Narratives are currently in beta

Key Takeaways

- Strategic cost reductions and asset sales are intended to strengthen financial stability and improve net margins.

- Diversification through renewable diesel and potential SAF production could enhance earnings amidst evolving market conditions.

- Operational challenges, cash management struggles, regulatory risks, and a difficult market environment threaten CVR Energy's profitability and financial stability.

Catalysts

About CVR Energy- Engages in the petroleum refining and marketing, and nitrogen fertilizer manufacturing activities in the United States.

- The upcoming major turnaround at Coffeyville and the focus on reducing operational costs and capital spending aim to strengthen the balance sheet, which may enhance future net margins.

- CVR Energy is positioning itself to take advantage of potential improvements in market conditions post-turnaround by maintaining adequate liquidity and leveraging capital markets, potentially impacting future earnings.

- Possible exploration of asset sales, including midstream assets, could improve liquidity and financial stability, impacting revenue and earnings by reducing debt and interest expenses.

- Focus on safe, reliable operations and reducing direct operating expenses are strategies to improve cost efficiency and capture rates, potentially increasing net margins.

- Optimizing the renewable diesel unit at Wynnewood, with a potential shift towards SAF production subject to favorable market conditions, could diversify revenue streams and enhance earnings.

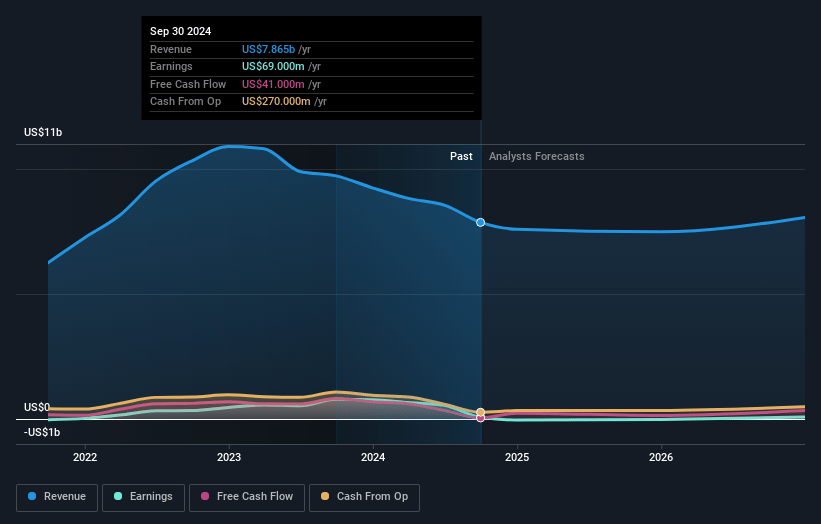

CVR Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CVR Energy's revenue will decrease by -1.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.9% today to 2.2% in 3 years time.

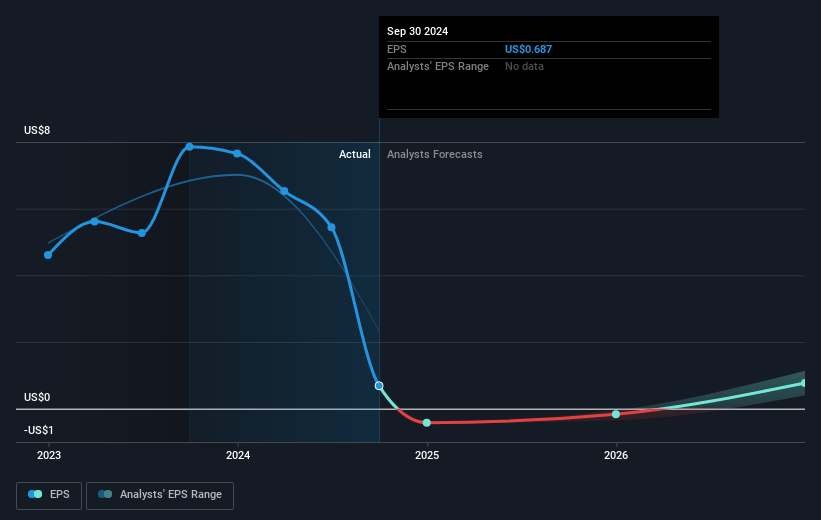

- Analysts expect earnings to reach $170.4 million (and earnings per share of $1.58) by about January 2028, up from $69.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $101 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, down from 28.3x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 2.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.79%, as per the Simply Wall St company report.

CVR Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Unplanned downtime and external power supply outages have led to operational challenges, resulting in decreased crude oil utilization and lost profit opportunities, which negatively impact revenue and earnings.

- The suspension of the quarterly dividend indicates cash flow management challenges as the company aims to preserve liquidity in light of a declining crack spread and anticipated cash needs, affecting net margins and shareholder returns.

- EPA's delays in ruling on small refinery hardship petitions for RFS obligations present regulatory risk, which may result in increased compliance costs and potential operational uncertainty, affecting earnings and net margins.

- A challenging refining market characterized by low mid-cycle crack spreads and oversupply conditions pressures the company's profitability, impacting revenue and net margins adversely in the near to medium term.

- Plans to explore access to capital markets, which might include non-core asset sales and reduced hiring, signal potential financial instability and could affect overall earnings if not efficiently managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $19.83 for CVR Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.6 billion, earnings will come to $170.4 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of $19.44, the analyst's price target of $19.83 is 2.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives