Key Takeaways

- Growth in sustainable water management and recycling is promising, but capital intensity and project delays may hinder margin and cash flow improvements.

- Revenue concentration and rising competition in key basins create risks from local disruptions and reduced pricing power, impacting infrastructure utilization and long-term earnings.

- Heavy infrastructure investments and industry reliance expose the company to margin compression, volatility, and revenue unpredictability amid regulatory, customer, and supply chain risks.

Catalysts

About Select Water Solutions- Provides water management and chemical solutions to the energy industry in the United States.

- Although Select Water Solutions benefits from rising demand for sustainable water management and the increasing importance of water reuse and recycling-trends reflected in their multi-year contract wins and expansion of recycling infrastructure-there is risk that significant outlays for growth capital, delayed ramp-up of new projects, or slower-than-expected customer offtake could limit the pace at which these initiatives translate into recurring revenue and higher margins in the near to medium term.

- While the company's leadership in water recycling technology and proprietary infrastructure buildout positions it to capture higher-margin, contract-backed business, the capital-intensive nature of these projects could pressure near-term free cash flow and earnings, particularly if project execution, integration, or customer commercialization faces delays.

- Despite the continued expansion of U.S. energy production, most of Select's major contract expansions are tied to long-cycle, large projects in shale basins; any unexpected slowdown in oil and gas development-such as protracted weakness in commodity prices or regulatory hurdles-could slow growth in both revenue and EBITDA, especially for the infrastructure segment.

- Even though the company has shifted its business mix toward more resilient, contracted, and production-weighted revenue streams, persistent revenue concentration in high-growth basins exposes Select Water Solutions to the risk that area-specific disruptions-such as drought-driven water restrictions or local regulatory shifts-could impact utilization rates and service margins for infrastructure assets.

- The drive toward closed-loop water systems and rising water intensity in hydraulic fracturing supports long-term demand for integrated solutions; however, ongoing consolidation in the oil and gas industry and the entry of larger, diversified service providers could increase competition, leading to potential pressure on pricing power and net margins, offsetting some anticipated benefits to long-term earnings.

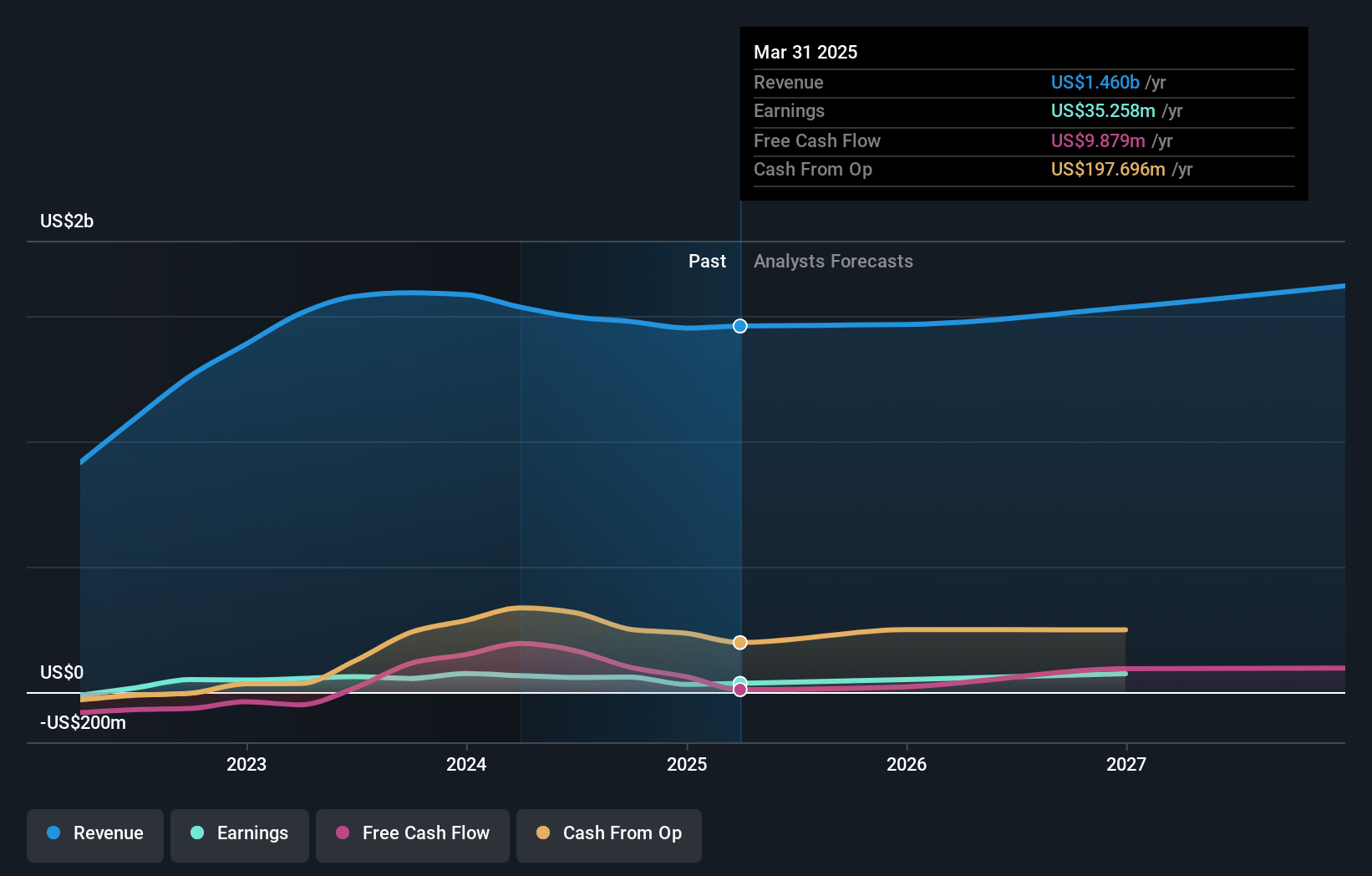

Select Water Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Select Water Solutions compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Select Water Solutions's revenue will grow by 4.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.4% today to 5.9% in 3 years time.

