Key Takeaways

- Accelerating demand and capacity expansion for oral nicotine and smoke-free products will drive higher margins and ongoing organic revenue growth.

- Regulatory support and successful multi-category strategy position PMI for sustained earnings growth and industry-leading profitability as consumer preferences shift.

- Shifting consumer preferences, tightening regulations, and ESG-driven divestment threaten future growth, margins, and valuation despite heavy reliance on newer smoke-free products.

Catalysts

About Philip Morris International- Operates as a tobacco company.

- Rapid expansion of the ZYN oral nicotine business, particularly in the U.S. where consumer demand significantly outpaces supply, points to strong future volume growth as production capacity normalizes and new manufacturing facilities come online. This dynamic is likely to drive both topline acceleration and high gross margin expansion over the next several years.

- PMI’s strategic and successful multi-category rollout of smoke-free alternatives (ZYN, IQOS, and VEEV) in both developed and emerging markets leverages rising discretionary income in a growing middle class across developing economies, which will expand the company’s addressable market and underpin sustained organic revenue growth.

- Ongoing innovation and investment in proprietary technology for heated tobacco and nicotine systems, coupled with demonstrated pricing power across smoke-free categories, is expected to further entrench PMI’s competitive advantage. As consumer adoption rises—supported by urbanization and lifestyle shifts—these products should continue to support gross margin expansion and robust long-term earnings growth.

- The company is achieving rapid mix shift toward higher-margin, reduced-risk products, now accounting for an increasing share of total gross profit and EBITDA, which structurally improves overall net margins and earnings consistency as combustible volumes face long-term declines.

- Global regulatory environments are becoming more supportive of harm reduction and tobacco alternatives; recent policy shifts and PMI’s leadership in smoke-free penetration position the business to benefit disproportionately from industry transformation—providing a long runway for innovation-driven revenue and sustainable adjusted EPS growth.

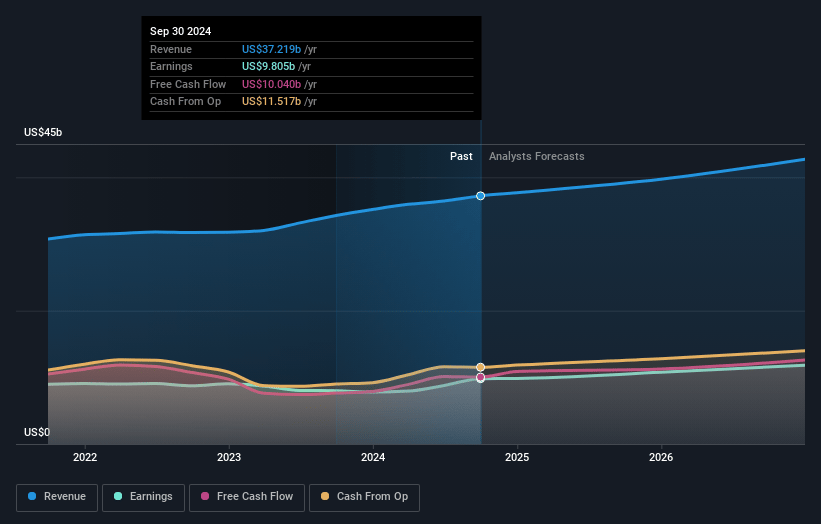

Philip Morris International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Philip Morris International compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Philip Morris International's revenue will grow by 8.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 18.6% today to 28.5% in 3 years time.

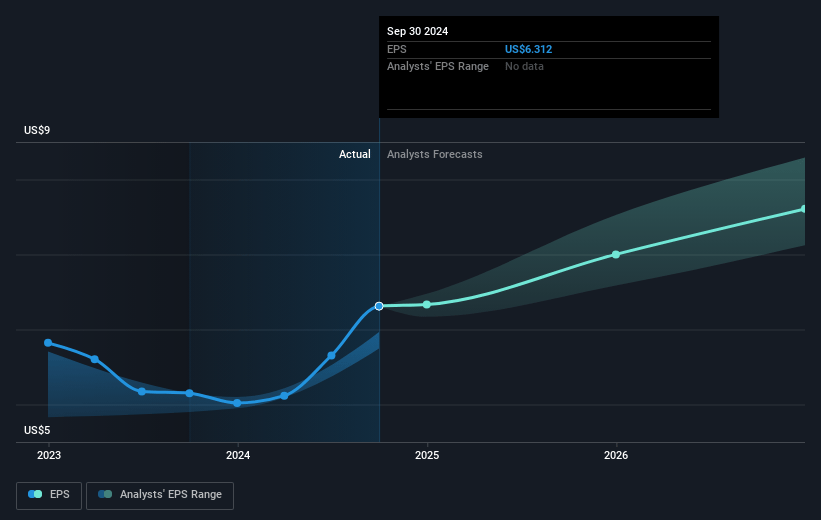

- The bullish analysts expect earnings to reach $13.9 billion (and earnings per share of $8.84) by about April 2028, up from $7.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, down from 36.3x today. This future PE is greater than the current PE for the GB Tobacco industry at 16.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

Philip Morris International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying global health consciousness and anti-smoking sentiment, combined with persistent declines in cigarette volumes, present a significant risk to Philip Morris International’s long-term ability to sustain and grow revenues, especially as consumer behaviors shift further away from tobacco products.

- Regulatory uncertainty remains a core risk, with ongoing annualization impacts from flavor bans in the EU, potential new market restrictions, higher excise taxes, and a generally tightening global regulatory landscape that could impose further compliance costs and constrain revenue and operating margins.

- Heavy reliance on rapid growth in the smoke-free category, particularly IQOS and ZYN, presumes continued strong consumer adoption and favorable regulatory outcomes. However, any slowdown in adoption, new regulatory barriers, or adverse FDA decisions—such as delays or uncertainty around the US launch of IQOS ILUMA—could compress growth and profit margins.

- The company’s growing geographic revenue concentration outside the US and Europe, especially in emerging markets with negative geographic mix (like Turkey, Egypt, and India), exposes Philip Morris International to localized regulatory crackdowns and weaker margins, which could dampen overall profitability and earnings growth.

- Evolving investor attitudes toward ESG, supported by the trend of sustained divestment from tobacco stocks, threatens to apply downward pressure on Philip Morris International’s valuation and may increase its cost of capital, negatively impacting shareholder returns over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Philip Morris International is $180.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Philip Morris International's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $180.0, and the most bearish reporting a price target of just $102.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $48.7 billion, earnings will come to $13.9 billion, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of $164.11, the bullish analyst price target of $180.0 is 8.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:PM. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.