Key Takeaways

- Expansion in avocados, blueberries, and mangoes signals revenue diversification and growth, potentially improving margins with strategic infrastructure use and market penetration.

- Focus on operational efficiency and geographic sourcing flexibility could stabilize earnings and enhance long-term profitability by managing supply challenges effectively.

- Supply chain disruptions, increased costs, and higher expenses are pressuring margins and profitability, while capital expenditures and tariffs could further strain cash flow and revenues.

Catalysts

About Mission Produce- Engages in the sourcing, farming, packaging, marketing, and distribution of avocados, mangoes, and blueberries to food retailers, wholesalers, and foodservice customers in the United States and internationally.

- The Mexican avocado season is ramping up, and Mission Produce experienced a 32% segment growth during the fiscal first quarter, with a 5% increase in avocado volumes sold and a 25% increase in per unit avocado selling prices, indicating potential for revenue growth in future quarters as supply stabilizes and prices remain favorable.

- Investment in the blueberry segment is ongoing, with expansion to over 550 hectares, which positions the company well to capitalize on growing consumer demand and should lead to increased revenue and potentially higher margins due to economies of scale and premium varietals.

- The strategic shift into the mango category, aiming to enhance customer relationships and leverage existing infrastructure, suggests an opportunity for revenue diversification and growth, especially in the underrepresented North American market, potentially impacting net margins positively as the category matures.

- Ongoing optimization of distribution and operational efficiency, including the strategic closures of Canadian facilities, suggests a focus on strengthening the cost structure, which could lead to improved net margins and overall profitability in the long term.

- Mission Produce’s ability to pivot sourcing across geographies such as Peru, Colombia, and Guatemala provides strategic flexibility, which could enhance earnings stability and margin management in response to supply challenges, thereby potentially increasing earnings consistency and reliability.

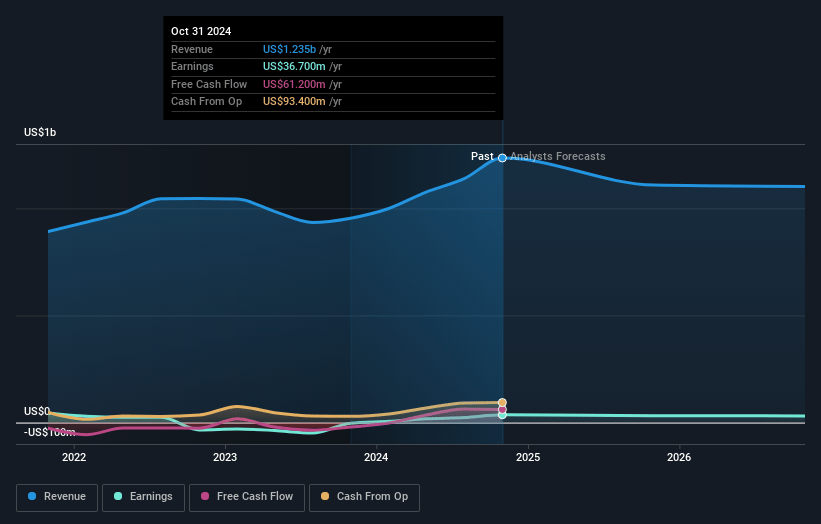

Mission Produce Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mission Produce's revenue will decrease by 7.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.1% today to 2.9% in 3 years time.

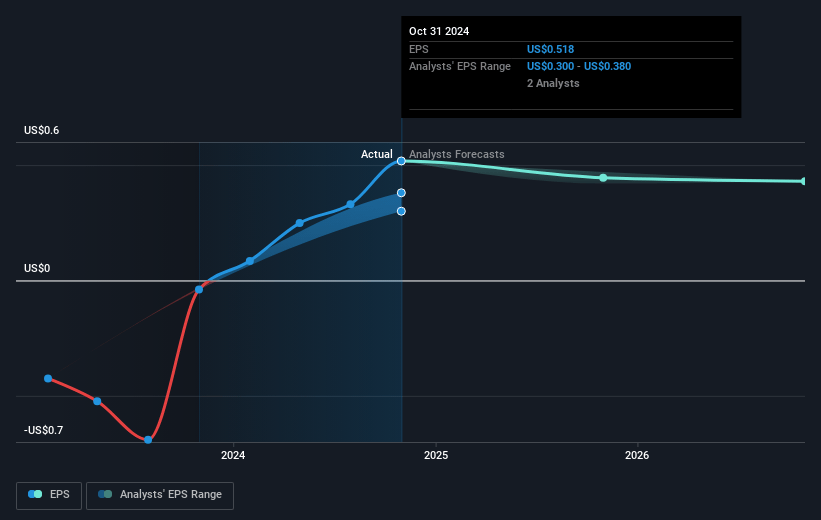

- Analysts expect earnings to reach $30.4 million (and earnings per share of $0.42) by about April 2028, down from $40.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 47.6x on those 2028 earnings, up from 18.3x today. This future PE is greater than the current PE for the US Food industry at 17.4x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Mission Produce Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The difficulty in obtaining sufficient Mexican avocado supply required increased reliance on co-packers and the spot market, leading to lower per unit margins on fruit sold, negatively impacting operating margins and earnings.

- Unstable industry supply in Mexico during the holidays required increased procurement costs, affecting gross profit and demonstrating potential vulnerability to supply chain disruptions impacting net margins.

- Higher SG&A expenses due to increases in employee-related costs, including statutory profit sharing and stock-based compensation, could pressure net earnings and overall profitability.

- Persistent trade and tariff uncertainties with North American neighbors could impose additional costs or market restrictions, adversely affecting revenues and profit margins.

- Increased capital expenditures in the International Farming and Blueberry segments, alongside the impact of higher working capital needs due to elevated per unit price points, could strain cash flow and limit future free cash flow availability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.0 for Mission Produce based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $30.4 million, and it would be trading on a PE ratio of 47.6x, assuming you use a discount rate of 6.2%.

- Given the current share price of $10.48, the analyst price target of $17.0 is 38.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.