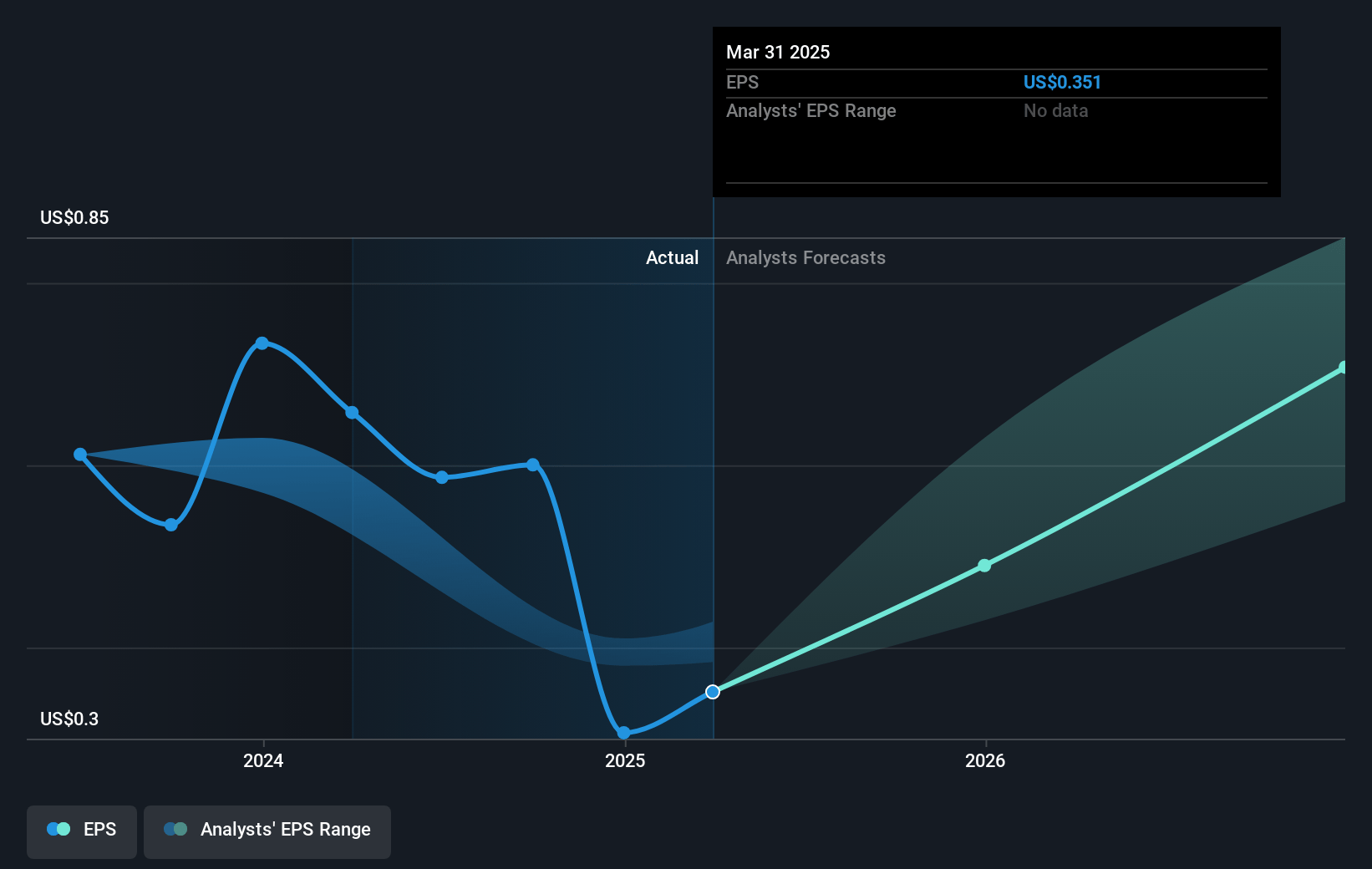

- The bearish analysts expect earnings to reach $97.6 million (and earnings per share of $0.94) by about July 2028, up from $35.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 17.3x on those 2028 earnings, down from 28.8x today. This future PE is greater than the current PE for the US Energy Services industry at 11.3x.

- Analysts expect the number of shares outstanding to grow by 1.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

Select Water Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's aggressive growth in capital-intensive infrastructure projects, including significant increases in net capital expenditures and ongoing commitments for projects like AV Farms, could lead to reduced free cash flow conversion rates and strain its ability to return capital to shareholders if these investments do not generate expected revenues or experience delays.

- Select Water Solutions' reliance on long-term contracts primarily with oil and gas operators exposes it to cyclical volatility in exploration and production budgets, meaning downturns in commodity prices or a broader energy transition away from fossil fuels could drive unpredictable revenue declines and impair long-term earnings stability.

- Customer concentration and industry consolidation pose ongoing risks, as power shifts to supermajors could result in increased pricing pressure and lower net margins, thus eroding profitability over time.

- Increasing compliance, environmental regulations, and ESG scrutiny, particularly in drought-prone regions or related to water usage, could drive up operating and maintenance costs or restrict operational flexibility, compressing net margins and weighing on earnings.

- Despite efforts to localize and vertically integrate supply chains, the Chemicals segment still relies on imported raw materials for roughly half of its inputs, exposing the company to potential cost increases, supply disruptions, and margin volatility if global trade tensions, tariffs, or geopolitical factors intensify.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Select Water Solutions is $11.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Select Water Solutions's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $19.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $97.6 million, and it would be trading on a PE ratio of 17.3x, assuming you use a discount rate of 7.4%.

- Given the current share price of $9.78, the bearish analyst price target of $11.0 is 11.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.