Key Takeaways

- Refocusing on core herb business and launching clean-label products improve margins and future earnings, aided by Narayan Group acquisition.

- U.S. retail expansion and tech advancements enhance efficiency and revenue, supporting market presence and profit growth.

- Strategic shifts towards higher-margin products and operational challenges, including acquisition risks and cost pressures, may hinder Edible Garden's path to profitability and stable revenue growth.

Catalysts

About Edible Garden- Edible Garden AG Incorporated, together with its subsidiaries, operate as a controlled environment agriculture farming company.

- The strategic decision to refocus operations on the core herb business and launch new clean-label sports nutrition products has improved gross margins, which should continue to positively impact net margins and earnings in the future.

- The acquisition of Narayan Group, with its vertically integrated supply chain, is expected to expand Edible Garden's product offerings internationally and improve operational efficiencies, potentially boosting both revenue and net profit margins.

- Expansion of the retail footprint across the U.S., along with the introduction of new high-demand, sustainably grown products, is projected to increase revenue and solidify market presence.

- Advancements in agricultural technology, resulting in increased yield and reduced harvest cycle time, are anticipated to enhance operational efficiency and reduce costs, positively affecting net margins.

- The launch of innovative products such as Squeezables and Kick sports nutrition, with strategic partnerships for distribution, aims to capture new market segments and drive revenue growth.

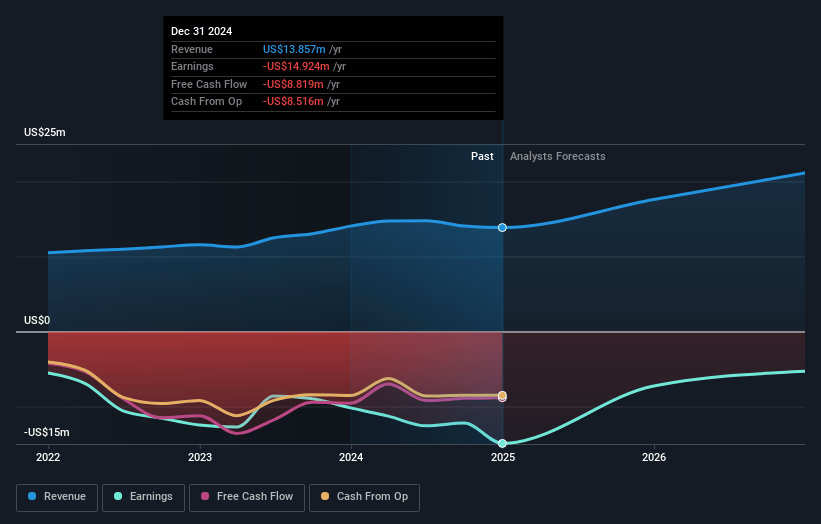

Edible Garden Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Edible Garden's revenue will grow by 22.5% annually over the next 3 years.

- Analysts are not forecasting that Edible Garden will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Edible Garden's profit margin will increase from -107.7% to the average US Food industry of 6.3% in 3 years.

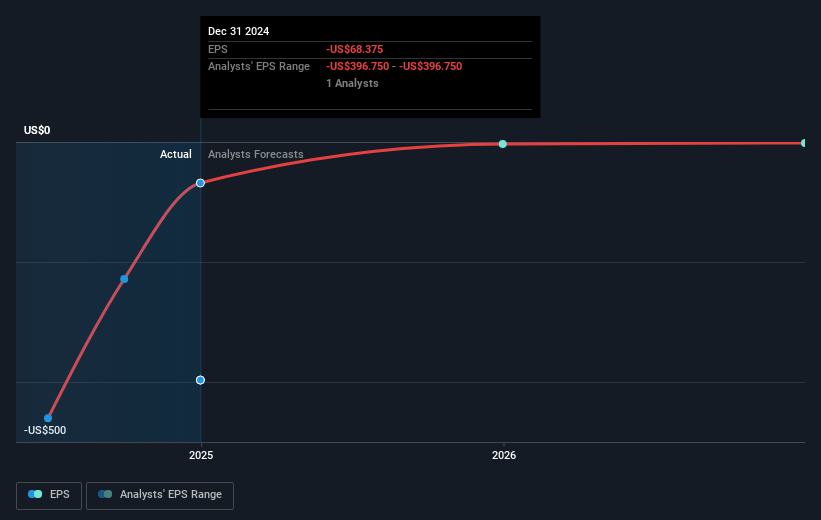

- If Edible Garden's profit margin were to converge on the industry average, you could expect earnings to reach $1.6 million (and earnings per share of $1.6) by about May 2028, up from $-14.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.1x on those 2028 earnings, up from -0.2x today. This future PE is lower than the current PE for the US Food industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.69%, as per the Simply Wall St company report.

Edible Garden Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The strategic exit from lower-margin product lines, such as lettuce and floral, resulted in a reduction in total revenue, which may impact Edible Garden's ability to maintain consistent revenue growth. [Revenue]

- Despite focusing on higher-margin products, the company's net loss increased from $10.2 million in 2023 to $11.1 million in 2024 largely due to elevated selling, general and administrative expenses. [Net Earnings]

- The lack of profitability in the core herb business and external market conditions could hinder the anticipated benefits from strategic shifts such as self-label shelf-stable products, potentially impacting the company's bottom line. [Net Margins]

- There are risks involved in the nonbinding letter of intent to acquire Narayan Group, including integration challenges and potential disruptions, which could threaten the anticipated operational and cross-selling efficiencies. [Earnings]

- Higher labor costs and increased costs of goods sold during peak seasons like Q4 could offset the improved gross margins achieved in other periods, affecting overall profitability. [Net Margins]

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.0 for Edible Garden based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $25.5 million, earnings will come to $1.6 million, and it would be trading on a PE ratio of 6.1x, assuming you use a discount rate of 6.7%.

- Given the current share price of $1.9, the analyst price target of $8.0 is 76.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.