Key Takeaways

- Freshpet is poised for accelerated margin expansion and free cash flow growth, driven by production advances, operational improvements, and underappreciated total addressable market potential.

- Category innovation, digital expansion, and premiumization trends support durable volume, pricing power, and long-term revenue runway well above current expectations.

- Multiple external and internal pressures threaten Freshpet's revenue growth, market share, and profitability, including market shifts, competitive dynamics, channel risks, and evolving consumer preferences.

Catalysts

About Freshpet- Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

- Analyst consensus expects operational improvements and new technology to moderately lift margins, but the Ennis facility's rapid margin transformation and promising new production technologies could drive an accelerated step-change in gross margin well above the 48% target, with significantly higher EBITDA and free cash flow as soon as 2026.

- While expanding into club and mass retail is seen as incremental, analysts broadly underestimate Freshpet's immense untapped total addressable market, especially among premium "MVP" pet owners; the company's latest modeling suggests active buyers could more than triple, setting up years of double-digit revenue growth far beyond current forecasts.

- There is substantial whitespace in e-commerce and digital, with only 13% of Freshpet's sales online versus an industry average of 35%; as digital penetration catches up with category norms and leverages its unique fridge network as micro-fulfillment centers, Freshpet can unlock both rapid revenue growth and higher-margin online transactions.

- The humanization of pets and a multi-generational shift in pet ownership preferences mean demand for premium, health-focused offerings will structurally outpace legacy brands, locking in sustained volume and pricing power that should drive organic revenue growth and reduce elasticity risk even as the macro environment normalizes.

- Freshpet's proven R&D engine and focus on category expansion-such as scaling up fresh cat food, investing in new treat and snack formats, and exploring adjacent health and wellness SKUs-gives it a long runway for innovation, driving higher basket sizes, increased franchise penetration, and upward bias to both revenue and operating income over the next decade.

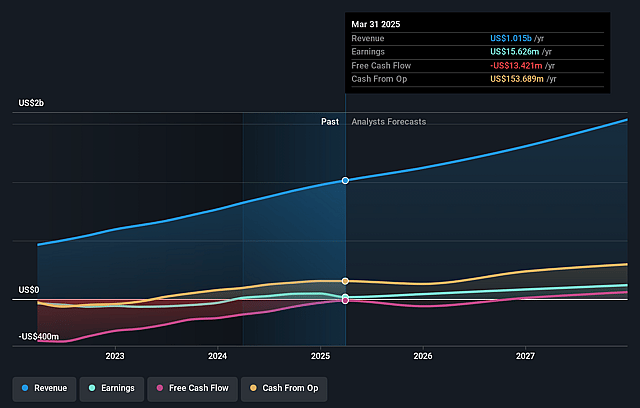

Freshpet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Freshpet compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Freshpet's revenue will grow by 15.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.2% today to 10.6% in 3 years time.

- The bullish analysts expect earnings to reach $170.6 million (and earnings per share of $3.4) by about August 2028, up from $33.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 47.2x on those 2028 earnings, down from 92.7x today. This future PE is greater than the current PE for the US Food industry at 20.8x.

- Analysts expect the number of shares outstanding to grow by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Freshpet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Softening category demand, declining growth in pet adoption, and macroeconomic headwinds-such as high housing costs and return-to-office trends-are limiting category expansion, which could suppress Freshpet's revenue growth for years.

- The company's heavy investments in marketing and media to drive household penetration may not yield proportional sales gains, and a reliance on high marketing spend could weigh on operating margins and earnings.

- Intensifying competition from both major conglomerates (such as General Mills' Blue Buffalo and the Farmer's Dog) and natural brands threatens Freshpet's market share and could erode pricing power, likely impacting revenue and gross margins.

- Freshpet's refrigerated, in-store focused distribution model is at risk as a growing share of pet food sales migrate to direct-to-consumer and online channels, where its products face logistical disadvantages, potentially slowing revenue growth and market share expansion.

- Shifting consumer concerns around sustainability and the environmental impact of packaging, if not adequately addressed by Freshpet's operations, could hurt demand among increasingly eco-conscious customers, putting pressure on future revenue and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Freshpet is $135.01, which represents two standard deviations above the consensus price target of $94.18. This valuation is based on what can be assumed as the expectations of Freshpet's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $158.0, and the most bearish reporting a price target of just $65.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $170.6 million, and it would be trading on a PE ratio of 47.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $63.98, the bullish analyst price target of $135.01 is 52.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.