Catalysts

About PAVmed

PAVmed is a diversified life sciences company that develops, finances and commercializes innovative medical technologies through independently capitalized subsidiaries.

What are the underlying business or industry changes driving this perspective?

- Impending Medicare coverage for Lucid's EsoGuard test positions PAVmed's largest asset to tap a vast, underpenetrated esophageal precancer screening population, which can drive a step change in test volumes and high margin recurring revenue that accrues to PAVmed through its substantial equity stake.

- Veris is advancing an implantable physiologic monitor under a clear 510k pathway with modest clinical requirements and fully funded development, creating a high value, device plus software offering that can expand average revenue per cancer patient and support margin expansion as fixed R and D costs are leveraged.

- The long term shift toward personalized, data driven oncology care and remote monitoring is accelerating adoption of platforms like Veris. The OSU commercial rollout serves as a scalable reference site that can support rapid center to center expansion and recurring software and services revenue growth.

- Planned AI based risk stratification and clinical decision tools within Veris directly address hospital demand to improve outcomes and lower care costs, enabling premium pricing, differentiated contracts with major cancer centers and structurally higher net margins over time.

- Acquiring and advancing breakthrough endoscopic imaging for real time esophageal precancer detection, alongside new life sciences assets under a shared services, independently financed subsidiary model, can create multiple new revenue streams while keeping PAVmed's corporate operating expenses near cash flow breakeven and supporting long term earnings leverage.

Assumptions

This narrative explores a more optimistic perspective on PAVmed compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

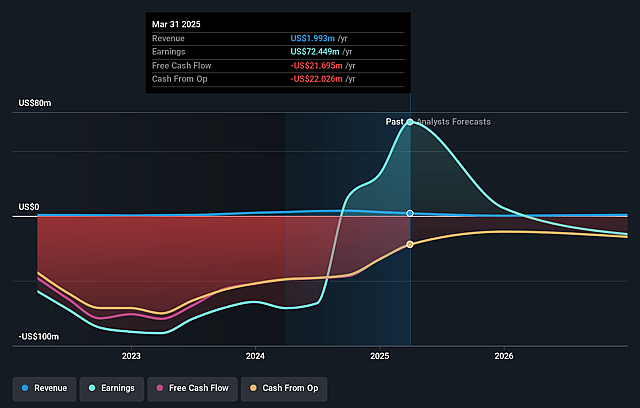

- The bullish analysts are assuming PAVmed's revenue will grow by 453.8% annually over the next 3 years.

- The bullish analysts are not forecasting that PAVmed will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate PAVmed's profit margin will increase from -2055.2% to the average US Medical Equipment industry of 12.9% in 3 years.

- If PAVmed's profit margin were to converge on the industry average, you could expect earnings to reach $635.9 thousand (and earnings per share of $0.02) by about December 2028, up from $-596.0 thousand today.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 1200.0x on those 2028 earnings, up from -15.3x today. This future PE is greater than the current PE for the US Medical Equipment industry at 30.4x.

- The bullish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.86%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- PAVmed's long-term strategy depends heavily on capital markets to fund new subsidiaries and complete its balance sheet restructuring. Any deterioration in financing conditions or inability to finalize remaining debt and equity steps could constrain investment in growth assets and delay portfolio expansion, weighing on revenue growth and long term earnings potential.

- The company has structured itself as an engine to ingest and develop multiple life sciences technologies. However, the broader trend toward tighter reimbursement, hospital cost pressure and more selective adoption of new tools may slow commercial uptake of new assets like the Duke endoscopic imaging technology and additional Veris offerings, limiting future revenue diversification and margin expansion.

- PAVmed's largest economic exposure is to Lucid Diagnostics, yet Lucid's revenues and share price remain sensitive to regulatory and payer decisions. Any delay in Medicare coverage, slower than expected commercial payer adoption or a sustained decline in Lucid's stock price would reduce equity method income and could pressure PAVmed's reported earnings and book value.

- Veris is pursuing a 510k pathway and AI based decision tools at a time when regulators and health systems are increasingly scrutinizing digital health claims and data usage. Any shift toward stricter FDA requirements, data privacy rules or institutional caution on AI could lengthen development timelines, increase R and D and compliance costs and delay the expected uplift in high margin software and services revenue.

- Although management highlights a baseline of operating near cash flow breakeven, the company still relies on external funding and grant support to cover development of the Veris implantable device and other projects. Any failure to secure similar targeted financing in the future or unexpected increases in non GAAP operating expenses could erode its breakeven profile and lead to deeper net losses and shareholder dilution.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for PAVmed is $17.0, which represents up to two standard deviations above the consensus price target of $9.5. This valuation is based on what can be assumed as the expectations of PAVmed's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $17.0, and the most bearish reporting a price target of just $2.0.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be $4.9 million, earnings will come to $635.9 thousand, and it would be trading on a PE ratio of 1200.0x, assuming you use a discount rate of 9.9%.

- Given the current share price of $0.33, the analyst price target of $17.0 is 98.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on PAVmed?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.