Key Takeaways

- Accelerating decarbonization trends and rapid alternative energy adoption threaten long-term demand, margins, and revenue growth for conventional oil-focused firms like Ring Energy.

- Heavy reliance on aging, mature Permian assets and industry consolidation pressures could limit production growth, strategic flexibility, and sustainable improvement in cash flow.

- Prolonged low oil prices, high leverage, and competition may limit Ring Energy's production, growth, and financial flexibility amid operational and market pressures.

Catalysts

About Ring Energy- An independent oil and natural gas company, engages in the acquisition, exploration, development, and production of oil and natural gas properties.

- While Ring Energy continues to benefit from robust global energy demand and its concentrated, low-decline Permian Basin asset base-which support stable cash flow generation-even moderate acceleration of global decarbonization policies threatens to put long-term pressure on baseline oil demand and pricing, ultimately reducing future revenue potential.

- Despite ongoing operational efficiency improvements and demonstrated capital discipline, persistent technological progress and cost competitiveness in alternative energy sources such as renewables and electric vehicles are likely to compress Ring's long-range addressable market, putting limits on their ability to maintain or improve net margins and revenue growth.

- Although recent acquisitions like Lime Rock have exceeded initial forecasts by adding scale and incremental, high-margin production, Ring Energy's heavy exposure to mature, conventional Permian fields could constrain production growth over the coming years as legacy assets age and well rework or secondary recovery become less effective, weighing on future earnings.

- While the company's emphasis on debt reduction and balance sheet strength can reduce financial risk, its relatively high leverage remains vulnerable if oil prices trend downward or if regulatory changes targeting emissions and water disposal further increase compliance costs, impacting net income and long-term flexibility.

- Although increased M&A activity in the sector could present strategic opportunities, the broader industry trend towards consolidation may ultimately disadvantage smaller players like Ring, exposing the company to the risk of being acquired at modest premiums or competing for high-quality drilling inventory, thus impeding sustainable long-term growth in both free cash flow and earnings.

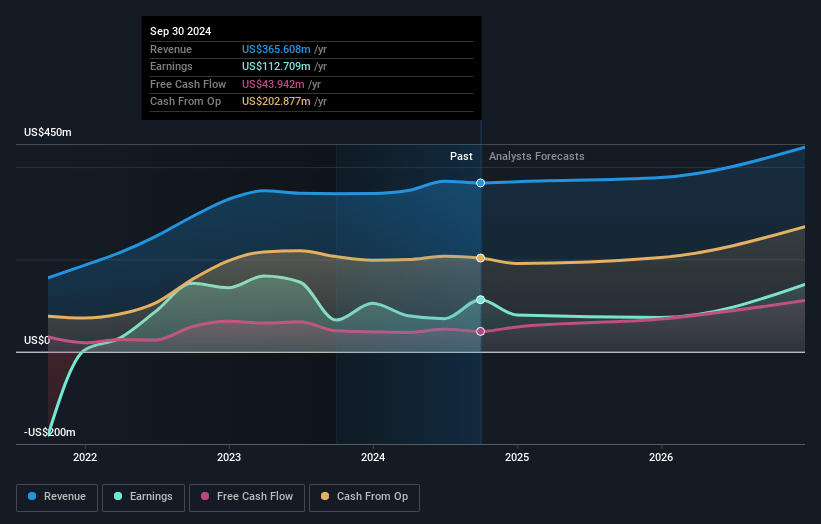

Ring Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ring Energy compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ring Energy's revenue will grow by 2.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 21.2% today to 6.6% in 3 years time.

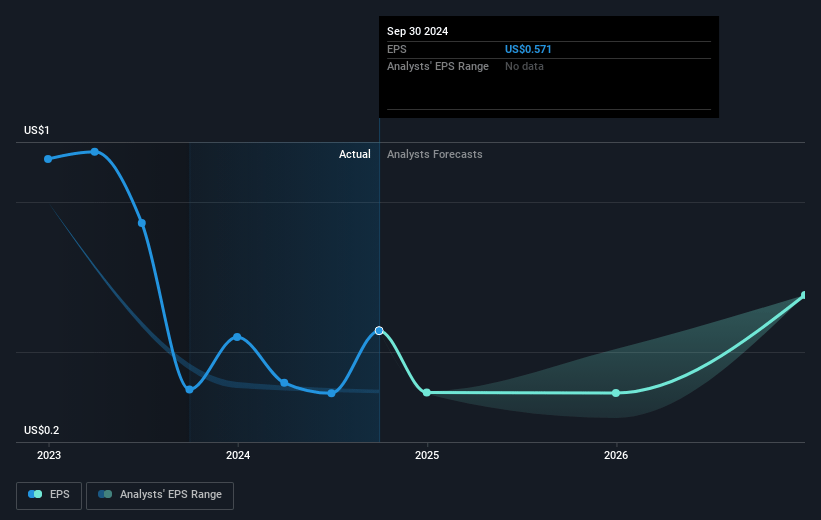

- The bearish analysts expect earnings to reach $24.0 million (and earnings per share of $0.1) by about July 2028, down from $71.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 32.9x on those 2028 earnings, up from 2.2x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.2x.

- Analysts expect the number of shares outstanding to grow by 4.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.68%, as per the Simply Wall St company report.

Ring Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A sustained lower oil price environment could materially impact Ring Energy's ability to reduce leverage below its target, making it harder to achieve net margin expansion and could limit free cash flow available for shareholder returns or growth initiatives.

- The company's concentration of assets in mature, conventional areas like the Central Basin Platform and reliance on shallow decline wells may restrict long-term production growth, potentially leading to stagnating revenues and limited upside to earnings as new high-return inventory becomes harder to source.

- Ring Energy's relatively high leverage ratio and recent debt-funded acquisitions expose the company to elevated interest expense and balance sheet risk, particularly if commodity prices remain weak, which could constrain net income growth and financial flexibility.

- Intensifying competition for acquisitions and acreage in the Central Basin Platform-alongside increased interest from larger, better-capitalized private operators-may drive up asset prices and reduce the company's ability to expand drilling inventory cost-effectively, potentially compressing future returns on capital and net margins.

- Volatility in realized natural gas and NGL prices, as well as ongoing gas takeaway constraints in the basin, creates downside risk for associated revenue streams and could pressure overall EBITDA if not offset by improvements in oil pricing or operational efficiencies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ring Energy is $2.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ring Energy's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $3.47, and the most bearish reporting a price target of just $2.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $363.1 million, earnings will come to $24.0 million, and it would be trading on a PE ratio of 32.9x, assuming you use a discount rate of 10.7%.

- Given the current share price of $0.75, the bearish analyst price target of $2.5 is 70.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.