Key Takeaways

- Expansion of digital initiatives and strategic partnerships aims to enhance customer engagement, optimize sales, and drive revenue growth through improved market penetration.

- Investments in capacity and infrastructure, particularly in Brazil and Mexico, are expected to boost revenue, net margins, and market share by resolving bottlenecks.

- Natural disasters, currency fluctuations, and high fixed costs may negatively impact Coca-Cola FEMSA's revenue and margins in the face of supply chain and market competition challenges.

Catalysts

About Coca-Cola FEMSA. de- A franchise bottler, produces, markets, sells, and distributes Coca-Cola trademark beverages in Mexico, Guatemala, Nicaragua, Costa Rica, Panama, Colombia, Brazil, Argentina, and Uruguay.

- The expansion of Coca-Cola FEMSA's digital initiatives, including the Juntos+ platform with advanced AI capabilities and increased user engagement, presents opportunities for revenue growth by optimizing sales processes and enhancing customer relationships.

- Coca-Cola FEMSA is investing in infrastructure to alleviate capacity constraints and improve supply chain efficiency. This includes new production lines and distribution centers, which are expected to support long-term revenue growth and improve net margins by reducing logistic costs.

- Strategic partnerships and product innovations, such as the rollout of Juntos+ as a service and an expanded loyalty program, aim to drive revenue growth by increasing customer retention and enhancing market penetration.

- Investment in capacity expansions in Brazil and Mexico, including addressing capacity constraints at the Porto Alegre plant, is likely to positively impact earnings through increased product availability and sales growth.

- Continued portfolio optimization and marketing initiatives, especially the acceleration of Coke Zero in Mexico and growth in premium categories in Brazil, are expected to enhance revenue and operating income by capturing a larger market share and expanding into high-margin segments.

Coca-Cola FEMSA. de Future Earnings and Revenue Growth

Assumptions

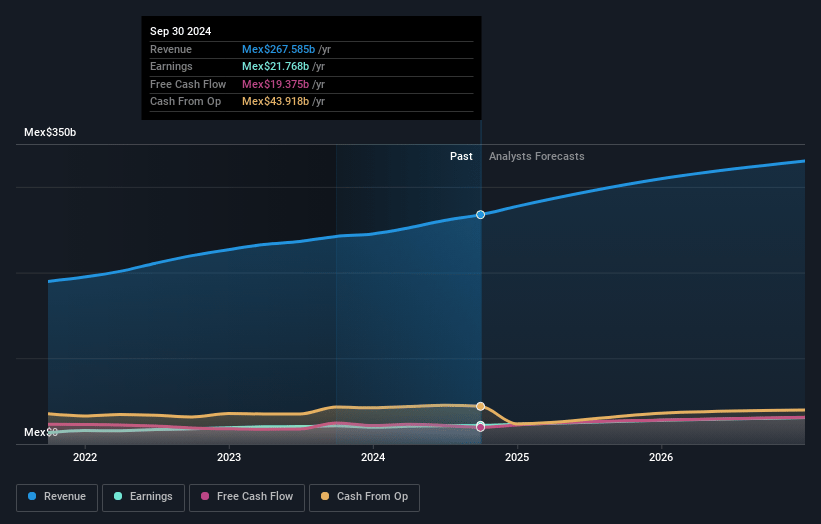

How have these above catalysts been quantified?- Analysts are assuming Coca-Cola FEMSA. de's revenue will grow by 8.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.5% today to 9.2% in 3 years time.

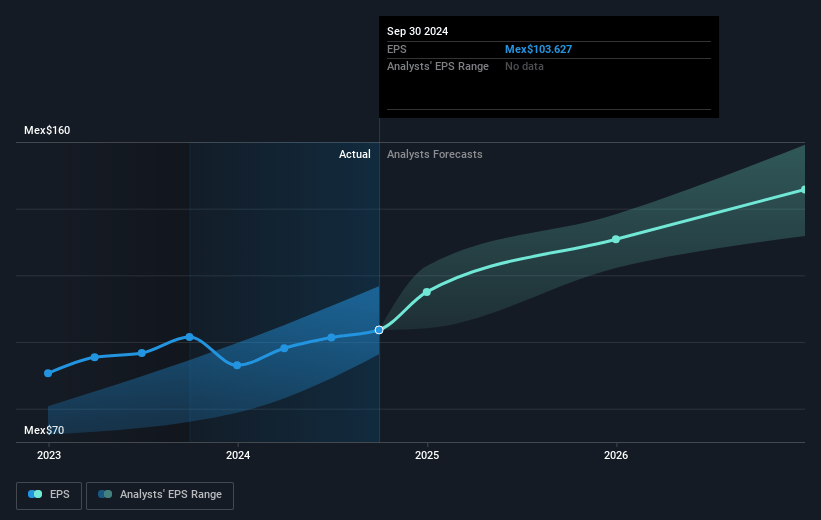

- Analysts expect earnings to reach MX$32.9 billion (and earnings per share of MX$131.06) by about April 2028, up from MX$23.7 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as MX$29.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, up from 16.7x today. This future PE is lower than the current PE for the US Beverage industry at 25.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.25%, as per the Simply Wall St company report.

Coca-Cola FEMSA. de Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Natural disasters, such as the flood in Brazil and Hurricane John in Mexico, have caused temporary plant closures and logistical challenges, potentially affecting capacity, supply chain efficiency, and thus impacting revenue.

- Currency fluctuations, especially the depreciation of local currencies against the U.S. dollar, have created operational foreign exchange losses, potentially impacting net margins and earnings.

- Unavailability of products due to supply chain capacity constraints resulted in significant out-of-stock situations, which could hinder volume growth and revenue capture opportunities.

- Increased competition in key markets, especially in the Coke Zero and premium beverage segments, may impact Coke FEMSA's ability to maintain market share and consequently affect revenues.

- High fixed costs such as labor, maintenance, and freight, along with increasing exposure to digital and AI-driven initiatives, could strain operating margins if revenue growth does not keep pace with these cost increases.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $110.512 for Coca-Cola FEMSA. de based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $195.0, and the most bearish reporting a price target of just $94.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be MX$356.3 billion, earnings will come to MX$32.9 billion, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 8.2%.

- Given the current share price of $94.76, the analyst price target of $110.51 is 14.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.