Narratives are currently in beta

Key Takeaways

- Strategic investments in leadership and acquisitions are set to enhance operations, boost revenue, and expand margins across home health and senior living segments.

- Strengthened financial position from equity financing allows for debt elimination and supports future growth through strategic acquisitions and operational investments.

- Regulatory pressures, acquisition complexities, labor costs, and economic factors may pose significant challenges to Pennant Group's revenue, margins, and overall financial performance.

Catalysts

About Pennant Group- Provides healthcare services in the United States.

- Significant investment in leadership development programs is expected to improve operations, enhancing the company's ability to integrate acquisitions and increase revenue from new and existing facilities. This focus on leadership is likely to boost both revenue and net margins as operational efficiencies and same-store growth continue to rise.

- The acquisition pipeline is strong, with new growth opportunities in both home health and senior living segments. The addition of strategically located properties, such as the Signature Healthcare At Home assets in the Pacific Northwest, presents opportunities for revenue growth and potential margin expansion through scale and improved integration.

- Recent equity financing has helped eliminate debt and strengthen the balance sheet, providing the company with ample resources for future acquisitions and operational investments. This financial flexibility supports potential earnings growth and expansion of EBITDA margins as new acquisitions are integrated effectively.

- An increase in reimbursement rates for hospice operations, coupled with anticipated market basket updates in home health, suggests potential revenue increases, although regulatory challenges exist. Positive clinical outcomes, such as high home health star ratings and low acute care hospitalization rates, are expected to support these revenue streams and contribute to favorable financial performance.

- The senior living segment is experiencing revenue and occupancy growth, with potential upside from recent acquisitions and operational improvements. Investing in leaders and enhancing occupancy and revenue per occupied unit are expected to drive continued revenue growth and improve overall segment margins.

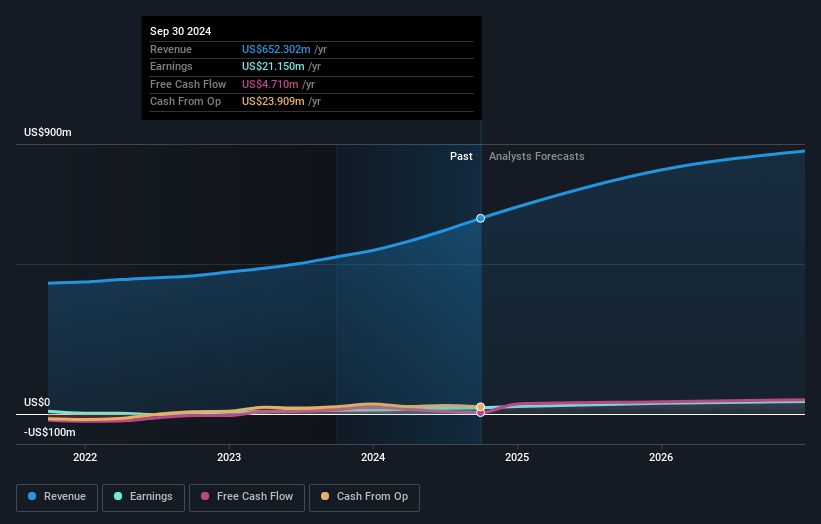

Pennant Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pennant Group's revenue will grow by 14.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.2% today to 5.4% in 3 years time.

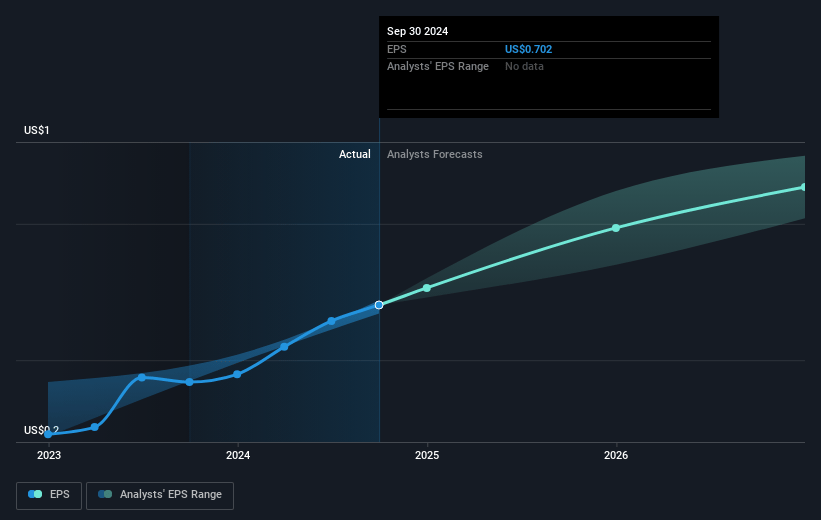

- Analysts expect earnings to reach $52.5 million (and earnings per share of $1.33) by about November 2027, up from $21.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.8x on those 2027 earnings, down from 54.6x today. This future PE is greater than the current PE for the US Healthcare industry at 24.8x.

- Analysts expect the number of shares outstanding to grow by 4.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.96%, as per the Simply Wall St company report.

Pennant Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory pressures and reimbursement challenges, particularly in home health and hospice sectors, could impact the company's revenue growth and profitability as unfavorable reimbursement rates may not offset inflation-related cost increases.

- The complexity and costs related to integrating acquisitions like Signature Healthcare At Home, as well as potential execution risks, could strain net margins and earnings if not handled efficiently.

- Rising labor costs and the challenge of retaining talent could compress operating margins in the face of flat or declining reimbursement rates in key areas like home health services.

- A reliance on local leadership without centralized acquisition teams might introduce risks of inconsistent execution across different locations, potentially affecting overall operational efficiency and financial outcomes.

- External economic factors such as interest rate fluctuations and inflation could affect the financials, particularly the cost of capital and operating expenses, which may impact both revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $38.25 for Pennant Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $967.1 million, earnings will come to $52.5 million, and it would be trading on a PE ratio of 33.8x, assuming you use a discount rate of 6.0%.

- Given the current share price of $33.65, the analyst's price target of $38.25 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives