Narratives are currently in beta

Key Takeaways

- Tidewater's fleet investments and strategy to increase day rates are set to enhance cash flow, revenue, and earnings as market conditions improve.

- Strong free cash flow supports Tidewater's active share repurchase program, indicating a focus on boosting shareholder value and EPS.

- Regulatory and tax changes, project delays, and market volatility could dampen Tidewater's revenue growth and strategic opportunities in the short-term.

Catalysts

About Tidewater- Provides offshore support vessels and marine support services to the offshore energy industry through the operation of a fleet of marine service vessels worldwide.

- Tidewater's investment in newer, higher specification vessels and a strategy to push global day rates higher is expected to continue contributing to free cash flow progression, likely impacting future revenue and earnings positively.

- The company plans to make more fleet investments in preparation for an anticipated better market in the second half of 2025, potentially leading to improved utilization and revenue growth as market conditions improve.

- The supply-demand imbalance in the offshore vessel market, driven by vessel attrition and a low number of new vessel orders, is expected to favor Tidewater, enabling them to increase leading-edge day rates, positively affecting revenue and earnings.

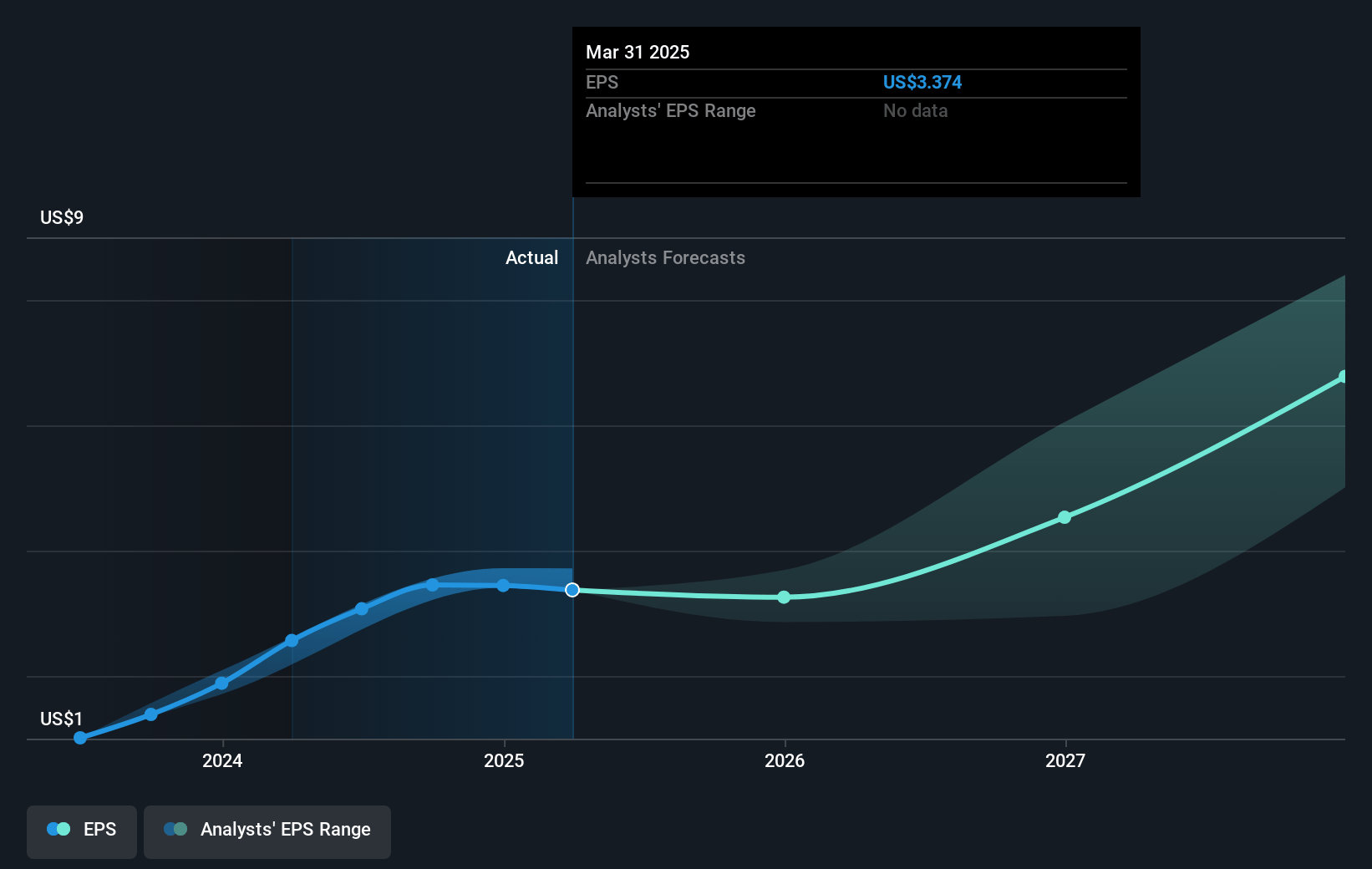

- Tidewater's active share repurchase program, backed by strong free cash flow projections, indicates a commitment to enhancing shareholder value and boosting earnings per share (EPS).

- Long-term projects and growth in demand in regions like Brazil, the Middle East, and the continued exploration and development projects globally provide a solid foundation for future revenue growth despite current uncertainties.

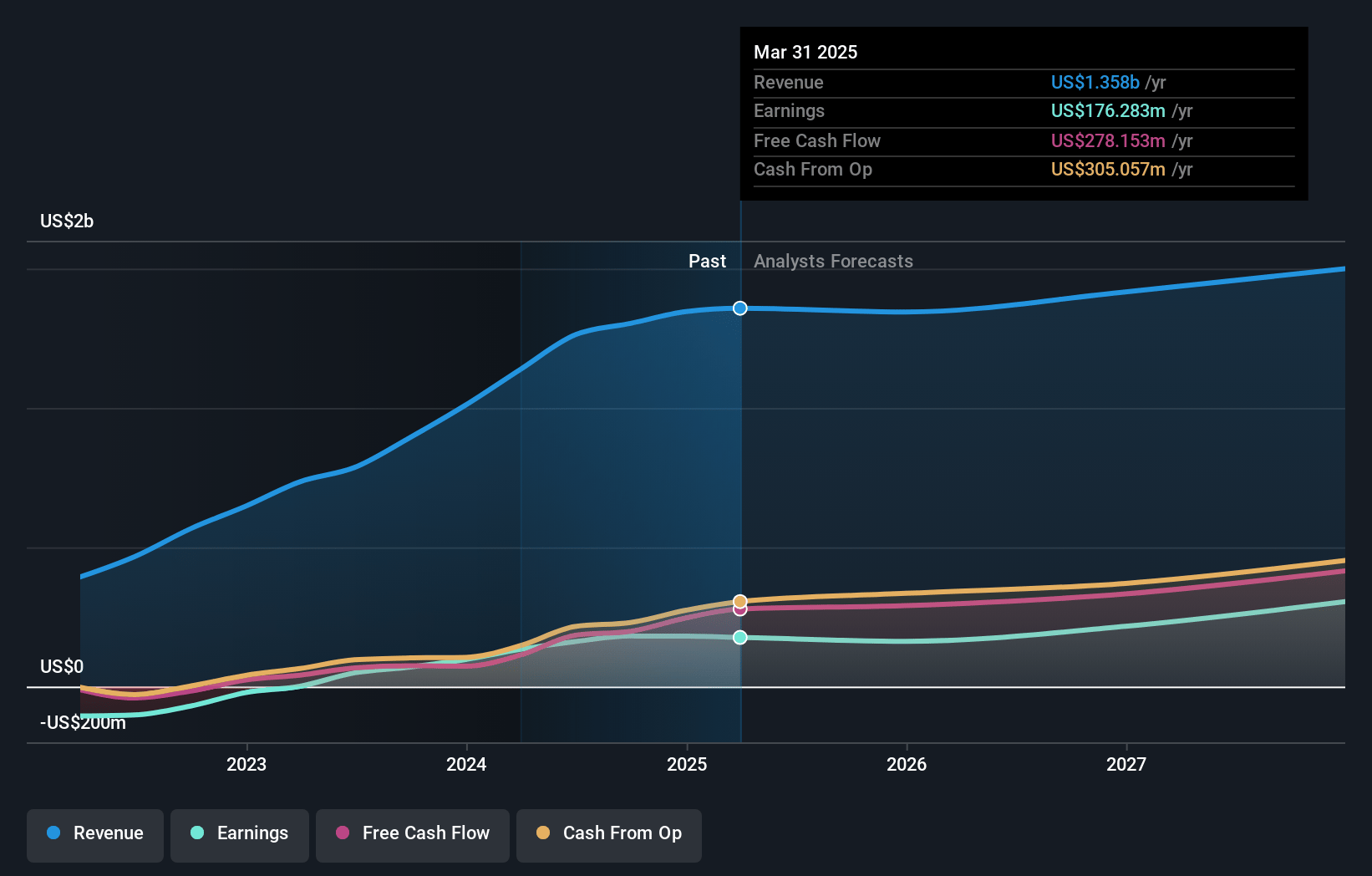

Tidewater Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tidewater's revenue will grow by 11.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.9% today to 36.4% in 3 years time.

- Analysts expect earnings to reach $662.0 million (and earnings per share of $12.38) by about January 2028, up from $181.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.1x on those 2028 earnings, down from 15.4x today. This future PE is lower than the current PE for the US Energy Services industry at 14.6x.

- Analysts expect the number of shares outstanding to grow by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.31%, as per the Simply Wall St company report.

Tidewater Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Regulatory and tax changes in the UK, including the extension of the Energy Profits Levy, could dampen future offshore drilling demand, impacting revenue growth opportunities.

- Uncertainty over the timing and execution of long-cycle offshore vessel activity and delays in project starts may limit near-term revenue growth, affecting Tidewater's ability to consistently push day rates higher.

- Increased idle time and higher-than-expected drydock days, as well as repair and maintenance expenses, could continue to pressure net margins in the short-term.

- Market visibility is declining, and while long-term fundamentals remain strong, short-term subdued activity growth and project stalls could impact earnings consistency.

- Reluctance of sellers to adjust their asking price in light of market volatility might delay accretive M&A opportunities, affecting strategic growth and long-term shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $79.57 for Tidewater based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0, and the most bearish reporting a price target of just $64.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $662.0 million, and it would be trading on a PE ratio of 8.1x, assuming you use a discount rate of 8.3%.

- Given the current share price of $53.26, the analyst's price target of $79.57 is 33.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives