Key Takeaways

- Strengthening brand relevance and diversified product growth fuel sustained revenue gains and robust margins, supported by premium pricing and expanding consumer loyalty.

- Supply chain investments and efficiency improvements position the company to overcome constraints and capitalize on further market penetration and category expansion.

- Heavy reliance on U.S. egg sales, operational bottlenecks, rising costs, intensifying competition, and regulatory pressures collectively threaten profitability and future revenue resilience.

Catalysts

About Vital Farms- A food company, packages, markets, and distributes shell eggs, butter, and other products in the United States.

- The ongoing rise in consumer demand for ethically produced, transparently sourced food is accelerating Vital Farms’ brand relevance and pricing power, as shown by consistent increases in brand awareness (up 5 percentage points in a single quarter) and expanding household penetration, which should drive sustained revenue growth and bolster gross margins.

- The company’s investments in supply chain expansion (significant family farm growth, new grading capacity, and upcoming Indiana facility) are expected to ease recent supply constraints, unlocking accelerated volume-driven revenue growth and supporting higher net margins through improved operational efficiency.

- Continued robust growth in adjacent categories (such as butter, with 41% year-over-year net revenue growth) points to successful category diversification, reducing concentration risk and opening new avenues for both top-line and profitability expansion.

- The low market penetration rate (only 11.3% of US households) combined with strengthening consumer loyalty provides a long runway for customer acquisition and increased wallet share, suggesting the current valuation does not fully reflect future earnings growth potential.

- Premium pricing initiatives—enabled by resilient demand from higher-income, value-driven consumers—are expected to offset cost pressures from tariffs and inflation, protecting future gross and net margins even in a dynamic macro environment.

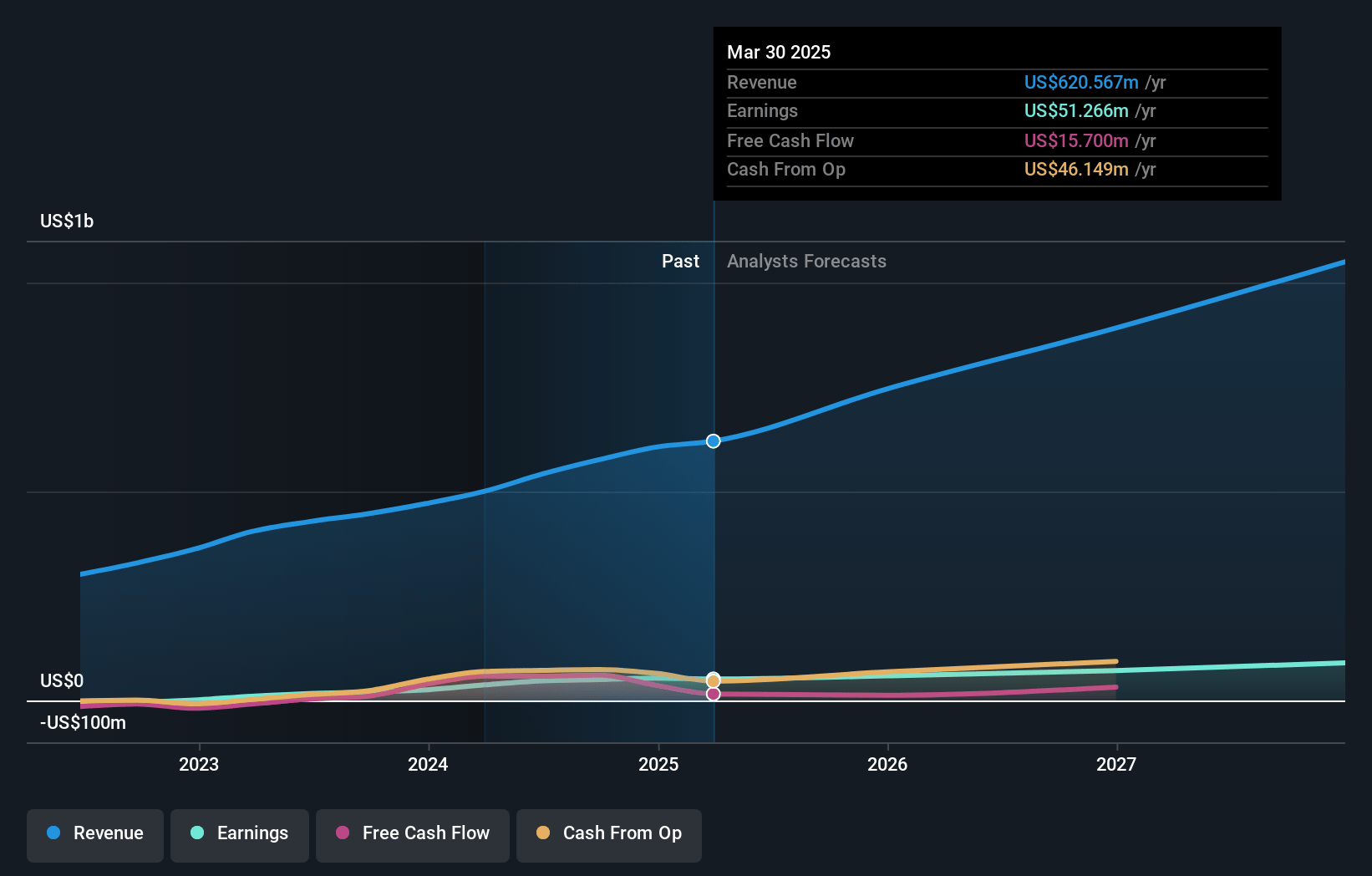

Vital Farms Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vital Farms's revenue will grow by 21.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.3% today to 8.5% in 3 years time.

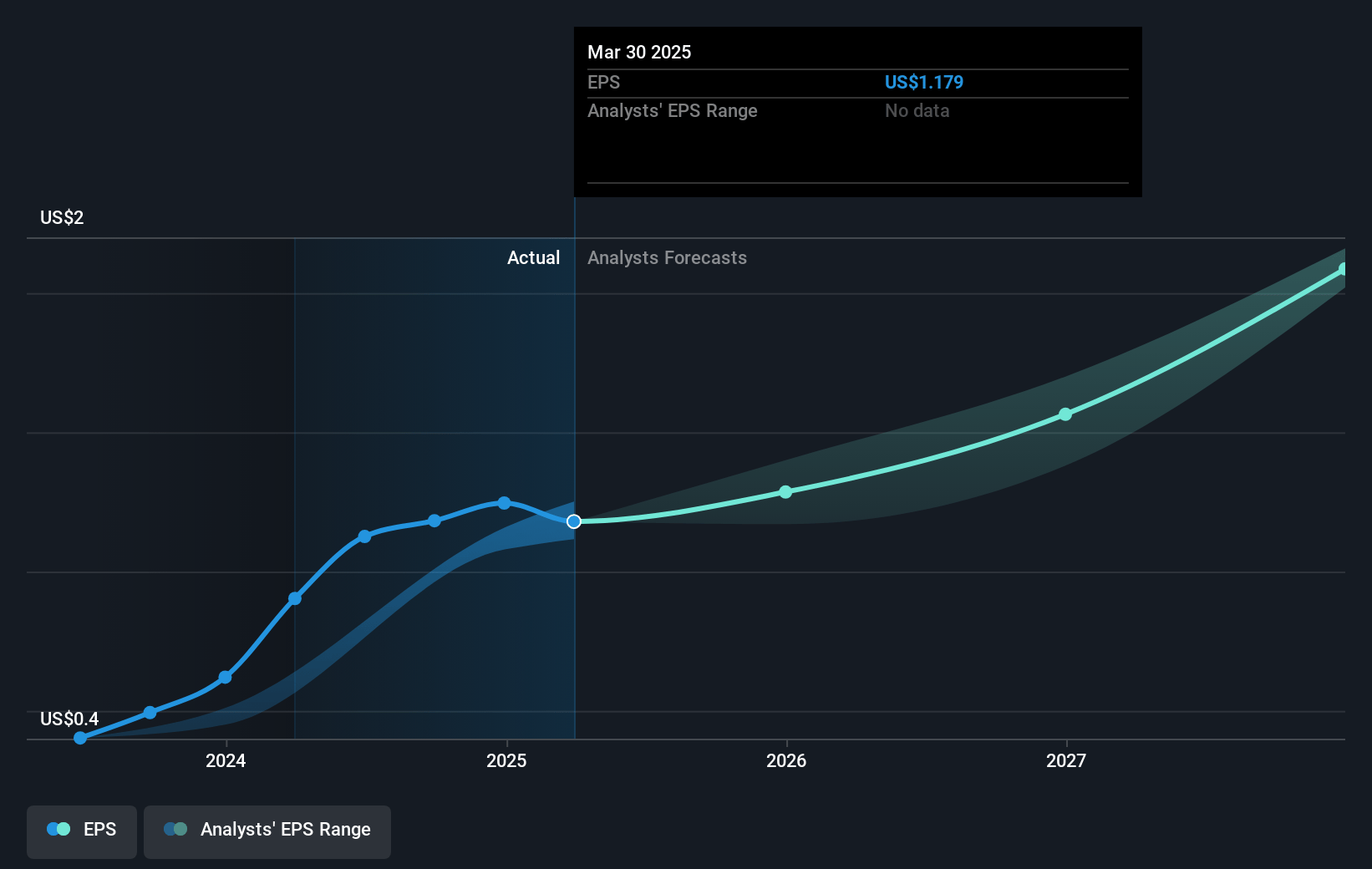

- Analysts expect earnings to reach $94.2 million (and earnings per share of $1.96) by about July 2028, up from $51.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.2x on those 2028 earnings, down from 32.8x today. This future PE is greater than the current PE for the US Food industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 3.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Vital Farms Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slowing volume growth and egg supply constraints—driven by farm onboarding lags, inventory depletion, and capacity limitations—directly impact the company’s ability to scale revenue, leaving Vital Farms vulnerable to operational disruptions and revenue shortfalls if onboarding or expansion encounters setbacks.

- Rising operating expenses—including increased headcount, professional services, and digital transformation costs—combined with higher tariffs and commodity inflation, are already compressing net margins and earnings, and may further pressure profitability if price increases are insufficient to offset these costs or if consumer price sensitivity becomes a factor.

- Continued heavy concentration in the U.S. market and over-reliance on eggs as the core product exposes Vital Farms to geographic and category risks; slow international expansion or diversification could make future revenues and earnings highly susceptible to U.S.-specific market shocks or shifting consumer protein preferences.

- Growing threats from lower-priced private label and store-brand “ethical” eggs, as well as industrial competitors adopting higher welfare standards, are likely to erode Vital Farms’ premium pricing power and competitive moat, risking downward pressure on revenue growth and shrinking gross margins as price competition intensifies.

- Escalating regulatory requirements, persistent risk of avian influenza or similar biological threats, and supply chain vulnerabilities inherent in a network of small family farms could drive up compliance and operating costs, disrupt supply, and negatively affect net margins and long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $45.0 for Vital Farms based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $39.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $94.2 million, and it would be trading on a PE ratio of 28.2x, assuming you use a discount rate of 6.4%.

- Given the current share price of $37.79, the analyst price target of $45.0 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.