Key Takeaways

- Strategic acquisitions and exploration successes position Gran Tierra Energy for revenue growth and enhanced production in diverse locations.

- Focus on waterflood optimization and high-quality plays improves efficiencies and boosts future reserves and income potential.

- Gran Tierra Energy faces financial strain from increased debt, low natural gas prices, halted share buybacks, reduced EBITDA, and exposure to market volatility.

Catalysts

About Gran Tierra Energy- Engages in the exploration and production of oil and gas properties in Colombia and Ecuador.

- The acquisition of i3 Energy positions Gran Tierra Energy as a diversified company with expanded assets in Canada, Colombia, and Ecuador, increasing future revenue potential from diversified production locations.

- The i3 Energy acquisition significantly increased Gran Tierra's proven reserves, suggesting potential for sustained production and increased earnings over the long term.

- Exploration successes in Ecuador, such as the Charapa-B7 well, indicate the potential for increased production volumes, thereby enhancing future revenue streams.

- Gran Tierra's ongoing development of waterflood optimization projects, especially in Colombia, aims to improve operational efficiencies, potentially increasing net margins.

- The company's continued focus on exploration and development in high-quality plays such as the Montney and Clearwater in Canada signals potential future growth in reserves and production, positively impacting revenues and net income.

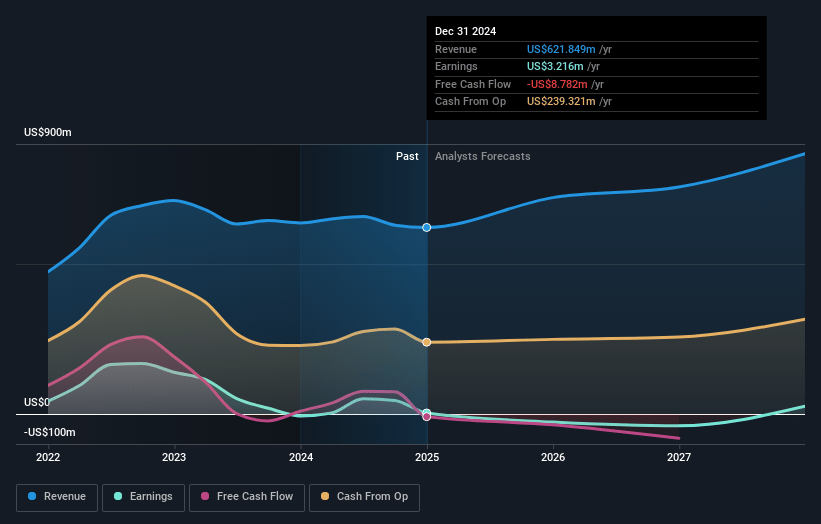

Gran Tierra Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gran Tierra Energy's revenue will grow by 8.2% annually over the next 3 years.

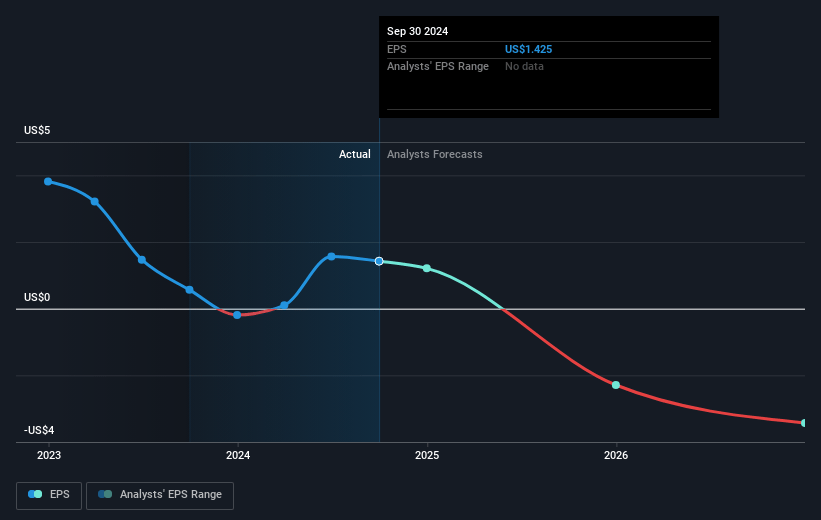

- Analysts assume that profit margins will shrink from 7.2% today to 1.7% in 3 years time.

- Analysts expect earnings to reach $13.4 million (and earnings per share of $0.36) by about February 2028, down from $45.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, up from 4.5x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.5x.

- Analysts expect the number of shares outstanding to decline by 4.95% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

Gran Tierra Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acquisition of i3 Energy, while strategically diversifying Gran Tierra's assets into Canada, has significantly increased the company’s net debt to $509 million, which may strain financial resources and impact net margins and earnings if not managed properly.

- The current low natural gas prices in Western Canada pose a risk to revenue growth, which the management hopes will be alleviated by future LNG projects; delays or failures in these projects could adversely impact revenue projections.

- The pause in the share buyback program due to the i3 acquisition may concern investors about shareholder returns, potentially affecting the company's ability to maintain market confidence and impacting its stock's market value and earnings per share.

- The company's EBITDA has decreased from $103 million to $93 million compared to the prior quarter, and the wider oil differentials, as well as the 12% decrease in operating netback due to lower Brent pricing, could further pressure net margins and revenue if these conditions persist.

- Undocumented temporary hedging strategies and adjustments to borrowings might expose the company to volatility in oil and gas prices, which could affect revenues, cash flow stability, and long-term planning.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.065 for Gran Tierra Energy based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $797.4 million, earnings will come to $13.4 million, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 10.9%.

- Given the current share price of $5.69, the analyst price target of $8.06 is 29.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives