Key Takeaways

- Large inventory of low-cost natural gas assets and strategic acquisitions position Mach for long-term revenue growth and operational flexibility amid volatile markets.

- Focus on gas production, disciplined spending, and proximity to key infrastructure enable Mach to capture rising global demand and sustain strong margins.

- Heavy reliance on acquisition-driven growth and natural gas exposure leaves Mach vulnerable to renewable energy trends, regulatory changes, and rising operational costs.

Catalysts

About Mach Natural Resources- An independent upstream oil and gas company, focuses on the acquisition, development, and production of oil, natural gas, and natural gas liquids reserves in the Anadarko Basin region of Western Oklahoma, Southern Kansas, and the panhandle of Texas.

- Mach’s significant inventory of low-cost, untapped natural gas assets in the deep Anadarko Basin positions it to capitalize on growing global energy demand, especially from emerging markets in Asia and Africa, which supports long-term revenue growth as the company increases gas production into 2026 and beyond.

- The company’s focus on opportunistic, accretive acquisitions—most recently the large, low-cost XTO acreage grab—continues to add scale and drilling optionality at bargain prices, enabling sustained production and potential EBITDA/earnings expansion even when commodity prices are volatile.

- Structural underinvestment in upstream oil and gas globally is likely to constrain future supply, supporting higher commodity prices and strengthening Mach’s realized revenues as it brings undeveloped gas-rich acreage online and maintains robust free cash flow.

- Mach’s operational flexibility and discipline, evidenced by its ability to shift drilling programs and maintain a reinvestment rate under 50% of operating cash flow, protects net margins and sustains high cash returns even during commodity price downturns.

- As North American natural gas export capacity (e.g., LNG) expands, Mach’s increasing focus on gas production—paired with its low-cost operations and proximity to strategic infrastructure—positions it to benefit from strengthening long-term demand fundamentals, directly impacting revenue and margin growth.

Mach Natural Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Mach Natural Resources's revenue will grow by 29.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.9% today to 25.3% in 3 years time.

- Analysts expect earnings to reach $517.9 million (and earnings per share of $2.29) by about July 2028, up from $159.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.6x on those 2028 earnings, down from 11.1x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.63%, as per the Simply Wall St company report.

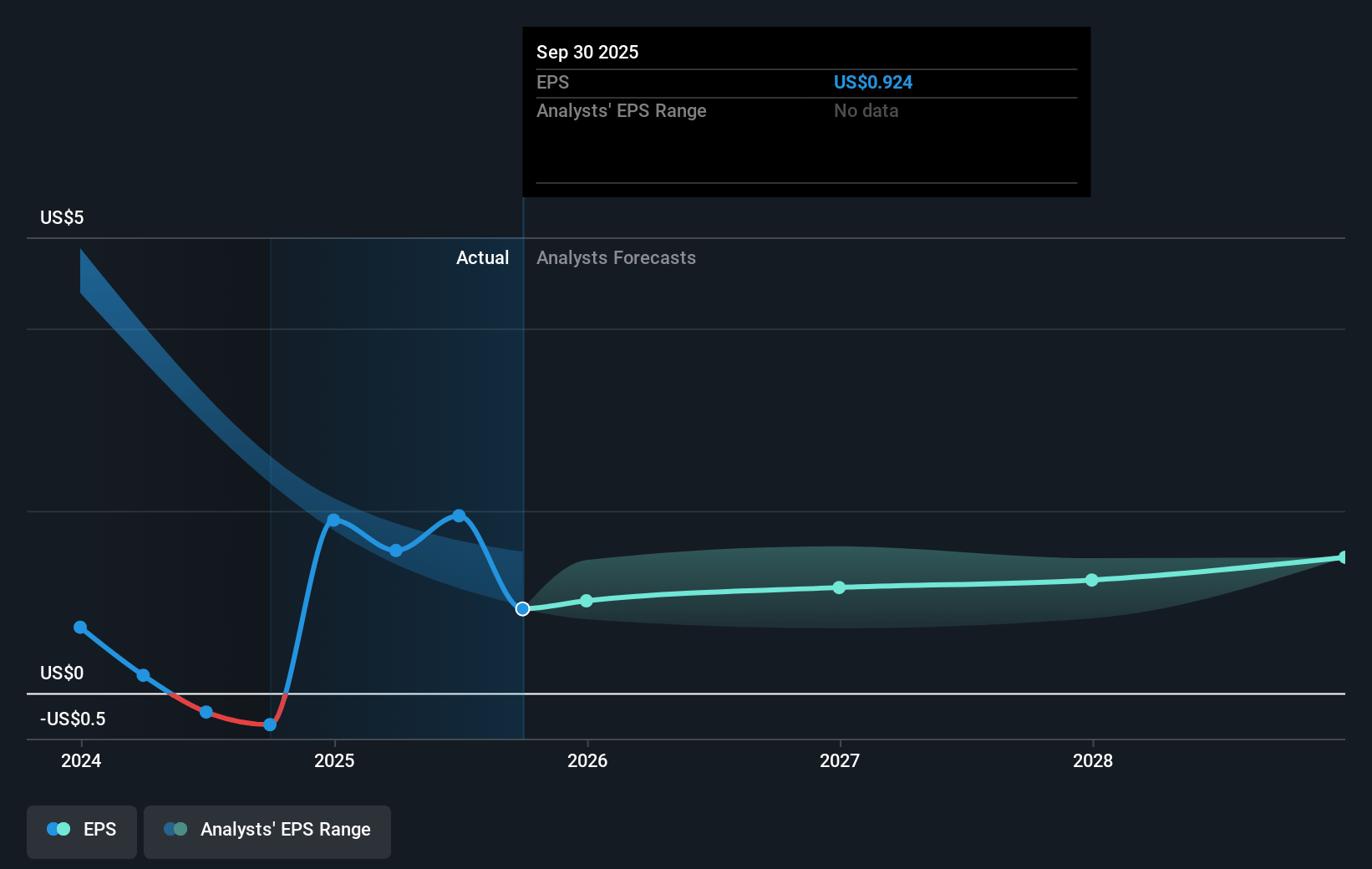

Mach Natural Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating global decarbonization trends, government regulation, and shifting consumer preferences toward lower carbon energy sources could diminish long-term demand for oil and natural gas, negatively impacting Mach’s future revenues and growth prospects over time.

- The company’s increasing focus on natural gas (with gas projected to exceed 70% of the production mix in 2026) exposes it to potential long-term price pressure from rising renewables adoption and the electrification of energy systems, which could compress net margins as commodity prices face structural headwinds.

- Mach relies heavily on a continuous stream of small, accretive acquisitions to support production and distributions. This acquisition-dependent growth model may be harder to sustain if market competition for assets intensifies, regulatory scrutiny over mergers increases, or access to attractive deals diminishes, threatening future earnings and cash flow.

- Much of Mach’s drilling program is contingent on maintaining a disciplined reinvestment rate (limited to 50% of operating cash flow), which could restrict the company’s ability to fully develop its asset base or respond flexibly to unexpected declines in operating cash flow, risking production declines and future top-line revenue growth.

- The company is exposed to risks from regulatory or royalty/tax structure changes in core operating regions (Oklahoma, Texas, Kansas), as well as rising costs for environmental compliance and saltwater disposal, which could increase lease operating costs and materially reduce free cash flow and net margins in the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $22.5 for Mach Natural Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $21.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.0 billion, earnings will come to $517.9 million, and it would be trading on a PE ratio of 7.6x, assuming you use a discount rate of 6.6%.

- Given the current share price of $14.9, the analyst price target of $22.5 is 33.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.