Key Takeaways

- Arcadia's focus on expanding Zola distribution and profitable product lines is set to drive revenue growth and improve earnings through high-margin sales.

- Strategic exits and IP monetization simplify operations, reduce expenses, and provide capital for growth, enhancing long-term financial stability.

- Arcadia faces revenue instability due to reliance on niche products, loss of assets, and potentially rising expenses amid market and transaction uncertainties.

Catalysts

About Arcadia Biosciences- Produces and markets plant-based food and beverage products in the United States.

- Arcadia Biosciences' focus on expanding Zola coconut water distribution has led to significant sales growth, with Zola revenues increasing 46% for the full year 2024. Continued distribution expansion in new stores and broader retail presence is expected to drive revenue growth in 2025.

- The company's strategic exit from underperforming brands and monetization of the wheat IP portfolio have simplified operations and reduced operating expenses, likely improving net margins and enhancing overall profitability.

- A stronger focus on high-growth, high-margin products like Zola, with gross margins over 30% consistently, positions Arcadia to improve its earnings as these products' sales volumes increase.

- The expected cash infusion of approximately $2.5 million in May 2025 from the GoodWheat asset sale provides non-dilutive capital that can be used to support further growth initiatives, likely positively impacting cash flow and financial stability.

- Efforts to monetize remaining intellectual property assets may provide additional revenue streams and capital, helping to strengthen financials and potentially support future growth opportunities.

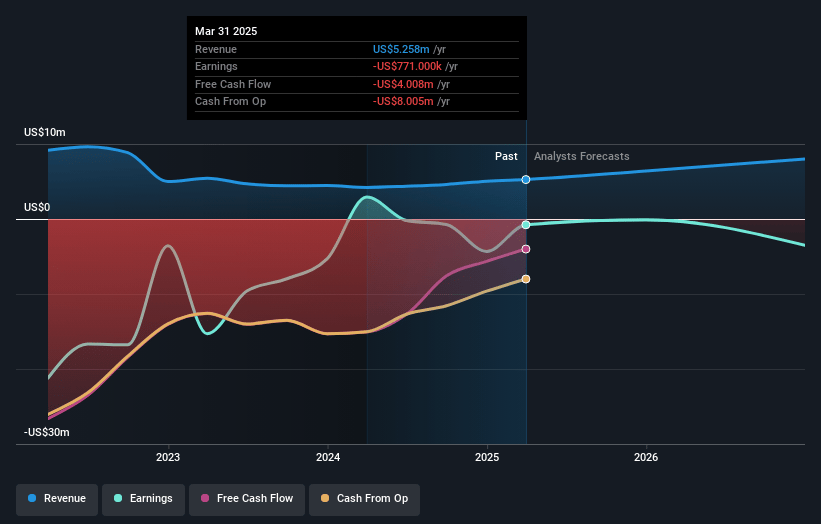

Arcadia Biosciences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Arcadia Biosciences's revenue will grow by 24.1% annually over the next 3 years.

- Analysts are not forecasting that Arcadia Biosciences will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Arcadia Biosciences's profit margin will increase from -85.6% to the average US Food industry of 6.6% in 3 years.

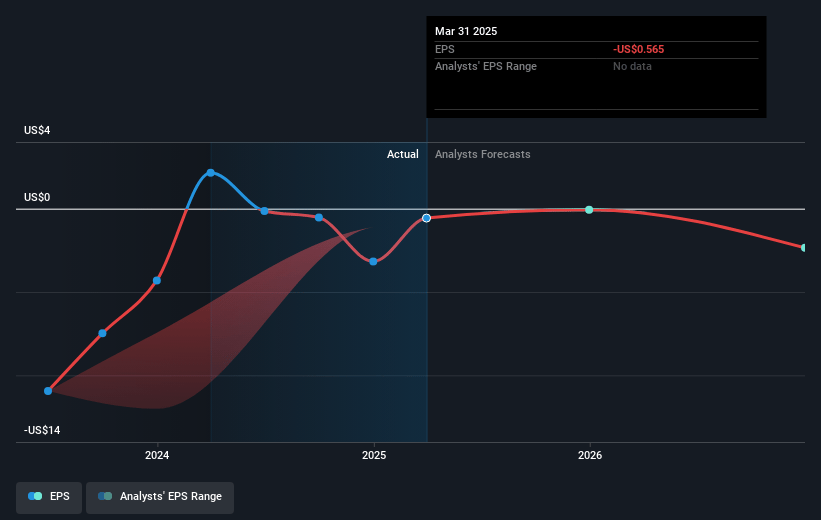

- If Arcadia Biosciences's profit margin were to converge on the industry average, you could expect earnings to reach $637.7 thousand (and earnings per share of $0.64) by about April 2028, up from $-4.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.5x on those 2028 earnings, up from -1.0x today. This future PE is greater than the current PE for the US Food industry at 17.4x.

- Analysts expect the number of shares outstanding to grow by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Arcadia Biosciences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Arcadia's focus on the Zola brand leaves the company vulnerable to market fluctuations within the niche coconut water category, which may impact future revenue stability.

- The significant decline in GLA oil sales coupled with the cessation of GLA inventory could lead to reduced revenue diversification and potentially impact net earnings negatively.

- The increased reliance on fewer products and the loss of the GoodWheat asset may result in lower revenue streams and could pressure profit margins if market conditions shift unfavorably.

- Higher-than-expected SG&A expenses, including unforeseen transaction-related costs, may strain net margins and reduce profitability.

- The pending transaction with Roosevelt Resources carries uncertainties in stockholder approval and SEC processes, which could affect future earnings and operational stability if complications arise.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.0 for Arcadia Biosciences based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.6 million, earnings will come to $637.7 thousand, and it would be trading on a PE ratio of 22.5x, assuming you use a discount rate of 6.2%.

- Given the current share price of $3.03, the analyst price target of $12.0 is 74.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.