Narratives are currently in beta

Key Takeaways

- Streamlined claims processing and enhanced sales tools are expected to boost efficiency, productivity, and revenue across sales and order operations.

- Strong financial health, with a secure cash position and share repurchase program, supports shareholder value and potential revenue growth in key markets.

- Reliance on Medicare and shifting policies risk revenue stability, while increased documentation and operating costs may pressure margins and disrupt operations.

Catalysts

About Tactile Systems Technology- A medical technology company, develops and provides medical devices to treat underserved chronic diseases in the United States.

- The transition from LCD to a single NCD policy by CMS for pneumatic compression devices is expected to streamline claims processing, potentially leading to improved Medicare sales and revenue growth as documentation requirements become less burdensome.

- The national rollout of the e-prescribing tool and enhancements in order operations are anticipated to increase efficiency in sales processes, improving sales rep productivity, which can positively impact revenue and operating margins.

- The introduction of new technology and workflow tools, including CRM systems, aims to improve sales and order efficiency. These operational improvements could lead to better revenue cycle management and enhanced net margins.

- The launch of Nimbl, a next-generation lymphedema platform, along with positive clinical trial results for existing products, can strengthen product demand and drive future revenue growth, particularly in the expanding lymphedema market.

- A strong cash position and the initiation of a share repurchase program indicate robust financial health and capital management, which can improve earnings per share (EPS) and provide shareholder value.

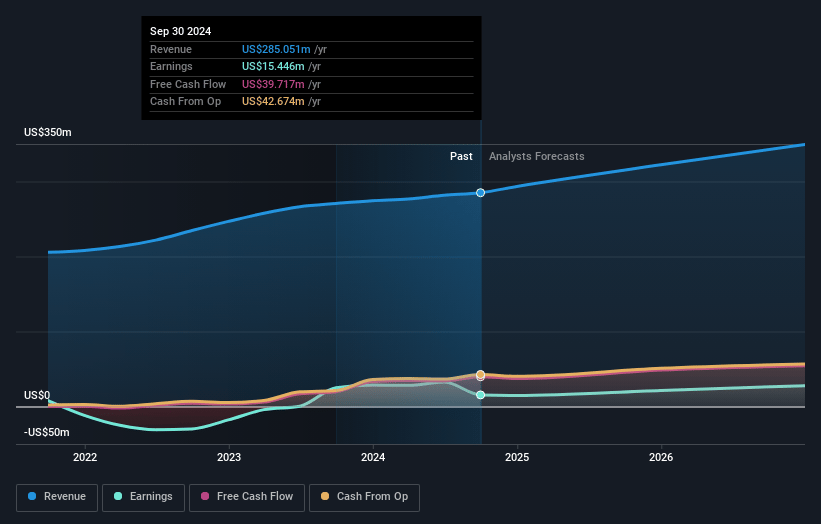

Tactile Systems Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tactile Systems Technology's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.4% today to 9.1% in 3 years time.

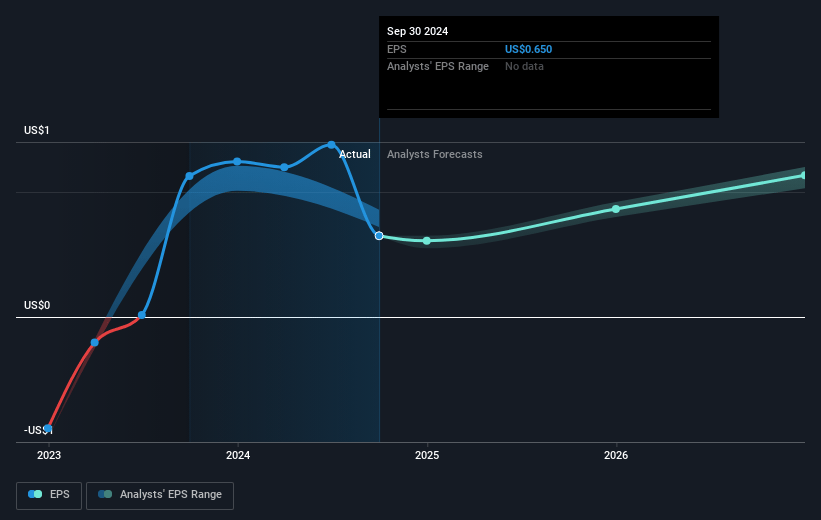

- Analysts expect earnings to reach $33.9 million (and earnings per share of $1.36) by about January 2028, up from $15.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.7x on those 2028 earnings, down from 27.0x today. This future PE is lower than the current PE for the US Medical Equipment industry at 37.0x.

- Analysts expect the number of shares outstanding to grow by 1.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.7%, as per the Simply Wall St company report.

Tactile Systems Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increased documentation requirements for lymphedema sales reps due to Medicare's interpretation of the pneumatic compression pump LCD are impacting sales rep productivity across all channels, potentially affecting revenue growth.

- Seasonal dynamics and uneven buying patterns in the airway clearance business could result in irregular revenue patterns, potentially affecting quarterly earnings.

- The ongoing shifts and uncertainties in Medicare coverage policies might lead to operational disruptions, which can impact revenue cycles and net margins.

- Increased operating expenses due to strategic technology investments could pressure net margins if revenue does not grow as anticipated.

- The company's reliance on Medicare and the potential for policy changes create revenue risk, as changes in Medicare claims adjudication could impact overall sales and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.0 for Tactile Systems Technology based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $373.9 million, earnings will come to $33.9 million, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 6.7%.

- Given the current share price of $17.38, the analyst's price target of $24.0 is 27.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives