Narratives are currently in beta

Key Takeaways

- Strong execution and key project completions are expected to significantly drive revenue growth and future earnings.

- High-return projects and storage acquisitions are positioned to enhance net margins and cash generation.

- Revenue growth may be constrained by natural gas prices, weather impact, production reductions, increased capital expenditures, and non-recurring asset sales gains.

Catalysts

About Williams Companies- Operates as an energy infrastructure company primarily in the United States.

- Strong execution on growth projects and higher-than-expected performance from acquisitions are projected to drive record EBITDA contributions, indicating increased future revenue.

- Completed key projects like Transco's Regional Energy Access and the MountainWest's Uinta Basin expansion are expected to contribute significantly to revenue growth as they ramp up production.

- The Southeast Supply Enhancement Project and other contracted gas pipeline projects totaling 5.3 Bcf a day are expected to drive substantial and visible long-term growth, positively impacting future earnings.

- The development of high-return projects like the Dalton Lateral Expansion and other transmission projects are positioned to capture new demand growth, potentially enhancing net margins through operational efficiency.

- Leveraging storage acquisitions and existing infrastructure, along with favorable macroeconomic conditions, is likely to boost financial performance and extend the company's capacity to generate cash returns, influencing net margins positively.

Williams Companies Future Earnings and Revenue Growth

Assumptions

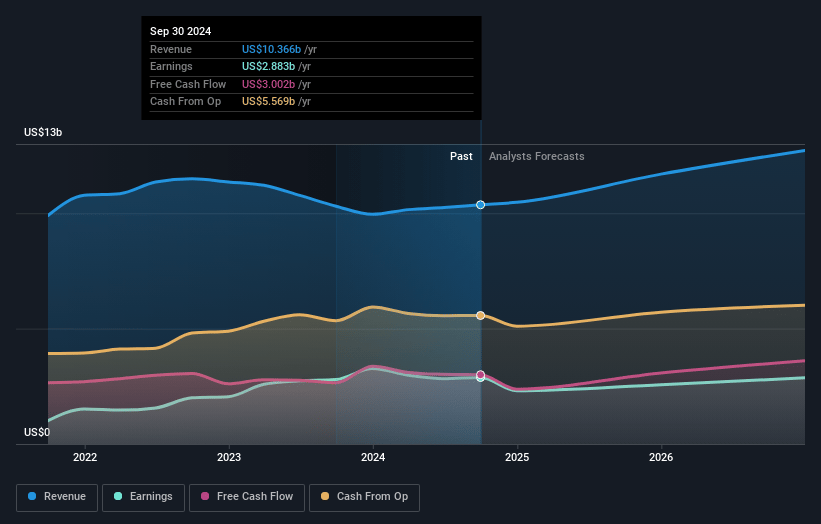

How have these above catalysts been quantified?- Analysts are assuming Williams Companies's revenue will grow by 7.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 27.8% today to 23.0% in 3 years time.

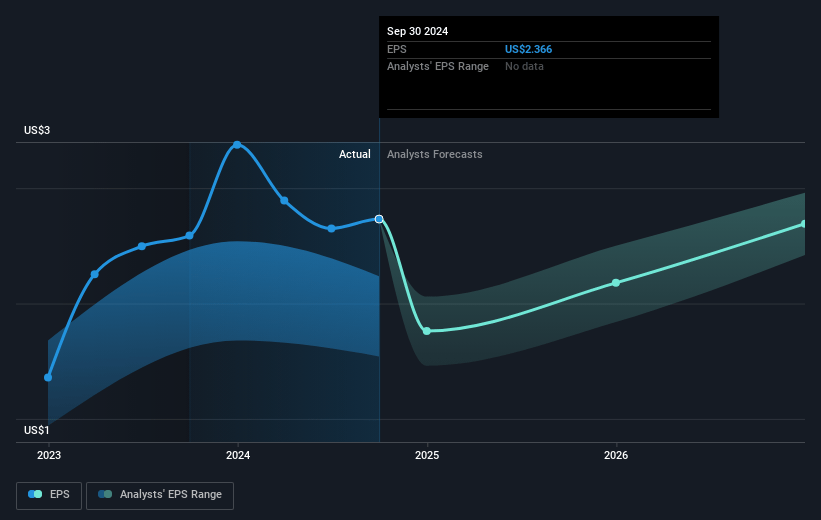

- Analysts expect earnings to reach $3.0 billion (and earnings per share of $2.47) by about January 2028, up from $2.9 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $2.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.7x on those 2028 earnings, up from 23.3x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

Williams Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The challenging natural gas price environment and significant hurricane impacts may constrain revenue growth if similar conditions persist, affecting Williams' ability to maintain or increase net margins.

- Temporary production reductions by producer customers, particularly in the Northeast and Haynesville regions, could limit throughput and consequently impact revenue and earnings.

- Increased capital expenditures associated with growth projects and expansions could strain cash flow if realized returns do not meet expectations, potentially affecting net earnings.

- Greater hurricane impacts compared to previous years have unavoidably affected operations in the Gulf of Mexico, posing a risk to revenue stability.

- The sale of assets, such as the Bayou Ethane system and interest in Aux Sable, represents a one-time gain that does not contribute to ongoing EBITDA growth, potentially affecting long-term revenue projections if such transactions are not consistently balanced by new acquisitions or growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $56.56 for Williams Companies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $74.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $13.0 billion, earnings will come to $3.0 billion, and it would be trading on a PE ratio of 28.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of $55.2, the analyst's price target of $56.56 is 2.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives