Narratives are currently in beta

Key Takeaways

- Expansion into Vaca Muerta and enhanced recovery strategies are set to drive production growth and stabilize revenue despite challenges from mature fields.

- Strong cash flow, liquidity, and financial flexibility support continued investment in high-value projects, sustaining growth and maximizing long-term earnings potential.

- Vulnerability to oil market fluctuations, operational cost increases, and delays in production highlight risks to financial stability and profit margins for GeoPark.

Catalysts

About GeoPark- Operates as an oil and natural gas exploration and production company primarily in Chile, Colombia, Brazil, Argentina, Ecuador, and other Latin American countries.

- GeoPark's expansion into the Vaca Muerta unconventional oil play, which is a significant hydrocarbon resource in Latin America, is expected to drive future production growth and increase revenue as new wells come online. The inclusion of production and cash flow from Vaca Muerta in financial statements later this year is anticipated to positively affect earnings.

- The company's strategic commitment to enhancing recovery rates through water flooding in key blocks like Llanos 34 is projected to improve production efficiency, thereby supporting future revenue stabilization despite declining output from mature fields.

- GeoPark's strong cash flow generation and liquidity position, with cash increasing significantly over recent months, is expected to bolster financial flexibility, enabling continued investment in high-value projects. This, in turn, should support revenue growth and sustain net margins.

- The upcoming release of GeoPark's 2025 work program will address strategic priorities for sustainable growth and capital allocation, emphasizing the potential of new assets in Vaca Muerta. This could lead to improved earnings through prioritized investments designed to maximize long-term value.

- The company has secured local capital market approvals in Argentina, providing financial optimization and flexibility through the potential issuance of $500 million in local debt securities. This could be a catalyst for continued project investment without over-leveraging, ultimately supporting future earnings growth.

GeoPark Future Earnings and Revenue Growth

Assumptions

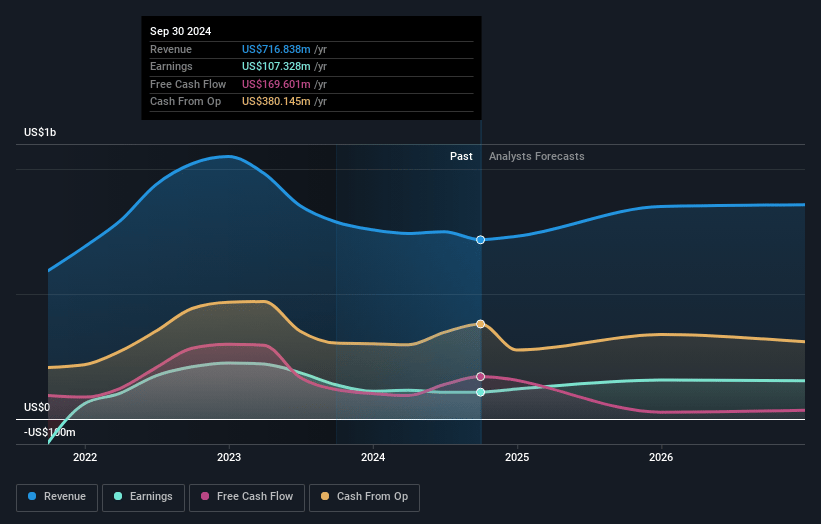

How have these above catalysts been quantified?- Analysts are assuming GeoPark's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.0% today to 17.1% in 3 years time.

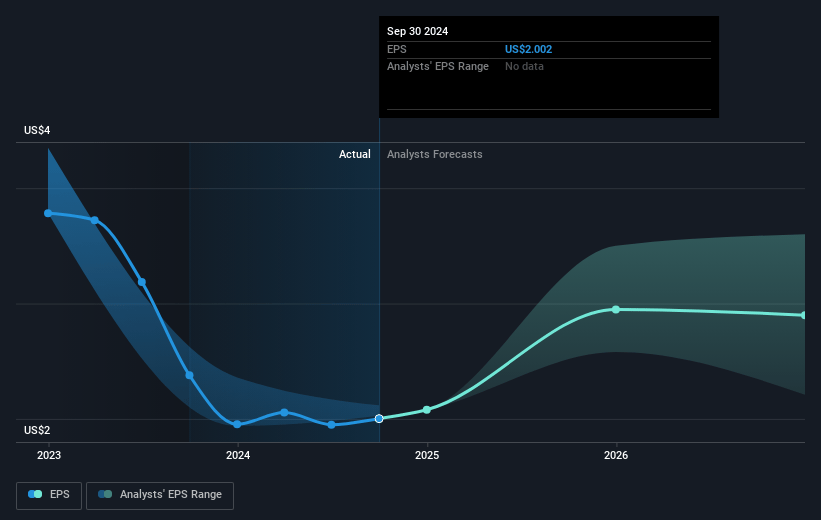

- Analysts expect earnings to reach $150.4 million (and earnings per share of $2.93) by about January 2028, up from $107.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $183.5 million in earnings, and the most bearish expecting $109 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.5x on those 2028 earnings, up from 4.4x today. This future PE is lower than the current PE for the US Oil and Gas industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.87%, as per the Simply Wall St company report.

GeoPark Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decrease in net revenue by 16% from the previous quarter, largely due to lower realized oil prices and production, reflects vulnerability to oil market fluctuations, which can negatively impact future revenues and earnings.

- The substantial increase in operational costs, particularly energy costs due to price volatility in the Colombian electricity market associated with El Niño, raises concerns about maintaining cost efficiency, ultimately affecting net margins.

- The reliance on acquiring and integrating new assets in the Vaca Muerta unconventional oil play poses operational and financial risks, particularly as production and cash flow from these assets are yet to be consolidated, potentially impacting reported earnings in the near term.

- The significant delays in Brazilian production, notably due to equipment maintenance issues, highlight operational risks and can lead to reduced revenue generation from those assets until issues are resolved.

- Increased competition and economic uncertainties, such as changes in tax policies or energy prices within GeoPark's operating regions, may influence long-term financial stability and the ability to sustain profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.33 for GeoPark based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $877.0 million, earnings will come to $150.4 million, and it would be trading on a PE ratio of 7.5x, assuming you use a discount rate of 12.9%.

- Given the current share price of $9.16, the analyst's price target of $15.33 is 40.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives