Key Takeaways

- Strategic asset expansion, operational efficiencies, and long-term contracts are expected to drive strong revenue, margin, and cash flow growth ahead of Permian competitors.

- Focus on deleveraging, capital discipline, and fixed-fee contracts will enable stable cash flows, dividend increases, and flexible growth opportunities.

- Heavy reliance on fossil fuel demand, geographic concentration, high leverage, and rising regulatory and competitive pressures threaten long-term profitability and financial flexibility.

Catalysts

About Kinetik Holdings- Through its subsidiaries, operates as a midstream company in the Texas Delaware Basin.

- Kinetik is positioned to capitalize on the multi-year surge in U.S. LNG exports and global petrochemical demand, with significant natural gas and NGL volume growth expected out of the Permian Basin. Their expanded Delaware Basin assets, long-term contracts, and proximity to export hubs should drive higher utilization rates, leading to substantial top-line revenue and EBITDA growth over the next several years.

- With the start-up of the Kings Landing processing complex, incremental capacity coming online, and ongoing investments into both gas and NGL gathering, Kinetik is set to outpace broader Permian growth by capturing outsized market share. This will underpin sustained volume and margin expansion, supporting bullish long-term earnings projections.

- Management is targeting meaningful operational efficiencies, particularly through potential behind-the-meter gas-fired power generation. This initiative is expected to reduce electricity OpEx and insulate the company from power price volatility, directly boosting margins and free cash flow as their internal energy consumption grows.

- The strategic expansion into New Mexico, ongoing integration of bolt-on acquisitions like Durango Permian and Barilla Draw, and full-cycle asset optimization (e.g., the ECCC pipeline interconnecting north and south assets) enhance asset utilization and cross-selling of multi-stream midstream services. These moves will drive step-changes in revenue and cash flow as contract roll-offs allow Kinetik to capture a greater share of processing and ancillary service economics in future years.

- Kinetik’s focus on deleveraging, capital discipline, and the transition toward higher fixed-fee contract coverage provides stable, predictable cash flows—enabling further dividend growth, opportunistic share repurchases, and favorable credit rating migration. This financial flexibility positions the company to capture synergies from future industry consolidation and high-return organic or inorganic growth, supporting continued EBITDA compounding and premium valuation potential.

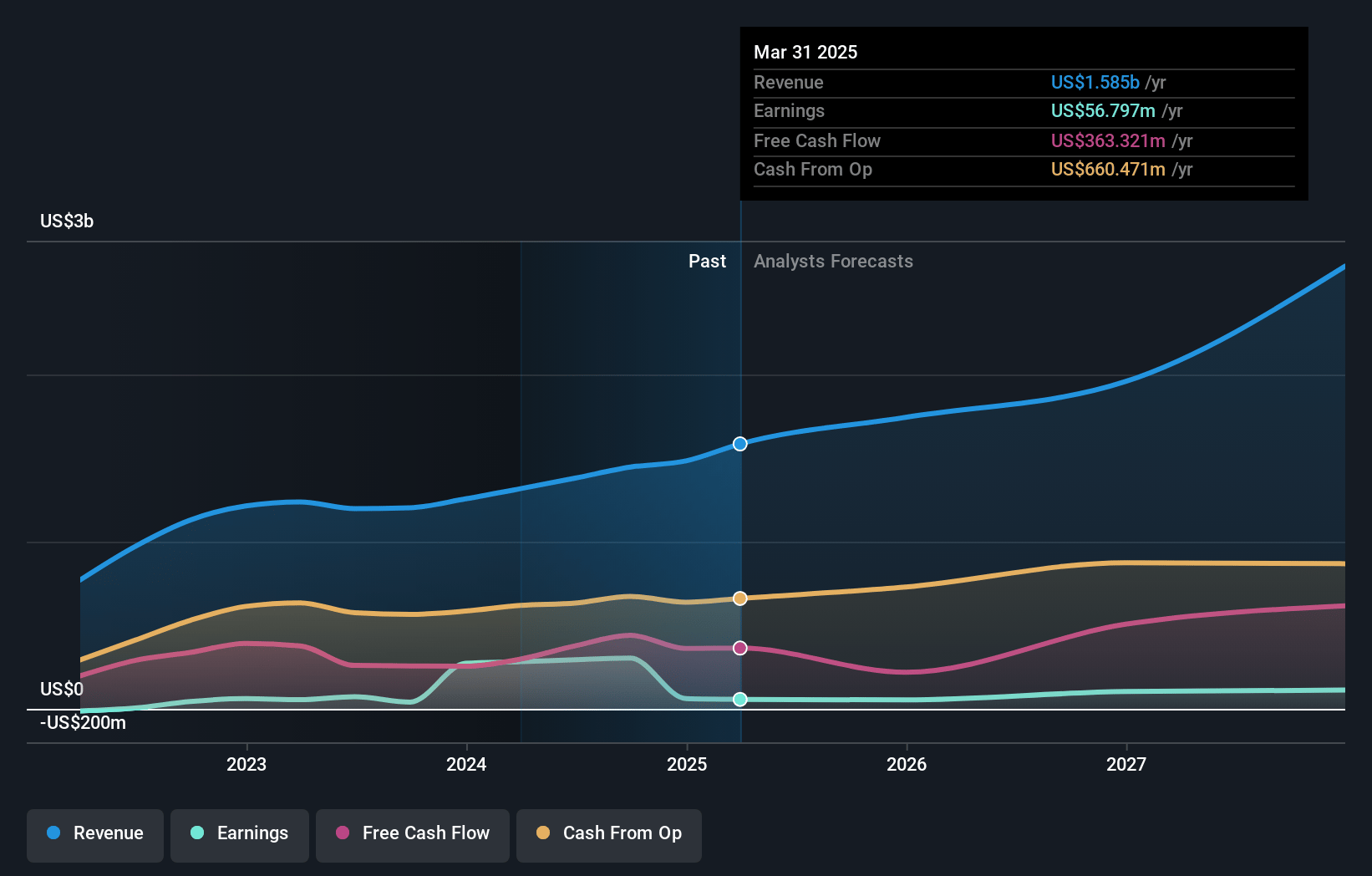

Kinetik Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Kinetik Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Kinetik Holdings's revenue will grow by 33.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.1% today to 11.0% in 3 years time.

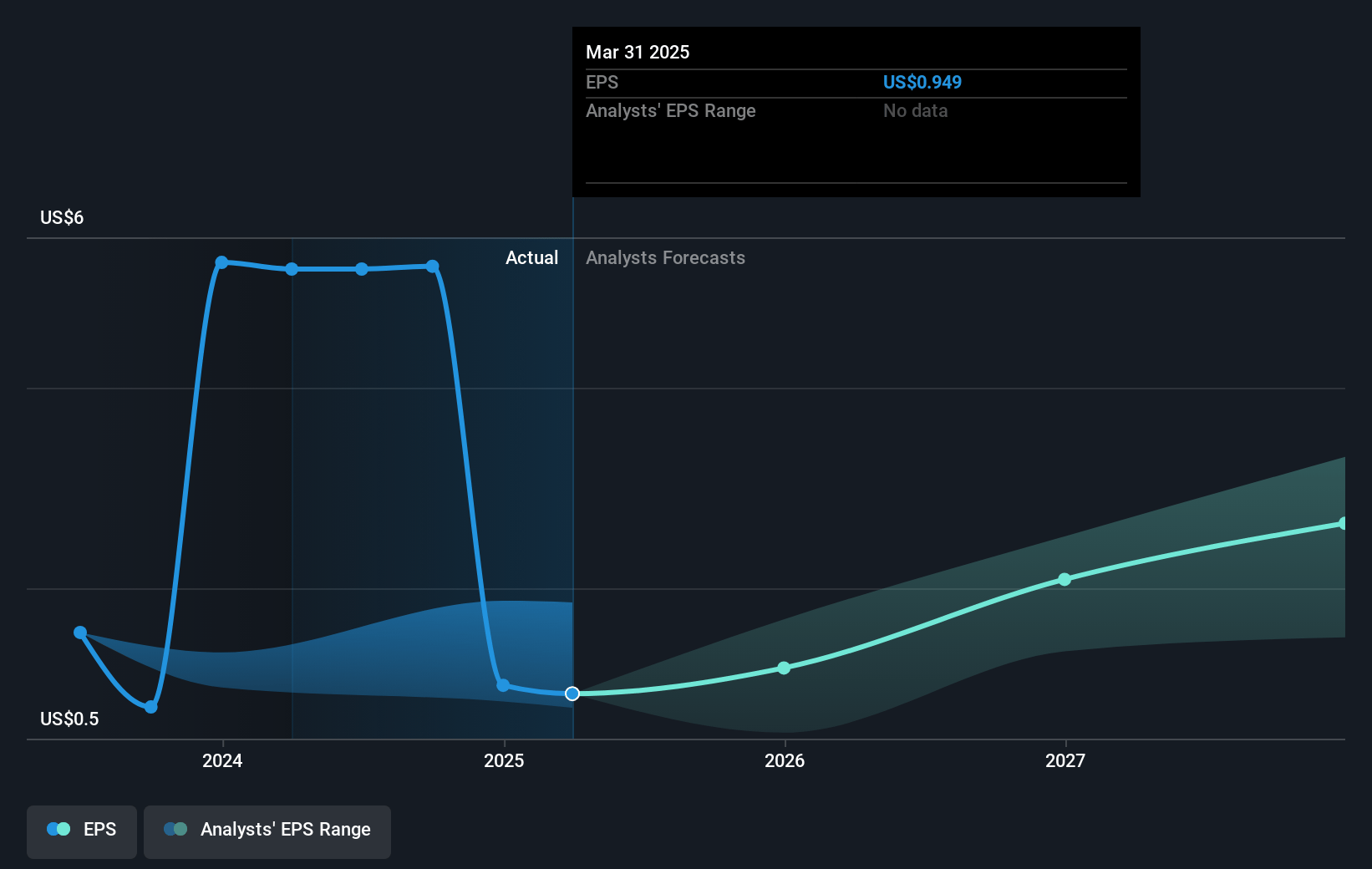

- The bullish analysts expect earnings to reach $383.7 million (and earnings per share of $3.47) by about April 2028, up from $61.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 36.4x on those 2028 earnings, down from 42.8x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to grow by 0.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.46%, as per the Simply Wall St company report.

Kinetik Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Kinetik’s growth and profitability remain highly exposed to fossil fuel demand, as the accelerating global shift toward renewable energy, electrification of transportation, and tighter ESG regulations could diminish demand for midstream assets, pressuring long-term revenues and EBITDA margins.

- Heavy customer concentration in the Permian Basin exposes Kinetik to volatility in producer activity and financial health, making its revenue streams and contract cash flows more vulnerable to localized slowdowns or operational disruptions.

- Despite recent deleveraging, Kinetik still operates with a relatively high leverage ratio and minimal business diversification, which amplifies refinancing risk and could weaken net margins or earnings in periods of commodity price downturns or sector-wide stress.

- The risk of midstream pipeline overcapacity is rising as the Permian faces a wave of new processing and transport infrastructure, potentially leading to excess capacity, lower tariffs, and declining returns on invested capital, all of which would weigh on revenue growth and long-term EBITDA.

- Increasingly stringent decarbonization mandates and rising costs for methane mitigation and carbon management could necessitate higher capital expenditures, eroding profit margins and constraining free cash flow available for dividends and shareholder returns over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Kinetik Holdings is $70.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Kinetik Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.5 billion, earnings will come to $383.7 million, and it would be trading on a PE ratio of 36.4x, assuming you use a discount rate of 7.5%.

- Given the current share price of $43.03, the bullish analyst price target of $70.0 is 38.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:KNTK. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.