Key Takeaways

- Shifting consumer preferences and demographics threaten demand for traditional offerings, weakening brand loyalty and constraining margin growth.

- Rising costs, increased competition, and digital disruption challenge Conagra's ability to sustain revenue, profitability, and operating leverage.

- Ongoing brand innovation, portfolio shifts, and supply chain improvements aim to boost margins, revenue growth, and operational efficiency in higher-growth food categories.

Catalysts

About Conagra Brands- Operates as a consumer packaged goods food company primarily in the United States.

- The ongoing consumer shift toward fresh and minimally processed foods threatens to erode long-term demand for Conagra's core frozen and packaged offerings, increasing the risk of declining sales and impairing the company's ability to sustain top-line revenue growth.

- Demographic changes and younger consumers' preference for niche, international, or health-forward brands could undermine Conagra's traditional brand loyalty and pricing power, putting sustained pressure on gross margins and future earnings.

- Persistent reliance on aggressive investments and marketing spend to prop up volumes, in the face of secular demand headwinds, points to structural growth limitations and raises the risk that increased spending will not yield meaningful long-term volume growth, ultimately compressing net margins and reducing operating leverage.

- Volatility in input costs (notably animal proteins, packaging materials, and tariffs) continues to drive significant margin compression, and Conagra's ability to pass along these costs via pricing is limited by heightened consumer value-seeking behavior and increased competition, especially from private labels.

- The rise of e-commerce and direct-to-consumer grocery threatens to disrupt Conagra's traditional distribution channels, exposing the company to potential share loss to digital-native and smaller challenger brands, which could further erode both revenue growth and long-term profitability.

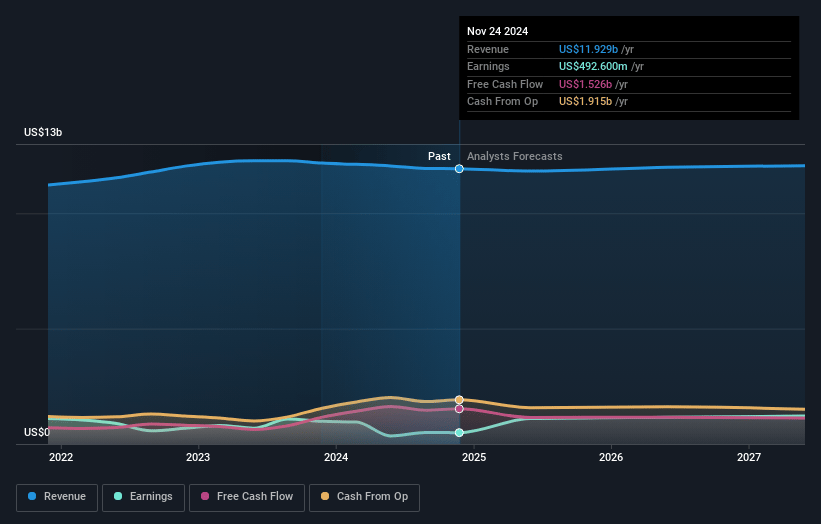

Conagra Brands Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Conagra Brands compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Conagra Brands's revenue will decrease by 1.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 9.9% today to 5.0% in 3 years time.

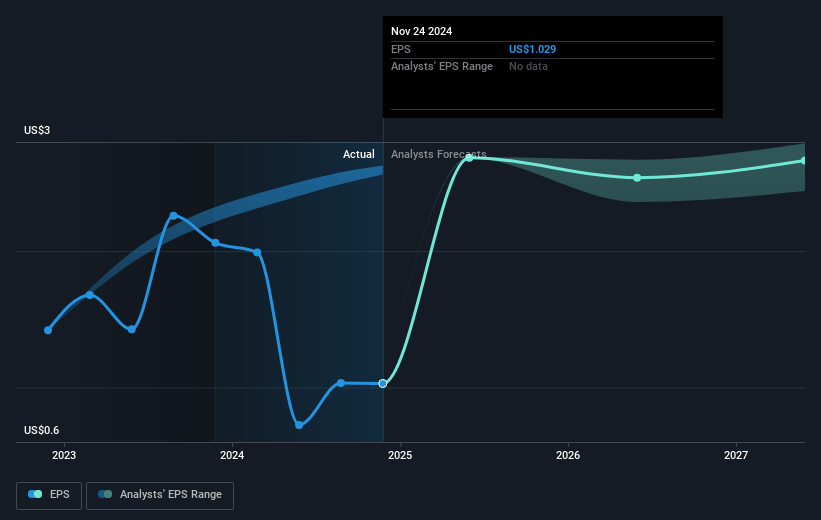

- The bearish analysts expect earnings to reach $557.1 million (and earnings per share of $1.97) by about July 2028, down from $1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.6x on those 2028 earnings, up from 7.9x today. This future PE is lower than the current PE for the US Food industry at 19.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.5%, as per the Simply Wall St company report.

Conagra Brands Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Conagra's strong track record and ongoing commitment to brand modernization, innovation, and premiumization-especially in frozen and snacks-has historically enabled the company to increase unit pricing and improve brand equity, which may drive future revenue growth and margin improvement.

- Strategic divestitures and portfolio reshaping continue to focus Conagra on higher-growth, higher-margin categories, suggesting a long-term positive shift in category mix that could support both improved earnings and revenue streams.

- Significant supply chain investments, including the repatriation of outsourced production and leveraging new automation and productivity technologies, are expected to enhance operational efficiency and reduce costs, bolstering future net margins.

- Robust innovation pipelines, exemplified by products like Banquet Mega Chicken Filets, have generated high consumer demand, and management's focus on multi-serve packaging and white space opportunities in frozen may accelerate top-line sales over the long term.

- Management indicates a pathway to post-inflationary gross margin recovery, with expectations for normalized inflation, strong productivity programs, and targeted pricing actions positioned to lift margins and earnings after the current year's compression.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Conagra Brands is $18.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Conagra Brands's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $27.9, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $11.2 billion, earnings will come to $557.1 million, and it would be trading on a PE ratio of 18.6x, assuming you use a discount rate of 6.5%.

- Given the current share price of $19.04, the bearish analyst price target of $18.0 is 5.8% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.