Narratives are currently in beta

Key Takeaways

- Strategic contract extensions and significant backlog provide revenue stability, supporting sustainable dividends and enhancing financial stability.

- Modern, fuel-efficient fleet ensures regulatory compliance, reducing costs and improving margins amidst growing global LNG demand and favorable interest rates.

- Potential interest rate fluctuations, oversupply in LNG shipping, and geopolitical uncertainties pose risks to revenue, earnings, and net margins.

Catalysts

About FLEX LNG- Engages in the seaborne transportation of liquefied natural gas (LNG) worldwide.

- The company has extended contracts for two of its ships, with expectations to secure longer-term charters at higher rates, which can enhance future revenue and earnings stability.

- There is a significant contract backlog with options extending to 2039, providing a clear pipeline of future earnings and supporting a sustainable dividend policy, likely boosting net margins and financial stability.

- The fleet includes modern, fuel-efficient ships that are better positioned to meet upcoming environmental regulations, which will likely result in lower operational costs relative to competitors and could improve net margins.

- As interest rates have begun to decline, the company has opportunistically increased its hedging on debt, potentially reducing interest expenses and enhancing net margins in future quarters.

- The anticipated growth in global LNG demand and U.S. export projects in the latter part of the decade could drive higher shipping demand, positively impacting revenue prospects and fleet utilization rates.

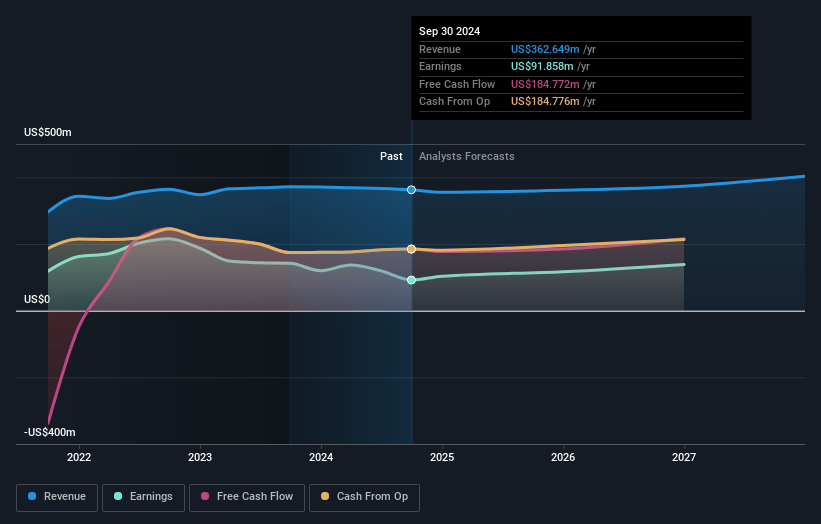

FLEX LNG Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming FLEX LNG's revenue will grow by 3.0% annually over the next 3 years.

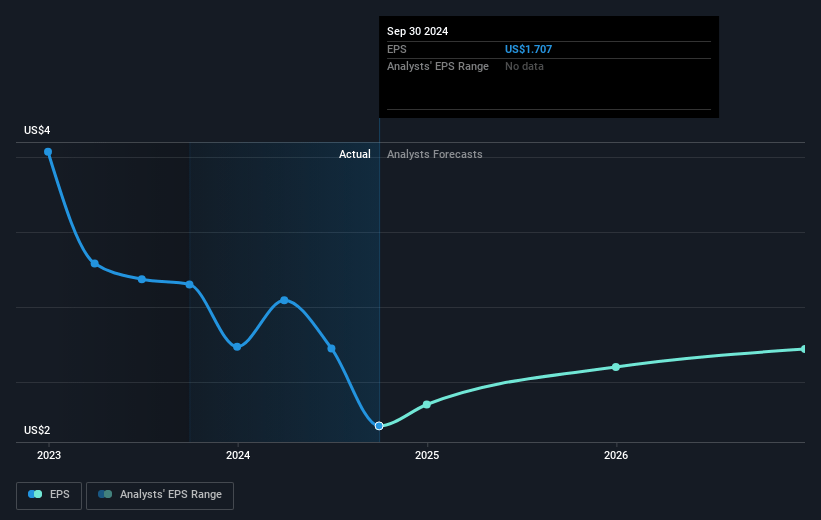

- Analysts assume that profit margins will increase from 25.3% today to 39.4% in 3 years time.

- Analysts expect earnings to reach $156.1 million (and earnings per share of $2.43) by about January 2028, up from $91.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, which is the same as it is today today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.4x.

- Analysts expect the number of shares outstanding to grow by 5.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.91%, as per the Simply Wall St company report.

FLEX LNG Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's exposure to interest rate fluctuations could lead to increased costs, as seen in the soft spot market impact on revenue, and the $10.7 million unrealized loss in Q3. Such fluctuations could negatively impact net margins.

- A potential oversupply in the LNG shipping market, with a high number of ships being delivered, could lead to decreased charter rates, negatively affecting future revenues and earnings.

- Geopolitical uncertainties, such as potential changes in U.S. trade policies under a new administration, could impact global LNG demand dynamics, potentially affecting revenue and earnings growth.

- High cash levels due to past strong operations might be a double-edged sword, potentially leading to inefficient capital allocation if the market downturn persists and executable investment opportunities remain scarce.

- The reliance on long-term charters for revenue stability makes the company vulnerable to potential defaults or renegotiations should market conditions deteriorate or customer financial health weaken, impacting earnings predictability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.33 for FLEX LNG based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $395.8 million, earnings will come to $156.1 million, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 9.9%.

- Given the current share price of $24.38, the analyst's price target of $26.33 is 7.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives