Last Update07 May 25Fair value Decreased 10%

Key Takeaways

- Direct-to-consumer and AI-powered dental solutions are eroding market share and pressuring Align’s pricing and margins amid rising competition and innovation.

- Economic uncertainty, regulatory scrutiny, and shifting consumer priorities are constraining demand, raising compliance costs, and limiting global growth opportunities.

- Strong global demand, innovative product launches, digitization, and operational efficiencies position Align for revenue growth, margin expansion, and resilience against economic and regulatory headwinds.

Catalysts

About Align Technology- Designs, manufactures, and markets Invisalign clear aligners, Vivera retainers, and iTero intraoral scanners and services in the United States, Switzerland, and internationally.

- Increasing consumer adoption of AI-powered, at-home dental solutions threatens to reduce the need for professional orthodontic treatments, which is likely to cannibalize Align Technology’s primary revenue streams as patients bypass traditional providers for lower-cost alternatives.

- Rising pressure on discretionary household income amid persistent macroeconomic uncertainty could significantly dampen demand for elective and premium-priced orthodontic treatments like Invisalign, leading to stagnation or contraction in unit volumes and limiting the company’s long-term top-line growth potential.

- Ongoing commoditization and looming patent expirations in clear aligner technology are expected to spur aggressive price competition, resulting in further erosion of Align’s average selling prices and compressing gross margins despite current innovation efforts.

- The proliferation of low-cost, direct-to-consumer clear aligner businesses and expanded 3D printing capabilities is set to undermine existing pricing structures and chip away at Align’s market share, translating to slower revenue growth and persistent margin headwinds.

- Intensifying regulatory scrutiny over health data privacy and cross-border digital health platforms is likely to drive up compliance costs and hinder international expansion, resulting in sustained operating margin pressure and constrained global earnings growth.

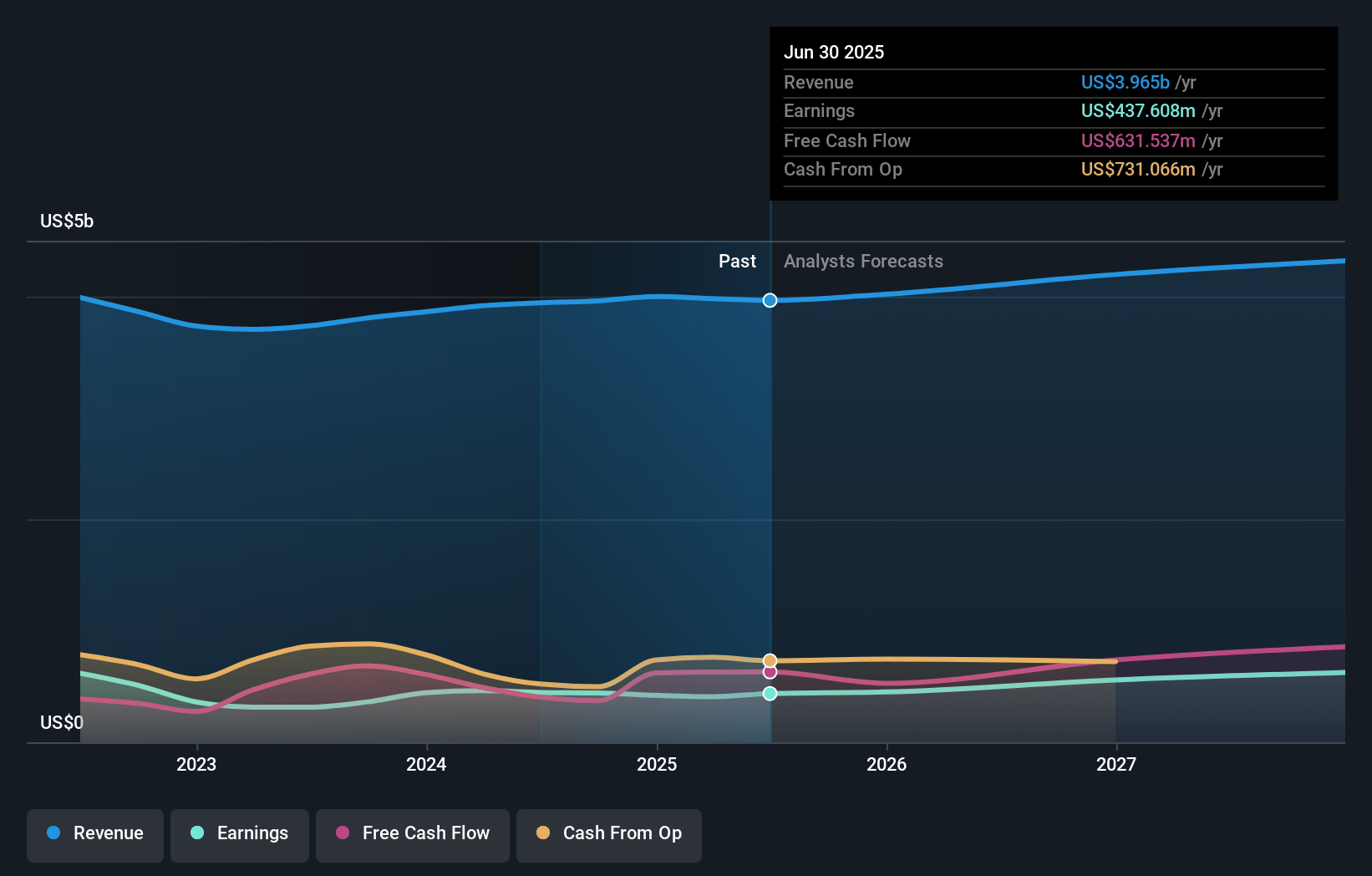

Align Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Align Technology compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Align Technology's revenue will grow by 4.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 10.3% today to 14.6% in 3 years time.

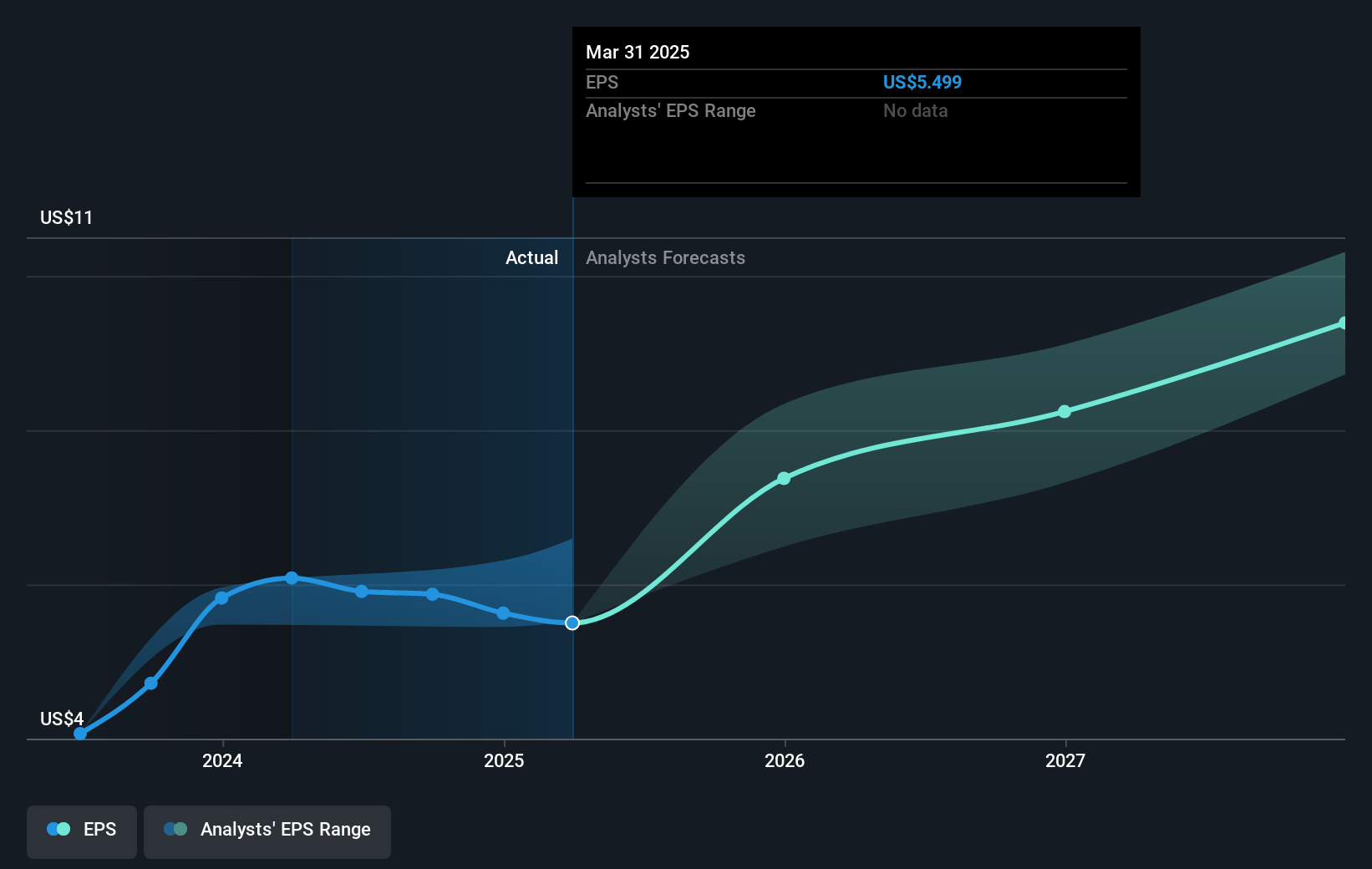

- The bearish analysts expect earnings to reach $655.2 million (and earnings per share of $8.8) by about May 2028, up from $409.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 20.8x on those 2028 earnings, down from 30.9x today. This future PE is lower than the current PE for the US Medical Equipment industry at 30.3x.

- Analysts expect the number of shares outstanding to decline by 2.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.93%, as per the Simply Wall St company report.

Align Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained global growth in demand for both teen and adult orthodontic treatments, with double-digit year-over-year increases in teen and kid starts worldwide, could drive higher overall volume and bolster future revenue.

- Successful commercialization and uptake of innovative new products such as the Invisalign Palate Expander System and Invisalign System with mandibular advancement, including their launch in new geographies and positive doctor feedback, may increase product mix and support ASP stabilization or growth, benefitting margins and revenue.

- Growing adoption of digital dentistry workflows, especially among fast-expanding Dental Service Organizations (DSOs), positions Align to capture incremental market share and enhance recurring revenues from both Clear Aligners and iTero scanners.

- Improving manufacturing efficiencies, cost controls, and increasing contributions from higher-margin products could support operating and gross margin expansion, as evidenced by management's guidance for margin improvement even amid FX and tariff headwinds.

- Flexible global manufacturing and supply chain localization, along with effective tariff and regulatory risk mitigation, lower the threat of cost disruption and position Align to maintain earnings resilience, even in a challenging macro environment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Align Technology is $163.8, which represents two standard deviations below the consensus price target of $230.1. This valuation is based on what can be assumed as the expectations of Align Technology's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $275.0, and the most bearish reporting a price target of just $150.54.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $4.5 billion, earnings will come to $655.2 million, and it would be trading on a PE ratio of 20.8x, assuming you use a discount rate of 6.9%.

- Given the current share price of $173.07, the bearish analyst price target of $163.8 is 5.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives