Key Takeaways

- Delays and uncertainty in government contracts are limiting near-term revenue growth, despite growth opportunities in decentralized and in-home care markets.

- Heavy investment and expansion into newer, lower-margin services constrain profitability, with long-term margins dependent on scaling and overcoming regulatory and operational risks.

- Heavy dependence on government contracts, operational inefficiencies, and competitive pressures are driving revenue declines, margin compression, and uncertainty around future profitability and growth.

Catalysts

About DocGo- Provides mobile health and medical transportation services in the United States and the United Kingdom.

- While DocGo is benefiting from secular tailwinds such as an aging population and the long-term growth in decentralized care, its near-term revenue outlook has been sharply curtailed by significant uncertainty and delays in municipal and federal government contracting, as political and budgetary indecision has put a freeze on new project launches, directly reducing expected top-line revenue growth and cash flow visibility.

- Although the company is experiencing robust expansion in its Payer & Provider and Medical Transportation verticals, its reliance on early-stage, lower-margin business lines drags on consolidated gross margin and EBITDA, with profitability recovery highly contingent on scaling these newer initiatives and successfully increasing clinician utilization-otherwise ongoing losses may persist and net margins remain constrained.

- Despite heavy investments in proprietary technology and operational efficiencies, DocGo faces sustained upward pressure on SG&A and healthcare labor costs due to industry-wide shortages and the need for reinvestment in scaling, limiting near-term margin expansion and delaying sustainable positive EBITDA.

- While the broader shift to remote and in-home health services positions DocGo well for future adoption and differentiated service delivery, the company's aggressive projections for home visits and care gap closure revenue are exposed to execution risk if plans or payers fail to drive desired member engagement or if competition increases, creating potential downside for both revenue acceleration and future earnings.

- Even as value-based care adoption motivates payors and providers to seek savings from mobile health offerings, DocGo remains vulnerable to increased regulatory scrutiny, potential cost controls, and compliance costs in the evolving healthcare technology landscape, which could impair long-term profitability and amplify volatility in earnings if reimbursement trends or oversight become more challenging.

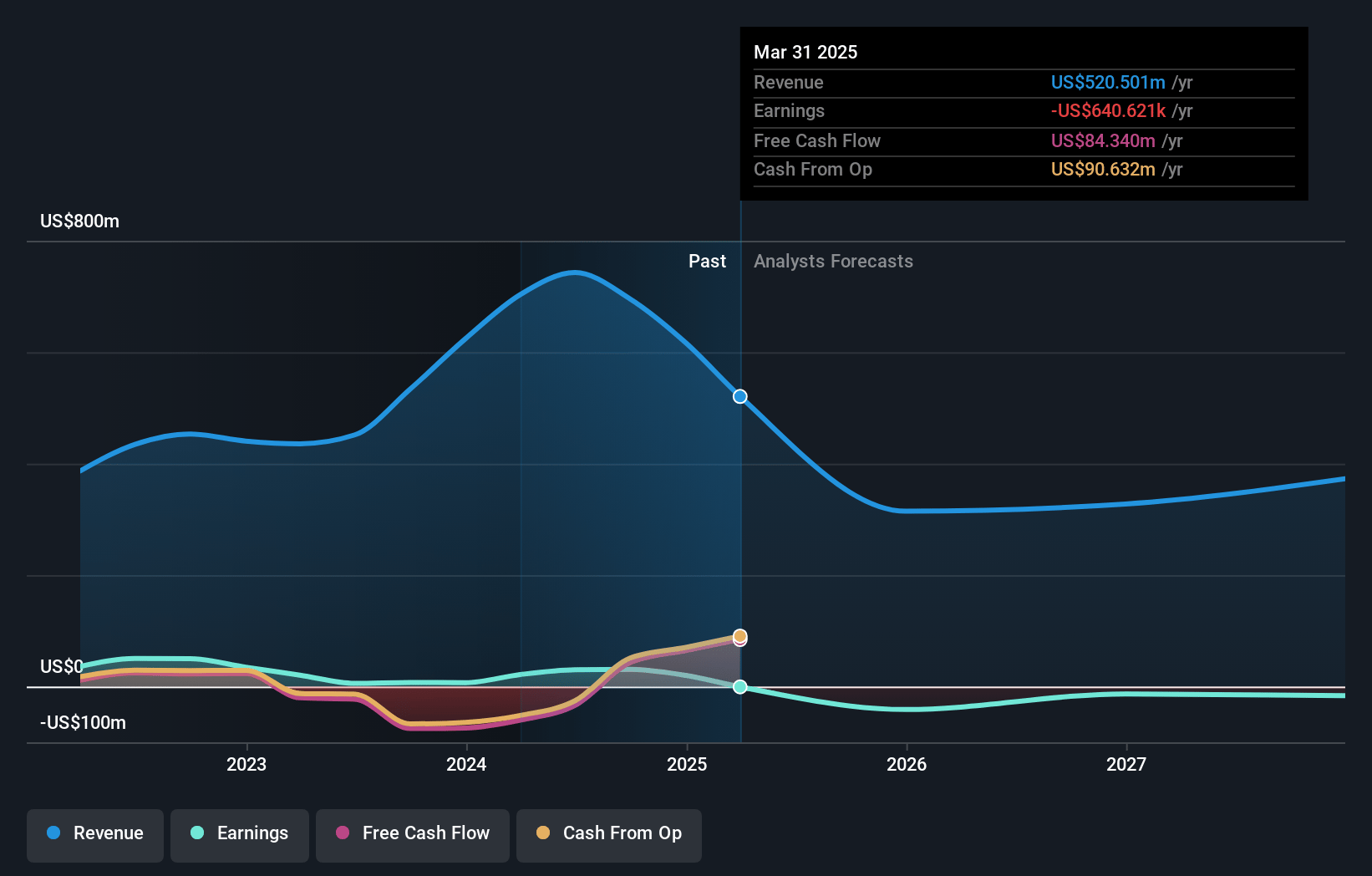

DocGo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on DocGo compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming DocGo's revenue will decrease by 10.5% annually over the next 3 years.

- The bearish analysts are not forecasting that DocGo will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate DocGo's profit margin will increase from -0.1% to the average US Healthcare industry of 4.7% in 3 years.

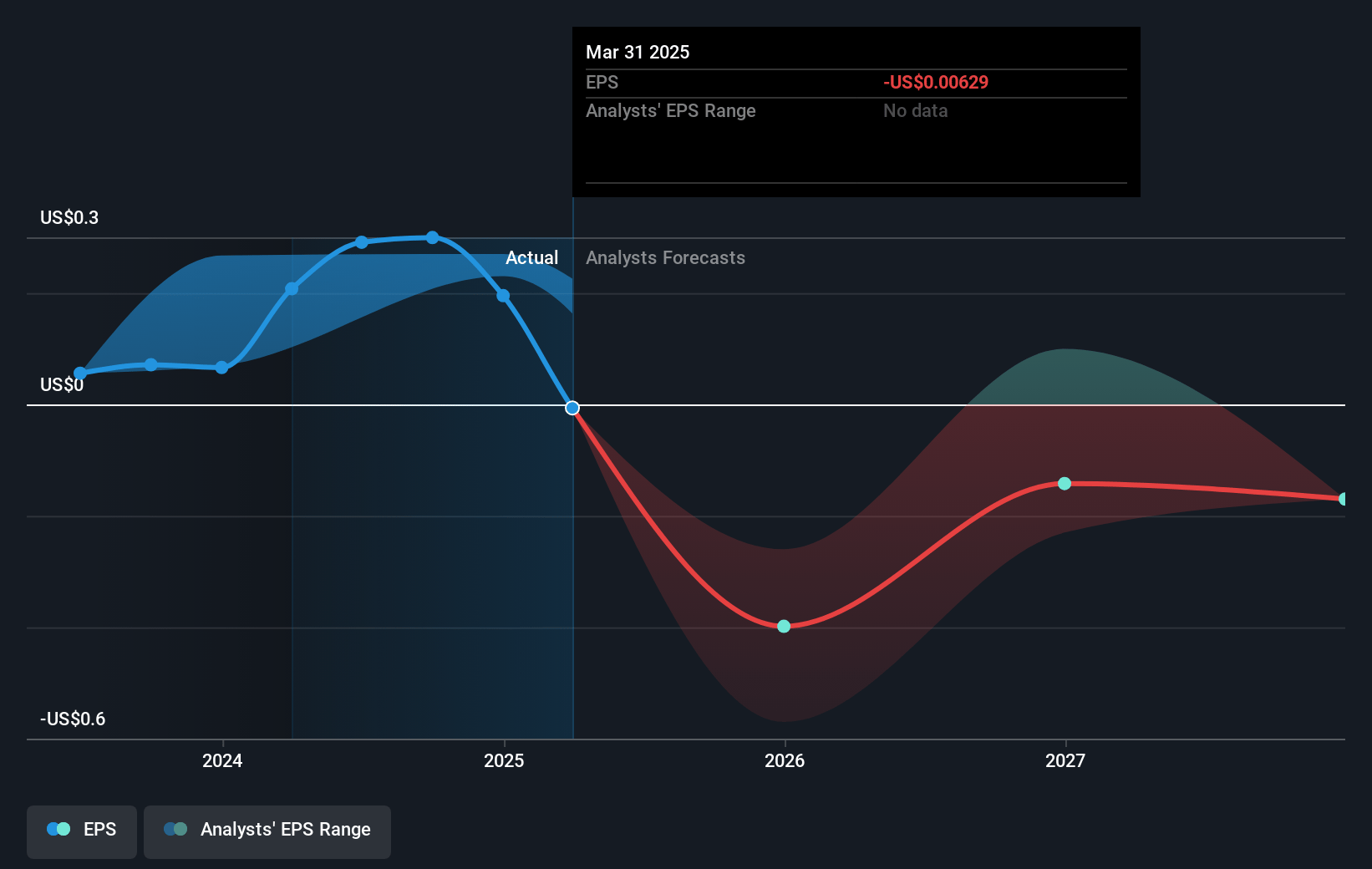

- If DocGo's profit margin were to converge on the industry average, you could expect earnings to reach $17.6 million (and earnings per share of $0.2) by about May 2028, up from $-640.6 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.9x on those 2028 earnings, up from -210.4x today. This future PE is lower than the current PE for the US Healthcare industry at 19.5x.

- Analysts expect the number of shares outstanding to decline by 3.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.46%, as per the Simply Wall St company report.

DocGo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- DocGo's heavy reliance on government contracts for its Population Health vertical has exposed the company to major policy, budget, and municipal decision-making risks, leading to the removal of over $100 million of expected revenues from its 2025 guidance and resulting in a projected adjusted EBITDA loss of $20 million to $30 million for the year, significantly impacting earnings.

- The sharp wind down of high-margin migrant-related contracts has caused a substantial year-over-year revenue decline, with Q1 2025 revenue dropping to $96 million from $192.1 million in Q1 2024, directly translating to a swing from net income to net loss and exerting downward pressure on gross margins and overall financial performance.

- As DocGo shifts focus to scaling its Payer & Provider segment, the early-stage nature of this business is depressing consolidated margins, as evidenced by Q1's adjusted gross margin for Mobile Health falling from 35.5% to 30.8%, and its current drag of up to 1.5 margin points is likely to continue until utilization rates increase significantly, delaying margin recovery and profitability.

- Elevated SG&A expenses as a percentage of revenue (46.7% in Q1 2025 compared to 26.8% in Q1 2024) reflect operational inefficiencies during this period of transition and restructuring; persistent SG&A inflation could erode net margins and make it more difficult to achieve sustainable profitability, especially if targeted cost reductions are not realized quickly.

- Intensifying regulatory, reimbursement, and competitive pressures-including policy changes that could further delay or reduce government and payer contracts, price compression from insurance/government payors, and the risk of larger, better-capitalized competitors capturing market share-threaten future revenue streams and could cause long-term challenges to scaling, innovation investment, and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for DocGo is $1.45, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of DocGo's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4.0, and the most bearish reporting a price target of just $1.45.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $372.9 million, earnings will come to $17.6 million, and it would be trading on a PE ratio of 8.9x, assuming you use a discount rate of 6.5%.

- Given the current share price of $1.36, the bearish analyst price target of $1.45 is 6.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.