Last Update07 May 25Fair value Decreased 2.63%

Key Takeaways

- Accelerating renewables adoption and stricter ESG standards threaten Valaris’ core offshore drilling business, putting pressure on revenue stability and margin sustainability.

- Higher modernization costs and competition from advanced extraction technologies risk shrinking Valaris’ market share and eroding long-term profitability.

- Strong contract backlog, advanced fleet, and strategic market positioning ensure high revenue stability, resilient demand, durable cash flows, and robust margins amidst careful cost management.

Catalysts

About Valaris- Provides offshore contract drilling services in Brazil, the United Kingdom, U.S.

- Global energy transition efforts and accelerating adoption of renewable energy are expected to erode long-term demand for offshore drilling, directly challenging the sustainability of Valaris’ revenue base and putting future contract volumes at risk.

- Government regulations and mounting ESG pressures are set to increase operating costs and could drive institutional capital away from offshore drilling, compressing Valaris’ net margins and stifling its access to essential finance for fleet upgrades.

- The risk of capital expenditures rising substantially to modernize and maintain the ageing portions of the company’s rig fleet is elevated, threatening to drain free cash flow and weaken the company’s ability to support shareholder returns and long-term earnings growth.

- Technological advances continue to make onshore shale and less capital-intensive extraction techniques more competitive, potentially resulting in a shrinking addressable market for Valaris and persistent revenue headwinds if offshore is deprioritized by oil and gas customers.

- Ongoing industry exposure to regulatory, environmental, and compliance risks—including the possibility of high-profile incidents—creates liability overhangs and could force Valaris to absorb structurally higher costs, directly pressuring future profitability.

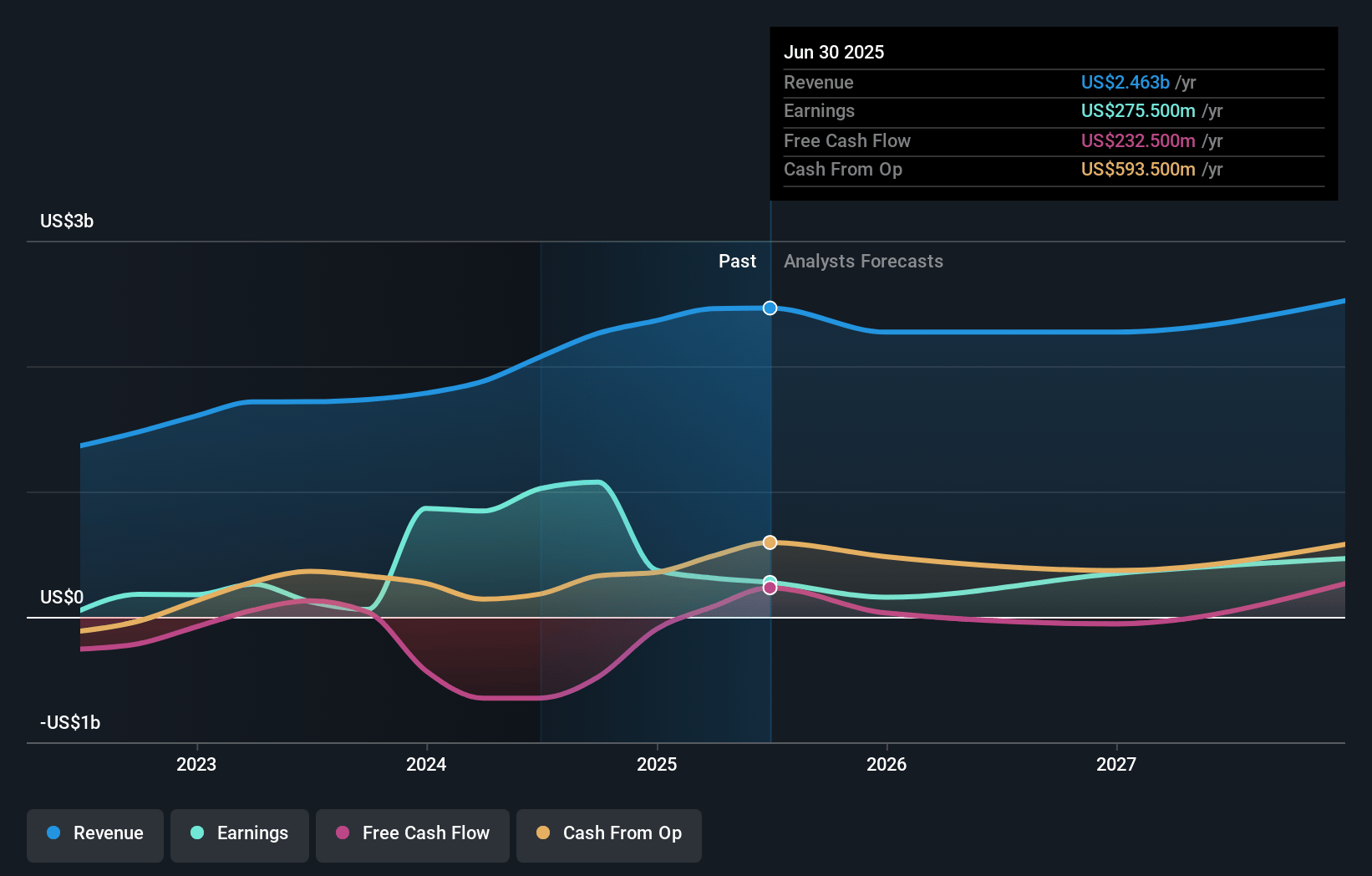

Valaris Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Valaris compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Valaris's revenue will decrease by 0.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 12.6% today to 15.2% in 3 years time.

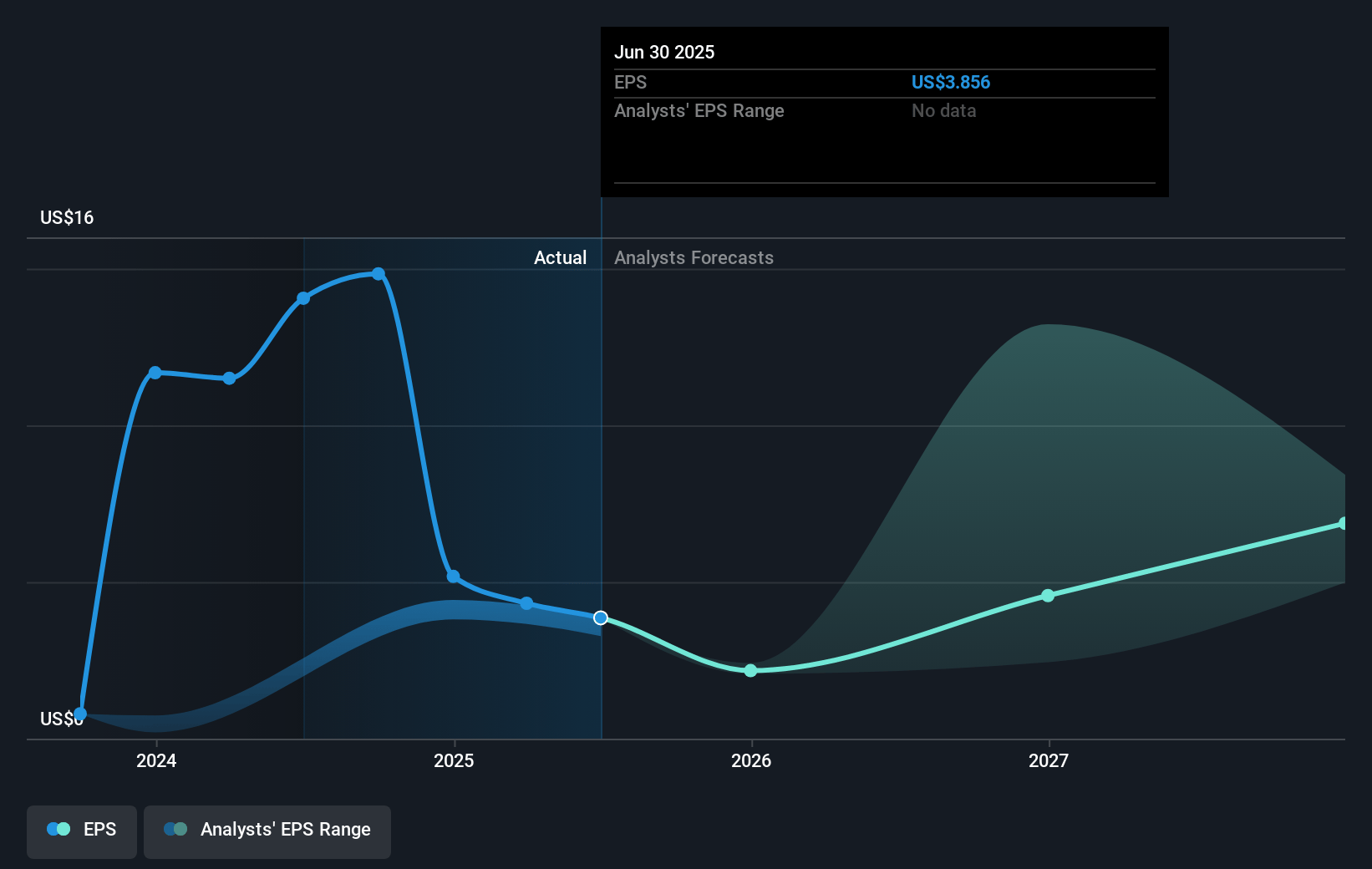

- The bearish analysts expect earnings to reach $371.0 million (and earnings per share of $5.22) by about May 2028, up from $310.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.3x on those 2028 earnings, which is the same as it is today today. This future PE is lower than the current PE for the US Energy Services industry at 10.6x.

- Analysts expect the number of shares outstanding to decline by 1.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.65%, as per the Simply Wall St company report.

Valaris Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Valaris has grown its contract backlog by over $1 billion in just two months, now exceeding $4.2 billion, with a nearly 20% increase from the previous quarter and 99% of expected 2025 revenues already contracted at the midpoint, creating significant revenue visibility and stability over the next several years.

- The company’s high-specification, technologically advanced fleet—especially its 7th generation drillships with dual blowout preventers and managed pressure drilling systems—is increasingly favored for long-term and complex offshore projects, supporting premium day rates and higher earnings as E&P clients prioritize technical capabilities and efficiency.

- Long-cycle, multi-year projects in deepwater regions such as West Africa, Brazil, Mozambique, and the North Sea continue to progress, with Valaris actively tracking 25 floater opportunities for 2026 and 2027, and customer demand for offshore hydrocarbons remains intact despite short-term market volatility, indicating resilient long-term contract volumes and revenue potential.

- The strategic extension of five jackup contracts in Saudi Arabia for five additional years, coupled with continued engagement with national oil companies and strong presence in resilient markets like the Middle East and Australia, ensures durable cash flow and margin strength for the jackup segment.

- Sustained focus on disciplined cost management, proactive fleet optimization, and customer-funded capital upgrades has improved free cash flow generation, strengthened the balance sheet, and enabled Valaris to rapidly respond to idle periods, thereby supporting net margins and mitigating downside risk to earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Valaris is $37.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Valaris's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $62.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $371.0 million, and it would be trading on a PE ratio of 8.3x, assuming you use a discount rate of 7.7%.

- Given the current share price of $36.29, the bearish analyst price target of $37.0 is 1.9% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.