Key Takeaways

- Portfolio refocusing and cost reduction initiatives are expected to improve margins, operational efficiency, and strengthen overall financial health.

- Emphasis on core categories and forward-looking M&A ambitions position the company for long-term, stable growth amid shifting consumer trends.

- Structural consumer shift away from processed foods, limited pricing power, high debt, rising costs, and lack of innovation threaten the company’s growth, margins, and relevance.

Catalysts

About B&G Foods- Manufactures, sells, and distributes a portfolio of shelf-stable and frozen foods, and household products in the United States, Canada, and Puerto Rico.

- The ongoing portfolio reshaping, including potential divestitures of non-core or lower-margin businesses and a sharpened focus on core categories (spices, seasonings, Mexican meal prep, baking staples), should increase operational efficiency, improve gross and EBITDA margins, and ultimately support higher free cash flow generation over time.

- Accelerated cost reduction programs—with an expected $10 million in savings this year and a $15–$20 million annual run rate—will structurally lower SG&A and cost of goods sold, directly benefitting net margins and earnings as these programs ramp.

- Lower leverage through debt paydown funded by divestitures and operational cash flow will reduce interest expenses, strengthen the company’s financial profile, and enhance the potential for improved net income and EPS.

- Stabilization or growth in consumption of shelf-stable product categories, supported by demographic trends such as dual-income households, urbanization, and increased at-home meal occasions with an aging population, provides a foundation for consistent long-term revenues even as short-term trends recover.

- Strategic focus on building platforms for future M&A within higher-growth categories positions B&G to benefit from growing consumer demand for convenient pantry staples, supporting long-term revenue growth and improved category mix as acquisition opportunities materialize.

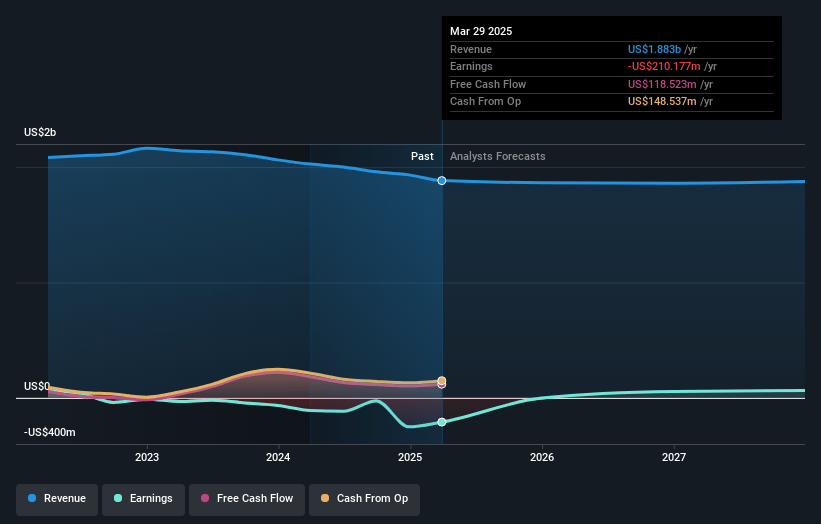

B&G Foods Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming B&G Foods's revenue will decrease by 0.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -11.2% today to 6.5% in 3 years time.

- Analysts expect earnings to reach $121.3 million (and earnings per share of $0.76) by about May 2028, up from $-210.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.1x on those 2028 earnings, up from -1.7x today. This future PE is lower than the current PE for the US Food industry at 19.5x.

- Analysts expect the number of shares outstanding to grow by 0.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.3%, as per the Simply Wall St company report.

B&G Foods Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining consumer demand for packaged and shelf-stable foods, as evidenced by a 10.5% year-over-year net sales decline in Q1 2025 and ongoing weak consumption trends (–6% in Q1, improving but still negative in April), highlights the risk that long-term shifts toward fresher, less-processed foods may structurally erode B&G’s revenue base over time.

- Increased pricing pressure from retailer inventory reductions and aggressive promotional spending (with trade spend up 175 basis points and net pricing down 1.2%), combined with more permanent retailer efforts to operate with lower inventories, could limit B&G’s pricing power and decrease gross margins and earnings over the long term.

- High leverage (debt at $1.97 billion, with 35% tied to floating rates and leverage targets remaining above 5x) and heavy interest expenses ($147.5M–$152.5M annual interest expense guidance) constrain financial flexibility and amplify risk, especially in a rising rate/uncertain credit environment, pressuring net margins and EPS.

- Persistent input cost inflation (notably for black pepper, garlic, olive oil, tomatoes, and cans), ongoing supply chain risks (especially with significant spice sourcing from Vietnam and China and potential tariff volatility), and the inability to fully pass on costs to retailers threaten gross margins and long-term profitability.

- Heavy reliance on short-term promotions and lack of evidence of organic product innovation (with company performance driven by reactive promotions rather than new growth drivers or healthier segment expansion) raises concerns that B&G’s brands may lose relevance against private label, direct-to-consumer, and fresher/healthier alternatives, impacting both long-term revenue growth and market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.5 for B&G Foods based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $121.3 million, and it would be trading on a PE ratio of 5.1x, assuming you use a discount rate of 11.3%.

- Given the current share price of $4.42, the analyst price target of $5.5 is 19.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.