Key Takeaways

- Dexcom's expansion efforts, including salesforce growth and new product launches, aim to increase revenue through market penetration and subscription growth.

- International expansion of G7 and Dexcom ONE+ in key markets drives growth while the pending G7 system promises cost efficiencies and improved margins.

- Dexcom faces challenges from U.S. market revenue decline and competition, while reliance on international growth may expose it to external risks.

Catalysts

About DexCom- A medical device company, focuses on the design, development, and commercialization of continuous glucose monitoring (CGM) systems in the United States and internationally.

- Dexcom's salesforce expansion and improved US productivity metrics suggest increased future revenue, particularly as new customer starts have returned to record levels, and the prescriber base expanded by 35,000 clinicians.

- International growth is being fueled by the rollout of G7 and Dexcom ONE+, with significant expansion in several core markets and new access in Japan and France, likely boosting revenue as these markets mature.

- The launch of Dexcom's new product Stelo in the U.S. opens access to the broader consumer market, offering an opportunity for further revenue growth through increased market penetration and subscription model engagement.

- Dexcom's forthcoming G7 15-day CGM system, pending FDA review, provides a potential avenue for cost efficiencies, potentially improving net margins due to the extended use life reducing production costs relative to existing sensors.

- Enhanced partnerships with DME channels and the integration of Stelo into their offerings provide additional distribution opportunities, likely contributing to revenue growth and increased market presence.

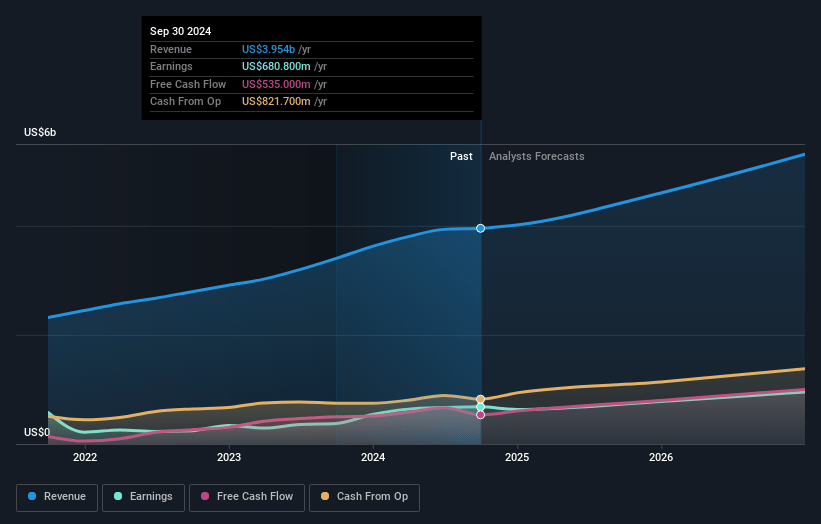

DexCom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming DexCom's revenue will grow by 14.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.2% today to 18.9% in 3 years time.

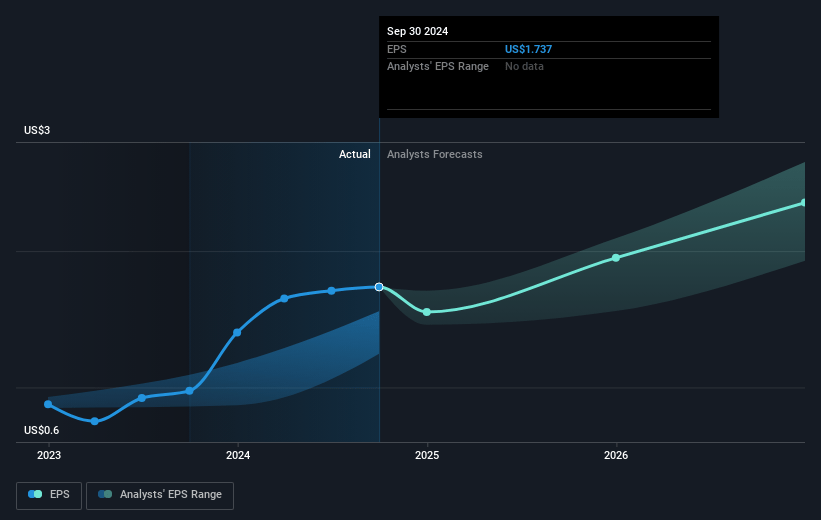

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $2.73) by about January 2028, up from $680.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.7x on those 2028 earnings, down from 50.7x today. This future PE is greater than the current PE for the US Medical Equipment industry at 34.7x.

- Analysts expect the number of shares outstanding to grow by 1.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.61%, as per the Simply Wall St company report.

DexCom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dexcom's U.S. revenue declined by 2% due to slower new customer starts and shifting channel dynamics impacting revenue per customer, which could affect future revenue growth.

- The eligibility component for rebates created significant headwinds, with approximately 6 points of negative growth impact, highlighting potential pressures on margins and net earnings due to pricing and reimbursement challenges.

- The company experienced share loss in the DME channel as anticipated, although trends are stabilizing, reflecting potential risks to revenue from channel-specific competition and strategic misalignment.

- International revenue growth appears more robust than U.S. growth, suggesting potential over-reliance on international markets to meet revenue targets, which may expose the company to foreign exchange risks and variable international market conditions.

- There is heightened competition in the CGM market, which might challenge Dexcom's market position, particularly with planned launches by competitors, potentially impacting its U.S. revenue and market share growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $96.26 for DexCom based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.0 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 42.7x, assuming you use a discount rate of 6.6%.

- Given the current share price of $88.35, the analyst's price target of $96.26 is 8.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives