Narratives are currently in beta

Key Takeaways

- Strategic investments in ethylene and clean ammonia transportation enhance market positioning, promising long-term revenue growth and improved cash flow.

- Operational efficiency through high vessel utilization and reduced debt costs boosts financial stability and net income potential.

- Disruptions in ethylene and new investments pose revenue risks, while bond issuance and regulatory compliance could strain net margins and earnings continuity.

Catalysts

About Navigator Holdings- Engages in owning and operating a fleet of liquefied gas carriers worldwide.

- The expansion of the Ethylene Terminal is on track for completion in Q4 2024, allowing for increased export volumes and throughput, which is expected to positively impact future revenue and cash flow as capacity expands.

- The MOU with Uniper for CO2 transportation and investments in clean ammonia transportation provide strategic positioning in emerging markets, setting the stage for long-term revenue growth as these markets develop.

- High vessel utilization and successful renewal of expiring time charters at higher rates indicate strong demand and operational efficiency, which could lead to improved earnings and net margins.

- Refinancing activities have reduced debt costs, improved liquidity, and extended maturities, increasing financial stability and potentially enhancing net income through lower interest expenses.

- Newbuilding orders for large liquefied ethylene gas carriers support the Ethylene Terminal's expansion, expected to contribute to future revenue growth through anticipated long-term charters and increased shipping capacity.

Navigator Holdings Future Earnings and Revenue Growth

Assumptions

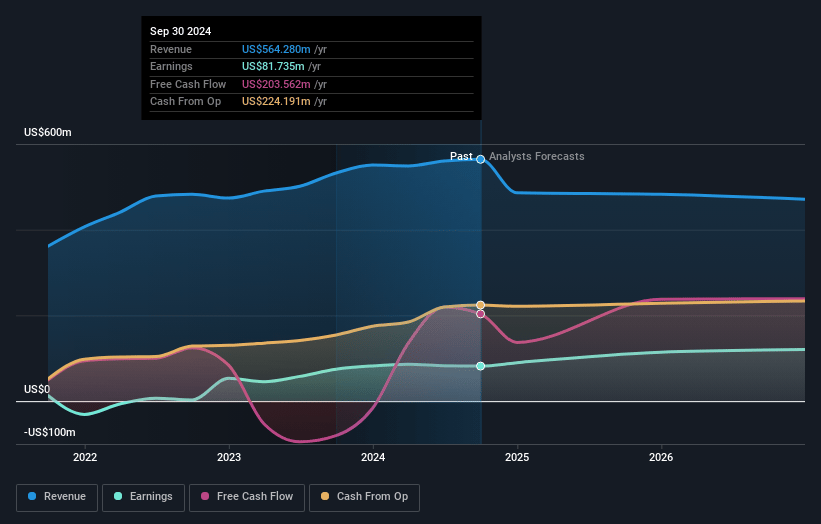

How have these above catalysts been quantified?- Analysts are assuming Navigator Holdings's revenue will decrease by -3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.5% today to 29.0% in 3 years time.

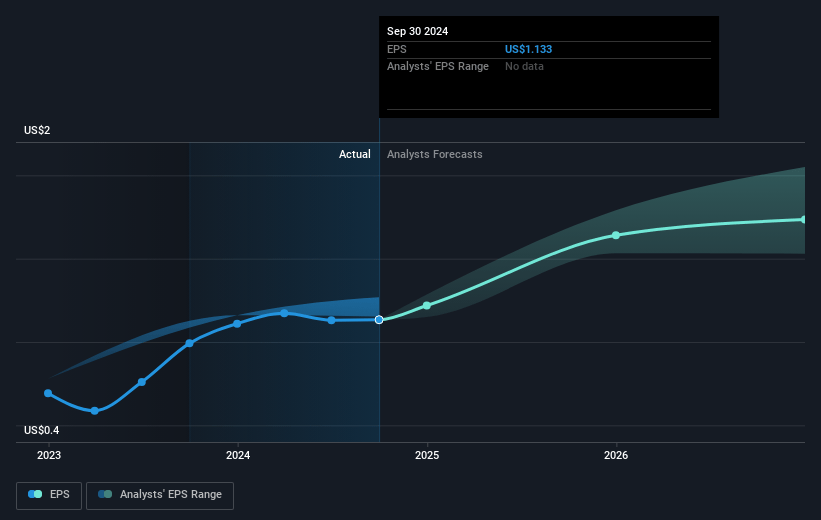

- Analysts expect earnings to reach $144.9 million (and earnings per share of $2.13) by about January 2028, up from $81.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, down from 13.8x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 0.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.7%, as per the Simply Wall St company report.

Navigator Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Hurricane Beryl disrupted ethylene production and inventory levels, temporarily impacting ethylene throughput, which could affect Navigator's revenue and cash flow from its Ethylene Export Terminal.

- The soft ethylene arbitrage in Q3, which led to a temporary dip in volumes despite take-or-pay contracts, could pose risks to the revenue forecast if such events recur or persist.

- The company's environmental, governance, and transparency ratings are high, but continued compliance and potential regulatory changes may elevate administrative costs, affecting net margins.

- The recent issuance of $100 million of unsecured bonds at a 7.25% coupon, while beneficial for liquidity, increases interest obligations, potentially impacting net income.

- Navigator has committed investments in future markets like CO2 and ammonia transport, yet these initiatives won’t generate significant cash flows in the near term, presenting a risk to earnings continuity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.17 for Navigator Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $500.2 million, earnings will come to $144.9 million, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 9.7%.

- Given the current share price of $16.21, the analyst's price target of $22.17 is 26.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives