Narratives are currently in beta

Key Takeaways

- Anticipated growth in alternative distribution channels and FRE product expansion could drive significant revenue increases and enhance market share.

- Strategic initiatives like systematic distributor onboarding and the share repurchase program could improve operational efficiency, net margins, and potential stock valuation gains.

- Regulatory challenges, market entry difficulties, and product mix issues could hinder revenue growth and impact net margins, necessitating strategic adjustments and investments.

Catalysts

About Turning Point Brands- Manufactures, markets, and distributes branded consumer products.

- The company anticipates significant continued growth in the alternative distribution channels for Zig-Zag products, which could drive revenue expansion as these channels gain mainstream acceptance.

- The introduction and expansion of FRE products in a market segment with high demand for more choices in nicotine strengths could lead to significant sales growth, impacting revenue positively.

- The company has plans to maximize the positioning and distribution of its brands, like implementing a consumer-focused go-to-market strategy for FRE, which could enhance market share and improve earnings.

- Systematic onboarding of new distributors and developing relationships to cater to the alternative markets are strategies that have the potential to improve operational efficiency and net margins due to diversified distribution.

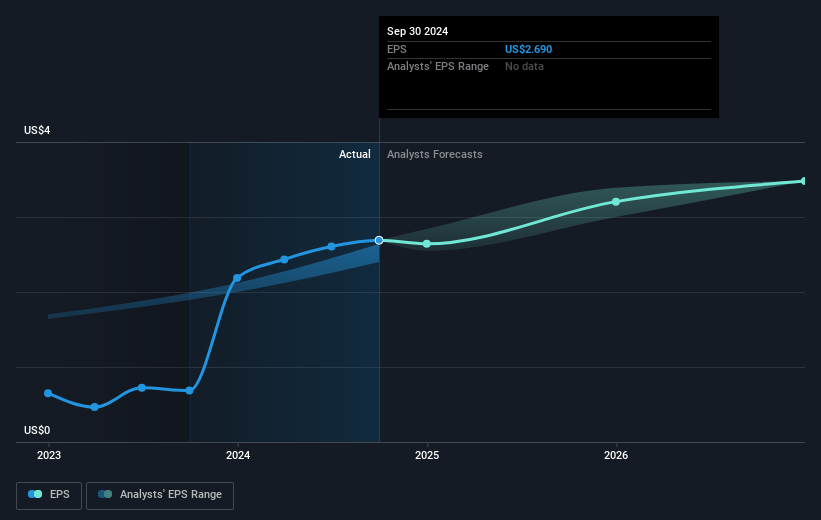

- The company has a $100 million share repurchase program, which could lead to an increase in earnings per share (EPS), offering a catalyst for stock valuation gains.

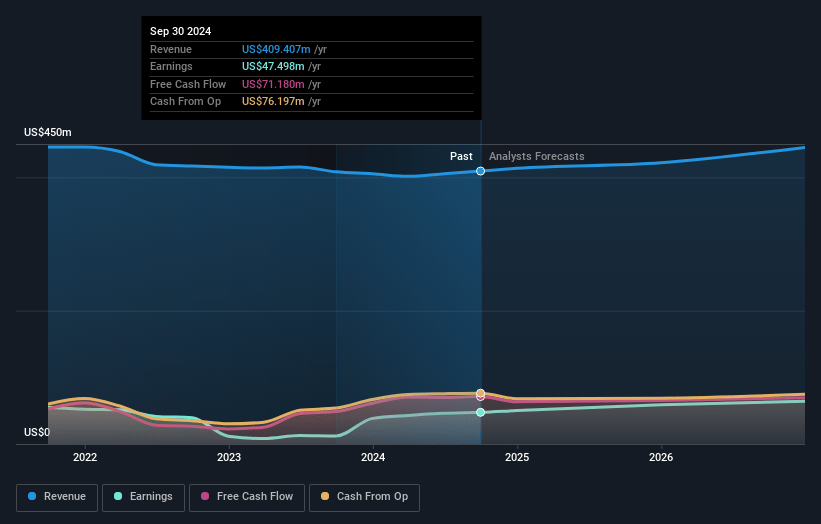

Turning Point Brands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Turning Point Brands's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.6% today to 17.0% in 3 years time.

- Analysts expect earnings to reach $78.1 million (and earnings per share of $3.84) by about November 2027, up from $47.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.4x on those 2027 earnings, down from 20.5x today. This future PE is greater than the current PE for the US Tobacco industry at 10.7x.

- Analysts expect the number of shares outstanding to grow by 4.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.29%, as per the Simply Wall St company report.

Turning Point Brands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in the lighter category's performance, which led to an assessment of its go-forward strategy, could impact revenue growth if adjustments do not lead to recovery or if further declines occur.

- Product mix challenges have decreased gross margins in the Zig-Zag segment, which could negatively affect overall net margins if not addressed or if cost efficiencies are not achieved in other areas.

- The introduction and expansion into 3-milligram and 6-milligram nicotine strengths for the FRE brand require significant investments for securing competitive placement and promotions, potentially impacting net margins if expected growth does not materialize as planned.

- The difficulty in gaining entry into large chain convenience stores for the FRE product line poses a risk to achieving desired sales volumes, which could hinder revenue and growth projections.

- Regulatory hurdles related to the PMTA process for their modern oral products, along with potential future tariffs implications for FRE, could affect future earnings and necessitate additional investments that might impact financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $60.0 for Turning Point Brands based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $459.8 million, earnings will come to $78.1 million, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 6.3%.

- Given the current share price of $55.0, the analyst's price target of $60.0 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives