Key Takeaways

- Enhanced production efficiency, digital expansion, and health-focused innovation are improving Freshpet's margins, competitive position, and prospects for top-line growth.

- Strong brand loyalty and retailer partnerships support sustainable market share gains as industry trends favor premium, fresh pet food and omni-channel purchasing.

- Slowing pet adoption, cautious consumer spending, increased competition, adjusted long-term targets, and high operating costs raise concerns about Freshpet's future growth and profitability.

Catalysts

About Freshpet- Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

- Operational improvements and implementation of new production technologies at Ennis and other facilities have driven higher yields, quality, and throughput, leading to a significant reduction in CapEx ($100 million less over 2025-26) and enhanced gross/EBITDA margins, setting the business up for improving net earnings and cash generation.

- Expansion of digital channels (digital up 40% YoY, now 13% of sales) and entry into the club channel (test expanded to 125 stores with further expected growth) positions Freshpet to capture the ongoing shift in consumer purchasing behavior toward online and omni-channel retail, likely boosting future revenues and household penetration.

- Consumer focus on ingredient transparency, nutrition, and less-processed foods is being leveraged through targeted health-forward marketing campaigns and new product innovation (e.g., complete nutrition bag, multipacks), enhancing competitive differentiation, supporting pricing power, and growing buy rates-key drivers for top-line growth.

- Despite macro headwinds, Freshpet's brand loyalty (MVPs up 18% YoY, represent 70% of sales), high customer retention, and strong relationships with retailers provide a foundation for sustainable market share gains within the premium fresh pet food segment, supporting both revenue and margin growth.

- As larger competitors invest in category awareness and the premium/fresh pet food segment expands, Freshpet-being the category pioneer with differentiated, health-focused offerings, growing capacity, and efficiency advantages-is well-positioned to capitalize on the long-term humanization and health trends in pet ownership, driving outsized revenue and margin growth versus the broader category.

Freshpet Future Earnings and Revenue Growth

Assumptions

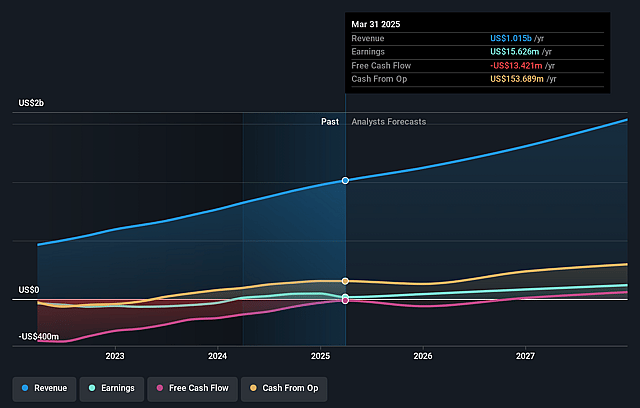

How have these above catalysts been quantified?- Analysts are assuming Freshpet's revenue will grow by 13.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.2% today to 8.9% in 3 years time.

- Analysts expect earnings to reach $136.7 million (and earnings per share of $2.73) by about August 2028, up from $33.7 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $92.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.1x on those 2028 earnings, down from 90.2x today. This future PE is greater than the current PE for the US Food industry at 20.9x.

- Analysts expect the number of shares outstanding to grow by 0.5% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Freshpet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slowing category growth for dog food, exacerbated by economic pressures (e.g., return-to-office mandates, high housing costs, lingering post-pandemic effects), has led to a weakened rate of new dog adoptions and pet replacements, which could limit Freshpet's long-term revenue growth if the dog population does not rebound as forecasted.

- Ongoing consumer hesitation to trade up to premium products, especially among more price-sensitive demographics during economic uncertainty or inflation, threatens Freshpet's ability to drive household penetration and increase buy rates, which may impact both revenue and profit margins.

- Heightened competitive pressure-particularly from entrenched brands like Blue Buffalo and others investing heavily in the fresh segment-poses a risk to Freshpet's market share and pricing power, potentially resulting in slower top-line growth and compressed net margins over time.

- The company's removal of its ambitious 2027 net sales and household penetration targets signals a recognition of structurally lower category growth, which may lead to investor skepticism regarding the company's long-term earnings trajectory and market expansion potential.

- Persistent high capital requirements for refrigeration, manufacturing, and logistics infrastructure, along with variable exposure to tariff and input cost increases, could constrain free cash flow and erode net margins if operational efficiencies and new technologies do not offset these expenses as projected.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $94.176 for Freshpet based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $158.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $136.7 million, and it would be trading on a PE ratio of 41.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $62.3, the analyst price target of $94.18 is 33.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.