Key Takeaways

- Integrated Vietnam operations and supply chain reliability uniquely position Cactus to outpace competitors, gaining market share and expanding operating margins despite industry disruptions.

- Product innovation and premium offerings, especially for international and high-spec applications, enable Cactus to achieve greater profitability and recurring cash flows.

- Heavy reliance on traditional oilfield equipment and North American markets exposes Cactus to risks from energy transition, regulatory pressures, and changing customer needs, threatening long-term profitability.

Catalysts

About Cactus- Designs, manufactures, sells, and rents engineered pressure control and spoolable pipe technologies in the United States, Australia, Canada, the Middle East, and internationally.

- Analyst consensus expects Vietnam manufacturing to merely offset China-sourced tariff disadvantages, but given Cactus' more fully-integrated Vietnam facility and seamless transition, Cactus is set to achieve not just margin preservation, but potentially capture additional market share as competitors struggle with higher input costs and less agile supply chains, offering sustained operating margin expansion.

- While analysts broadly see the ramp-up of Spoolable Technologies and new products like sour service pipe as supporting incremental future revenue growth, the material addressable opportunity in the Middle East, combined with rising global demand for high-H2S applications, could position Cactus for a structural uplift in international revenues and boost segment profitability well above current expectations.

- Cactus' leading customer retention through downturns, superiority in on-time delivery, and unmatched supply chain reliability are likely to drive outsized market share gains as operators increasingly high-grade to the most dependable suppliers, amplifying revenue growth well beyond core market activity levels as others lose share in a volatile environment.

- Global population growth and urbanization will drive legacy energy demand far above current forecasts, and as North America emerges as a preferred, secure energy source amid geopolitical risks, Cactus' premium positioning in domestic drilling and completions equips it to achieve sustained, high utilization, supporting superior earnings resilience and long-term adjusted EBITDA growth.

- Cactus' expansion of SafeDrill™ and integrated wellhead systems for both land and offshore-combined with the increasing adoption of digitalized, ESG-compliant oilfield solutions-unlocks premium pricing power and higher-margin cross-selling, which directly supports both net margin expansion and the generation of robust, recurring cash flows over the next decade.

Cactus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cactus compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cactus's revenue will grow by 1.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.8% today to 25.1% in 3 years time.

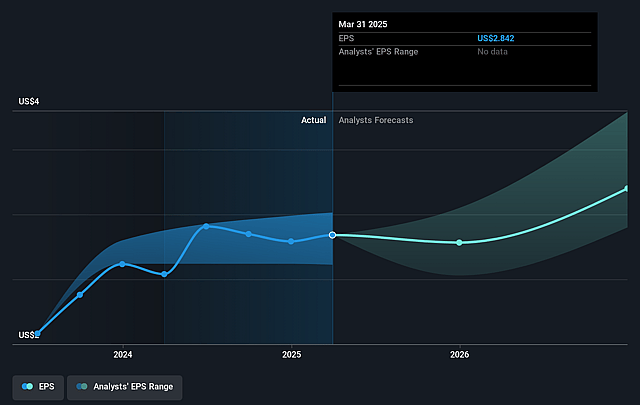

- The bullish analysts expect earnings to reach $300.4 million (and earnings per share of $4.23) by about July 2028, up from $190.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.2x on those 2028 earnings, up from 16.0x today. This future PE is greater than the current PE for the US Energy Services industry at 11.3x.

- Analysts expect the number of shares outstanding to grow by 2.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.9%, as per the Simply Wall St company report.

Cactus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing acceleration of the global energy transition toward renewables could create structural headwinds for Cactus, as long-term demand for oil and gas-and thus core oilfield equipment and services-declines, likely putting persistent pressure on revenues over time.

- Heightened regulatory scrutiny and ESG pressures are raising compliance costs and restricting capital access for oilfield service companies, which may compress Cactus's net margins and elevate the company's cost of capital, reducing future earnings growth potential.

- Cactus's concentrated exposure to North American shale basins leaves it vulnerable to regional industry downturns, regulatory changes, and customer budget resets in a weakening commodity price environment, heightening the risk of revenue volatility and sustained margin pressure.

- The company's reliance on a limited number of product lines, particularly wellhead equipment within Pressure Control, makes it susceptible to market share loss or margin compression if customers shift to alternative solutions or if new drilling technologies reduce demand for traditional offerings, impacting long-term revenue streams and gross profit.

- Ongoing and potential future steel tariffs, coupled with inflationary supply chain dynamics and limited access to cost-effective domestic steel, threaten to drive up input costs, and while Cactus expects to mitigate some of these, the risk of margin compression and lower net income persists, especially if these inflationary pressures prove persistent or intensify.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cactus is $57.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cactus's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $57.0, and the most bearish reporting a price target of just $39.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $300.4 million, and it would be trading on a PE ratio of 20.2x, assuming you use a discount rate of 6.9%.

- Given the current share price of $44.43, the bullish analyst price target of $57.0 is 22.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.