Key Takeaways

- New CEO Paul Goodfellow's leadership is expected to improve operational efficiency, enhancing revenue and earnings growth through strategic execution.

- Strong free cash flow and robust reserves position Talos Energy for debt reduction, potential shareholder returns, and long-term revenue growth.

- High capital expenditure and strategic uncertainties, combined with potential operational disruptions, may impact profitability, liquidity, and future growth due to exploration and regulatory challenges.

Catalysts

About Talos Energy- Through its subsidiaries, engages in the exploration and production of oil, natural gas, and natural gas liquids in the United States and Mexico.

- The appointment of Paul Goodfellow as the new CEO, with his extensive experience in deepwater operations and leadership roles at Shell, is expected to refine Talos Energy's strategic plan and boost operational efficiency, potentially enhancing future revenue and earnings growth.

- The successful drilling and completion of the Katmai West #2 well under budget and ahead of schedule demonstrates operational efficiency, indicating potential for increased future production and earnings with improved net margins due to cost management.

- Talos Energy's 2025 drilling program, including key wells like Sunspear and Daenerys, is anticipated to generate significant production increases. Successful outcomes in these high-impact projects could lead to higher future revenues.

- The company's strong free cash flow generation, with a record of $511 million in 2024 and similar expectations for 2025, provides a foundation for debt reduction and potential shareholder returns, positively impacting net margins and earnings.

- Talos has a robust reserve base, with proven reserves of 194 million barrels of oil equivalent and additional probable reserves, providing long-term revenue potential. The ongoing exploration and development in areas like the Wilcox trend could further enhance reserve volumes and future growth.

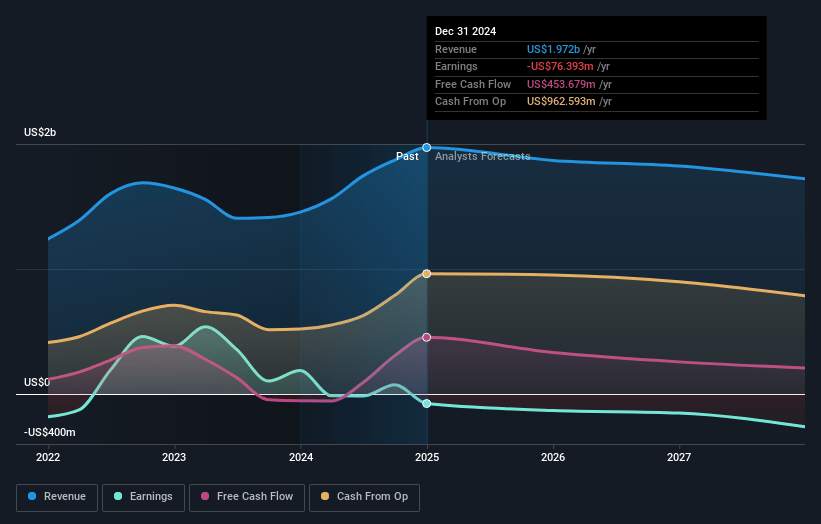

Talos Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Talos Energy's revenue will decrease by 4.1% annually over the next 3 years.

- Analysts are not forecasting that Talos Energy will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Talos Energy's profit margin will increase from -3.9% to the average US Oil and Gas industry of 14.7% in 3 years.

- If Talos Energy's profit margin were to converge on the industry average, you could expect earnings to reach $255.1 million (and earnings per share of $1.53) by about May 2028, up from $-76.4 million today.

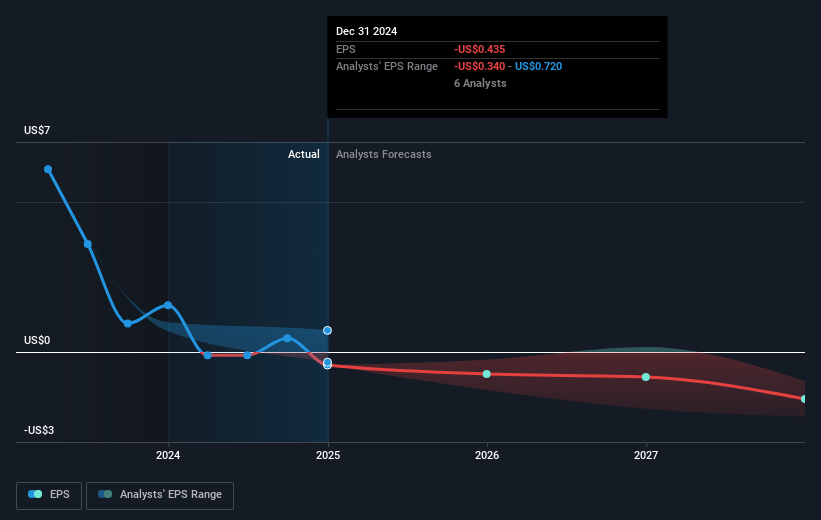

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, up from -17.2x today. This future PE is lower than the current PE for the US Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to decline by 2.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.42%, as per the Simply Wall St company report.

Talos Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The planned shutdowns and maintenance activities scheduled for 2025, including weather-related downtime such as hurricanes, could temporarily impact production volumes, potentially affecting revenue and overall profitability.

- Despite successful projects like Katmai West #2, the need for continuous capital investment in exploration and drilling means the company may face high capital expenditure, which could limit net margins if these investments do not yield expected returns.

- Uncertainty tied to the leadership change with a new CEO coming in might lead to strategic shifts or transitional challenges, potentially impacting earnings if strategic plans are revised or delayed.

- Delays in regulatory approvals, specifically in Mexico, could affect asset sales and related cash inflows, impacting liquidity and net earnings if the transactions do not complete as expected.

- Proposed future projects, such as significant drilling efforts in the Gulf of Mexico, have inherent exploration and execution risks; failure to deliver successful results could affect anticipated future growth in reserves and revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.0 for Talos Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $255.1 million, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 8.4%.

- Given the current share price of $7.36, the analyst price target of $13.0 is 43.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.