Key Takeaways

- The Hawaii SAF project and operational recovery in Wyoming are set to drive revenue growth and stabilize earnings by targeting key markets and restoring capacities.

- Strategic project executions and cost reduction efforts enhance operational efficiency and profitability, while share repurchase initiatives improve earnings per share outlook.

- Operational and financial challenges, including facility incidents and project execution risks, could impact production, revenue, and financial stability if not mitigated effectively.

Catalysts

About Par Pacific Holdings- Owns and operates energy and infrastructure businesses in the United States.

- The Hawaii Sustainable Aviation Fuel (SAF) project is progressing on schedule with a startup expected in the second half of 2025. This project is anticipated to contribute to revenue growth by taking advantage of carbon incentive programs and offering SAF to the emerging Asia Pacific market.

- The Wyoming facility is working to restore operations after an operational incident, with partial operations expected by mid-April and full operations by Memorial Day. Returning to full capacity should improve future revenue and earnings as operations stabilize.

- Par Pacific plans to execute several key projects, including the Montana FCC and alky turnaround, which are expected to enhance operational efficiency and competitiveness, potentially leading to improved net margins and earnings.

- An ongoing focus on cost reduction initiatives aims to achieve $30 million to $40 million in annual savings. These cost management efforts are likely to bolster net margins and improve overall profitability.

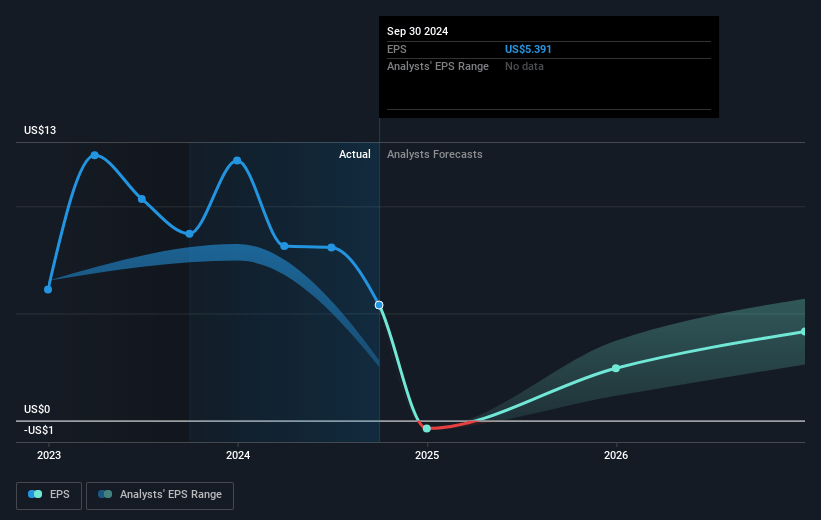

- Par Pacific repurchased nearly 5 million shares in the past year and received Board authorization for up to $250 million of additional share repurchases. This capital allocation strategy is expected to be accretive to earnings per share (EPS) over time.

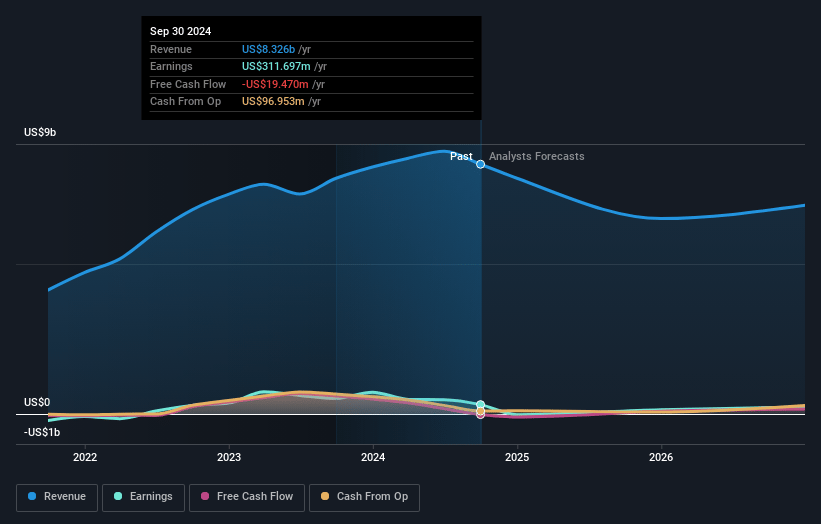

Par Pacific Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Par Pacific Holdings's revenue will decrease by 7.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.4% today to 6.8% in 3 years time.

- Analysts expect earnings to reach $434.5 million (and earnings per share of $7.86) by about March 2028, up from $-33.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 3.0x on those 2028 earnings, up from -23.7x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.7x.

- Analysts expect the number of shares outstanding to decline by 5.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Par Pacific Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The operational incident at the Wyoming facility, leading to a crude heater furnace damage, poses risks to production continuity and could negatively impact refining throughput and earnings.

- Although the refining segment experienced an optimistic outlook due to tight supply and demand balances, the history of nine months of declining refining margins highlights vulnerabilities that could adversely affect future revenue if margins decrease again.

- Dependence on the successful execution of major projects, such as the Hawaii SAF unit and the Montana turnaround, introduces execution risk, which, if not managed effectively, could impact the company's ability to enhance earnings power and net margins.

- The Washington segment's challenges, reflected in negative index margins, demonstrate potential weaknesses in capturing expected margins, which could lower revenue and profitability if not addressed.

- The need to balance between share repurchases and debt reduction in light of their strategic objectives suggests a precarious financial position, where missteps could impact liquidity and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.25 for Par Pacific Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.4 billion, earnings will come to $434.5 million, and it would be trading on a PE ratio of 3.0x, assuming you use a discount rate of 11.4%.

- Given the current share price of $14.41, the analyst price target of $20.25 is 28.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.