Last Update01 May 25Fair value Increased 0.91%

AnalystConsensusTarget made no meaningful changes to valuation assumptions.

Read more...Key Takeaways

- Transitioning to a subscription-based model aims to enhance revenue predictability and improve net margins with recurring income.

- Leveraging EHR and e-prescription networks can stimulate revenue growth by deepening engagement with pharma manufacturers and healthcare providers.

- Uncertainty in achieving targets and transitioning models, coupled with competitive pressures and regulatory impacts, may affect revenue, profitability, and growth forecasts.

Catalysts

About OptimizeRx- A digital health technology company, engages in the provision of tech-enabled marketing solutions for life sciences organizations, healthcare providers, and patients.

- The company is transitioning its data component of offerings to a subscription-based model, which could lead to more predictable and recurring revenue, improving both revenue visibility and net margins over time.

- OptimizeRx is leveraging its large EHR and e-prescription network alongside an omnichannel technology platform, which can expand the company’s revenue streams through enhanced engagement with pharma manufacturers and healthcare providers, thereby boosting revenue growth.

- The company's ability to address pharma’s commercial challenges like brand visibility and script abandonment with creative solutions could attract and retain more customers, increasing revenue and potentially improving net margins.

- Expanding market opportunities in a large, underpenetrated market with a $10 billion TAM alongside increased pharma advertising spend on digital channels presents a strong case for future revenue growth.

- The focus on scaling DAAP solutions, particularly dynamic audience creation, which is subscriptive in nature, could lead to higher-margin revenue as these services become a more significant portion of the company's offerings, thereby impacting net margins positively.

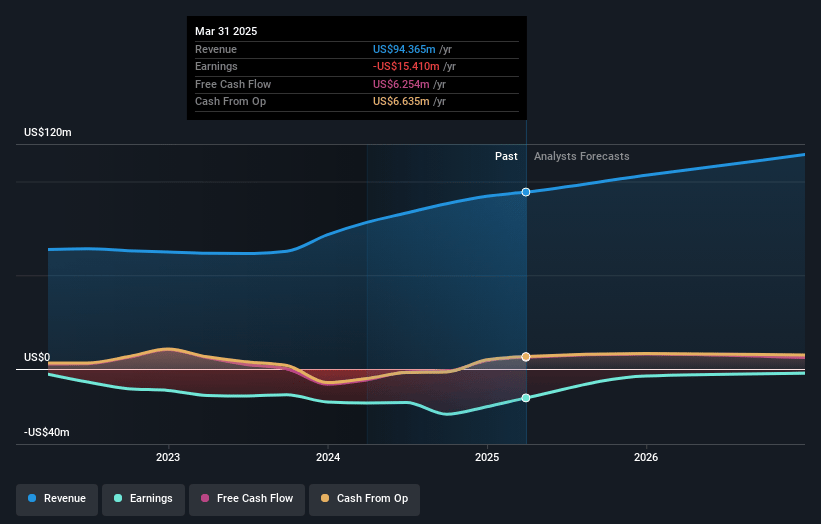

OptimizeRx Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming OptimizeRx's revenue will grow by 10.2% annually over the next 3 years.

- Analysts are not forecasting that OptimizeRx will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate OptimizeRx's profit margin will increase from -21.8% to the average US Healthcare Services industry of 14.7% in 3 years.

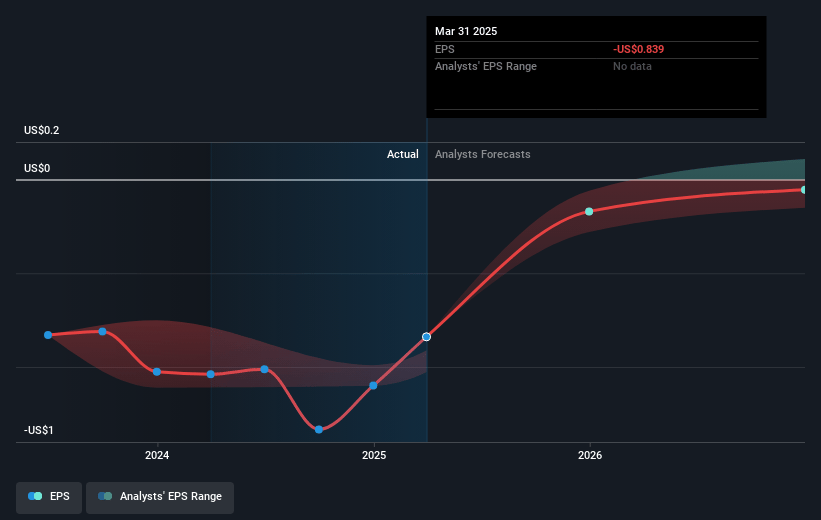

- If OptimizeRx's profit margin were to converge on the industry average, you could expect earnings to reach $18.1 million (and earnings per share of $0.96) by about May 2028, up from $-20.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.6x on those 2028 earnings, up from -8.4x today. This future PE is lower than the current PE for the US Healthcare Services industry at 53.8x.

- Analysts expect the number of shares outstanding to grow by 1.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.93%, as per the Simply Wall St company report.

OptimizeRx Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- There is uncertainty regarding the timing to achieve the Rule of 40 target, which may impact cash flow projections and assumed profitability within the next three to five years.

- The transition to a subscription-based model may not be as swift as anticipated, potentially affecting revenue predictability and overall growth forecasts if conversion rates lag.

- The financial guidance assumes certain levels of new deals and recurring revenue; unforeseen competitive pressures or an inability to close anticipated new deals could affect revenue projections.

- Gross margin volatility is expected due to product mix changes, specifically the balance between recurring and transactional revenues, which could lead to fluctuating profits if high-margin recurring revenues do not materialize as anticipated.

- External regulatory factors, such as FDA approval rates, historically impact new pharmaceutical product availability, which could affect OptimizeRx's market conditions and anticipated revenue from new contracts and expansions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $10.333 for OptimizeRx based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $6.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $123.4 million, earnings will come to $18.1 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 7.9%.

- Given the current share price of $9.18, the analyst price target of $10.33 is 11.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.