Key Takeaways

- Strategic focus on technology and diversified services enhances client retention, operational efficiency, and recurring revenue stability, supporting long-term profitability despite sector volatility.

- Aging demographics and labor shortages increase demand for AMN’s solutions, while leadership in event management secures high-margin opportunities and boosts market share expansion.

- Persistent declines in core staffing revenue, margin pressures, rising competition, and regulatory headwinds threaten AMN's earnings stability and revenue diversification prospects.

Catalysts

About AMN Healthcare Services- Provides technology-enabled healthcare workforce solutions and staffing services to acute and sub-acute care hospitals, and other healthcare facilities in the United States.

- Rising demand for healthcare professionals fueled by an aging U.S. population and growing incidence of chronic illnesses is expected to drive long-term growth in AMN’s workforce solutions and staffing offerings, supporting higher future revenue and earnings as labor shortages intensify.

- Continued investments in technology-enabled solutions—such as the rollout of ShiftWise Flex and enhancements to the AMN Passport app—are anticipated to boost recruiter productivity, improve client retention, and increase operational efficiency, likely leading to expanded net margins over time.

- Increasing incidences of labor disruption in healthcare and AMN’s leading event management technology position the company as the go-to solution for hospitals facing workforce shortages or strikes, providing a differentiated, high-margin revenue stream with strong pipeline visibility for future periods.

- AMN’s diversification across service lines—including international recruitment, language services, and education/credentialing—broadens its addressable market, enhances recurring revenue streams, and stabilizes earnings despite near-term volatility in core travel nursing, strengthening long-term profitability.

- Expansion of enterprise and large-scale managed service provider (MSP) contracts, amid industry consolidation and regulatory cost pressures, should drive incremental revenue growth and increase AMN’s market share, reinforcing sustained top-line expansion and margin resilience against commoditization pressures.

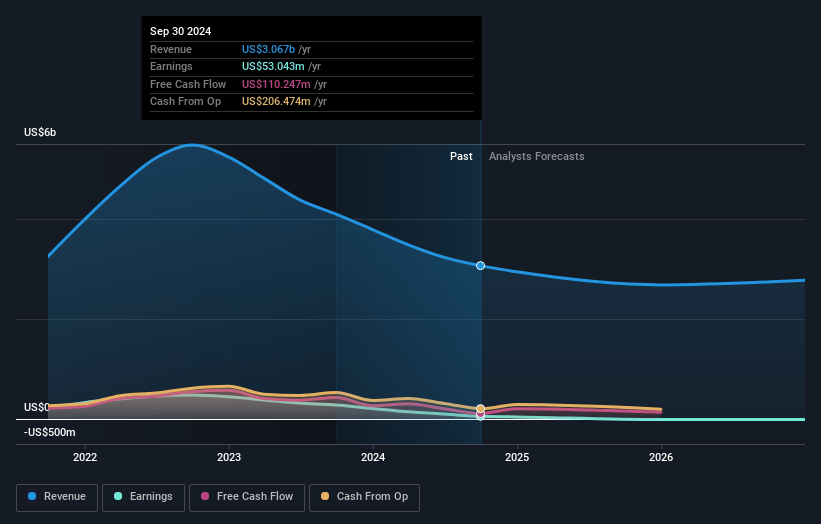

AMN Healthcare Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AMN Healthcare Services's revenue will decrease by 2.0% annually over the next 3 years.

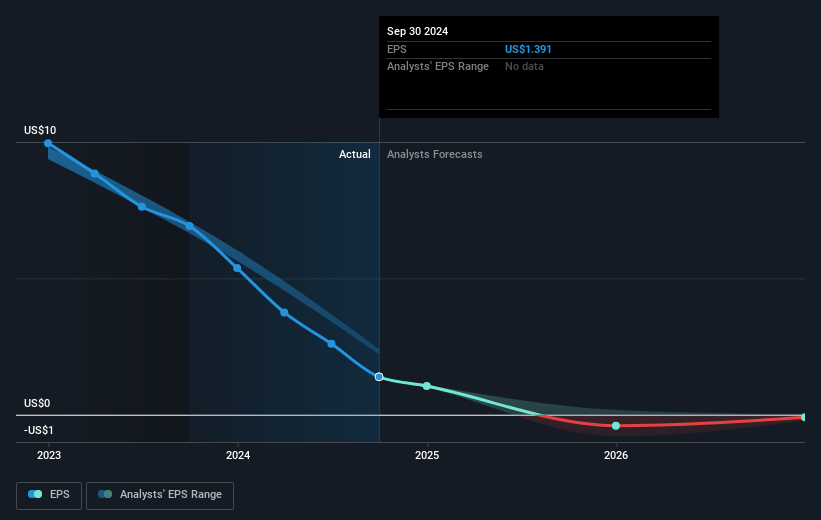

- Analysts are not forecasting that AMN Healthcare Services will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate AMN Healthcare Services's profit margin will increase from -5.8% to the average US Healthcare industry of 4.6% in 3 years.

- If AMN Healthcare Services's profit margin were to converge on the industry average, you could expect earnings to reach $122.9 million (and earnings per share of $3.15) by about July 2028, up from $-165.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.4x on those 2028 earnings, up from -4.6x today. This future PE is lower than the current PE for the US Healthcare industry at 20.9x.

- Analysts expect the number of shares outstanding to grow by 0.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.27%, as per the Simply Wall St company report.

AMN Healthcare Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s core Nurse and Allied staffing revenues and volumes are experiencing significant year-over-year declines (Nurse and Allied revenue down 20%, Travel Nurse revenue down 36%, Allied revenue down 13%, segment volume down 22%), indicating ongoing cyclical and potentially structural shifts away from reliance on temporary staffing solutions, which poses a risk to AMN’s future revenue growth.

- Consolidated gross margins and operating margins are declining across business segments year-over-year (e.g., gross margin down 270 basis points YoY, Nurse and Allied gross margin down 240 basis points, Physician and Leadership Solutions operating margin down 350 basis points), largely driven by rising housing, per diem reimbursements, and competitive pricing pressure; sustained margin compression could negatively impact earnings and net margins over time.

- Language Services, a historically high-growth and high-margin business, is experiencing intensified competition due to industry consolidation, resulting in price and margin pressure, while softening growth in Spanish volume—potentially due to shifting political and regulatory environments—adds demand uncertainty and could erode segment profitability and revenue diversification.

- There is elevated and persistent competition across all service lines, intensified by market consolidation among both clients (health systems) and competitors, which increases client bargaining power for more favorable contract terms and places ongoing pressure on AMN’s pricing, fill rates, and ultimate profitability.

- The company’s international business faces regulatory barriers and labor supply constraints (e.g., visa retrogression), leading to sequential declines in international placements and a lack of meaningful recovery expected until at least 2026; this headwind limits AMN’s ability to diversify revenues and exposes it to cyclical downturns in domestic markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.536 for AMN Healthcare Services based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $122.9 million, and it would be trading on a PE ratio of 10.4x, assuming you use a discount rate of 7.3%.

- Given the current share price of $19.88, the analyst price target of $26.54 is 25.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.