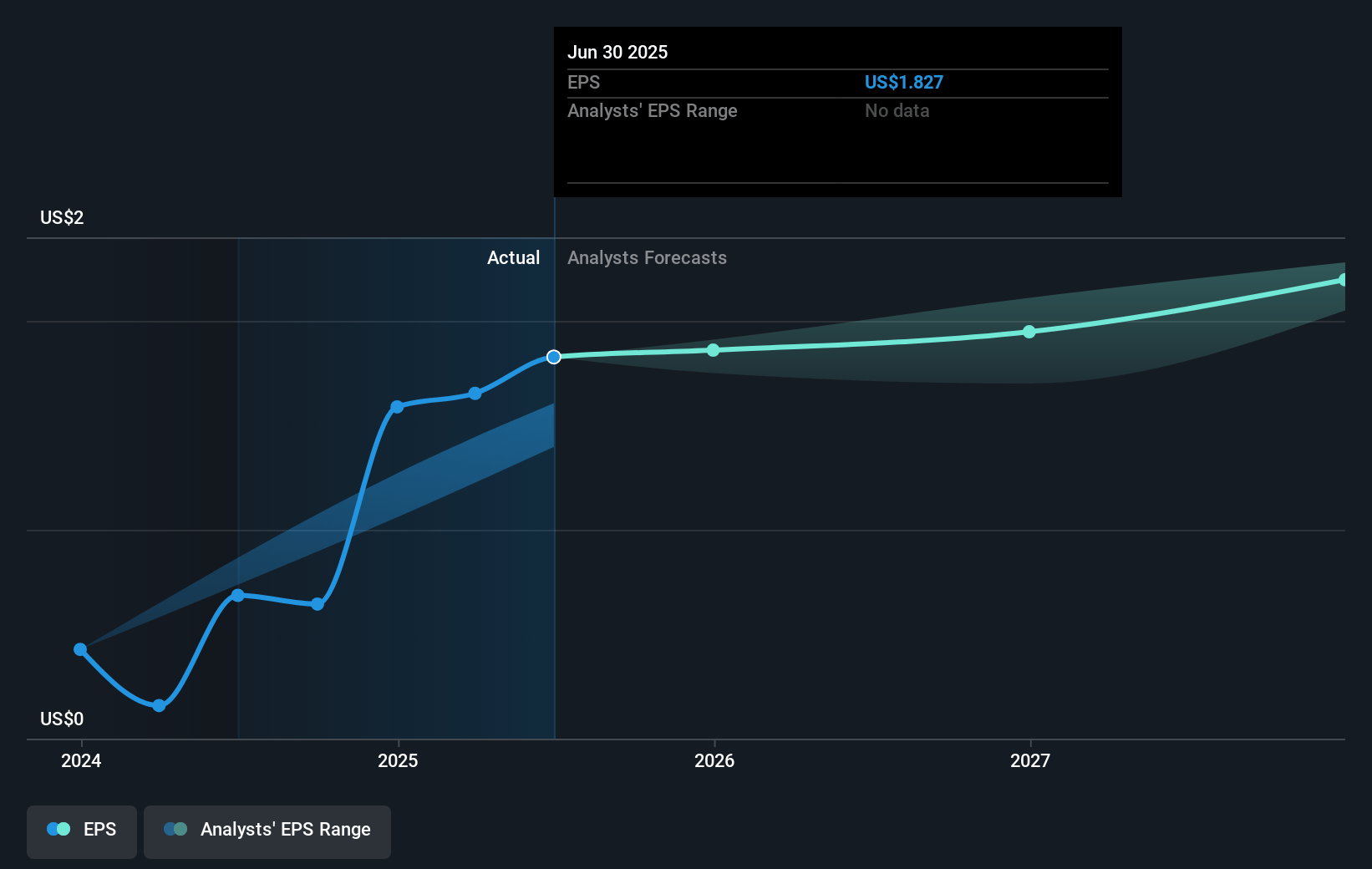

- The bearish analysts expect earnings to reach $324.7 million (and earnings per share of $2.14) by about July 2028, up from $224.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.2x on those 2028 earnings, up from 7.0x today. This future PE is lower than the current PE for the US Healthcare industry at 21.0x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.46%, as per the Simply Wall St company report.

Ardent Health Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing increase in labor costs, particularly the persistent pressure from hospital-based physician subsidies and professional fee growth running above inflation, could significantly squeeze net margins for Ardent Health over the long term.

- Heavy debt levels and lease-adjusted net leverage at three-times EBITDA heighten financial risk, with higher interest expenses and reduced flexibility posing downside risks to both earnings and free cash flow if performance softens or if interest rates rise.

- Accelerating payer claim denials and slowdown in payments from payers, especially among Medicare Advantage and exchange populations, are creating headwinds for revenue recognition and have resulted in weaker cash flow in recent quarters, which may undermine revenue growth and liquidity.

- The shift of procedures from inpatient to outpatient and home settings is already illustrated by a decline in outpatient surgeries and could structurally restrain hospital utilization, pressuring topline revenue as industry trends accelerate away from higher-margin inpatient care.

- Regulatory dependence on supplemental Medicaid programs like New Mexico's DPP, which remains subject to delayed approvals and policy shifts, injects uncertainty into recurring revenue and exposes Ardent's profitability to potential reductions in public reimbursement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ardent Health is $14.96, which represents two standard deviations below the consensus price target of $20.24. This valuation is based on what can be assumed as the expectations of Ardent Health's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $14.6.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $7.2 billion, earnings will come to $324.7 million, and it would be trading on a PE ratio of 8.2x, assuming you use a discount rate of 7.5%.

- Given the current share price of $11.06, the bearish analyst price target of $14.96 is 26.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.