Key Takeaways

- Freshpet's expansion in household penetration and operational efficiencies is driving revenue growth and improved profitability through logistics and cost enhancements.

- Strategic capacity expansion and changes in pet specialty channels aim to enhance long-term growth, supporting profitability and market presence.

- Freshpet's strategy of limiting growth for free cash flow positivity by 2026 might result in missed revenue if market conditions favor expansion.

Catalysts

About Freshpet- Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

- Freshpet has demonstrated significant growth in household penetration, adding approximately 2 million households with heavy and super heavy users, and expanding distribution with new stores and additional fridges, which is expected to drive further top-line revenue growth.

- The company's operational efficiencies have resulted in a 650 basis point increase in adjusted gross margin in 2024, with continued improvements in logistics, quality, and input costs. These enhancements are likely to positively impact net margins and overall profitability.

- Freshpet has clear plans for capacity expansion, with new production lines and technology development to support up to $3 billion in sales from existing facilities. This is expected to enable long-term revenue growth and operational leverage, enhancing earnings potential.

- The company plans to change its approach in the pet specialty channel, which is underdeveloped but represents a sizable opportunity. Effective execution in this area could boost revenue growth and market share, enhancing net income growth prospects.

- Freshpet anticipates achieving free cash flow positivity by 2026, intending to self-fund its growth efforts. This financial strategy could lead to enhanced profitability and investor confidence, potentially improving earnings scalability.

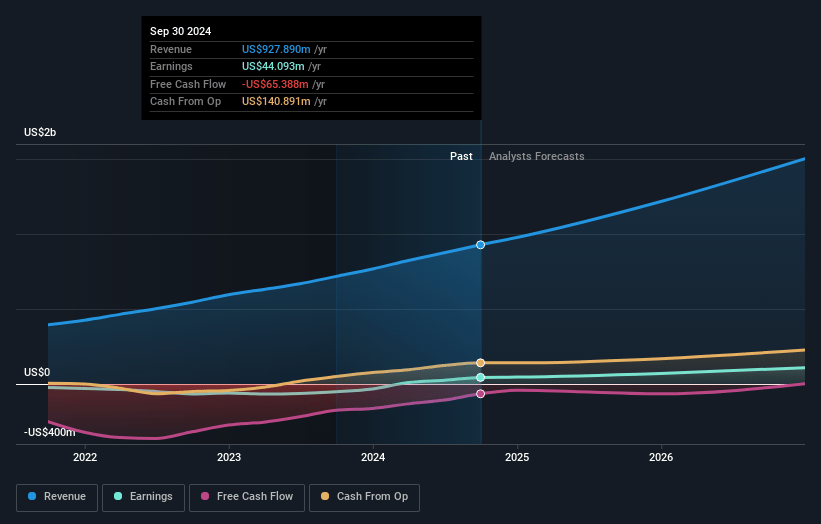

Freshpet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Freshpet's revenue will grow by 22.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.8% today to 8.5% in 3 years time.

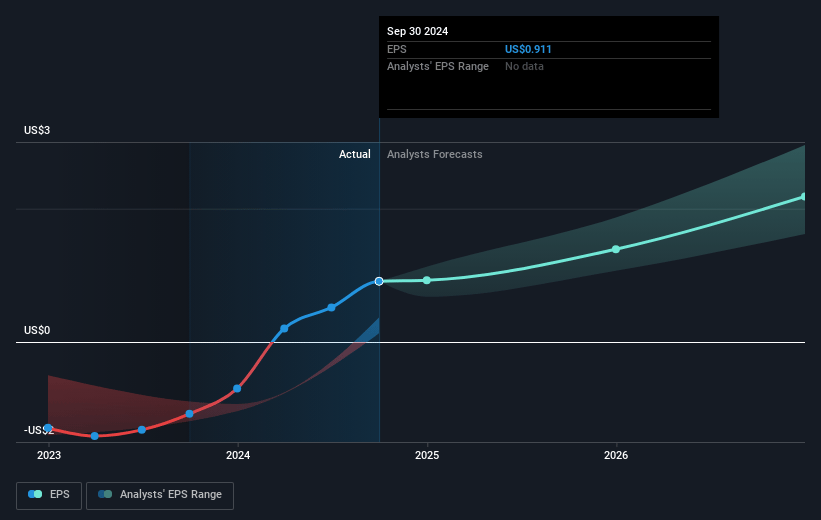

- Analysts expect earnings to reach $152.1 million (and earnings per share of $3.0) by about March 2028, up from $46.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $172.5 million in earnings, and the most bearish expecting $128.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 58.5x on those 2028 earnings, down from 100.6x today. This future PE is greater than the current PE for the US Food industry at 18.7x.

- Analysts expect the number of shares outstanding to grow by 0.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Freshpet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Potential shifts in retail strategies and the uncertain impact on the distribution model, particularly in the pet specialty channel, could affect future revenue growth.

- The company’s reliance on significant capital investments for capacity expansion and new technological advancements poses risks if expected efficiencies and sales volumes are not realized, impacting net margins and earnings.

- The decision to constrain growth to be free cash flow positive by 2026 instead of pursuing higher growth rates could lead to missed revenue opportunities if market conditions are favorable.

- Changes in distribution partners within the pet specialty channel may lead to short-term disruptions and nonrecurring expenses, potentially impacting short-term profitability.

- The assumption of maintaining strong growth rates amid competitive pressures and changing consumer preferences could challenge Freshpet's ability to sustain expected revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $151.537 for Freshpet based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $195.0, and the most bearish reporting a price target of just $110.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $152.1 million, and it would be trading on a PE ratio of 58.5x, assuming you use a discount rate of 6.2%.

- Given the current share price of $96.86, the analyst price target of $151.54 is 36.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives