Narratives are currently in beta

Key Takeaways

- Integration of Aera Energy strengthens financials and operational efficiency, boosting revenue and cash flow through synergy execution and capital allocation.

- Growth in carbon management positions California Resources to benefit from decarbonization, with increased revenue potential from electricity demand and shareholder returns.

- Reliance on regulatory approvals, federal incentives, and market conditions poses risks to project timelines, revenue, and cash flow stability.

Catalysts

About California Resources- Operates as an independent oil and natural gas exploration and production, and carbon management company in the United States.

- The successful integration of Aera Energy has positioned California Resources as a larger and financially stronger entity, with high-quality, low decline, and low capital intensity fields, allowing for more efficient capital allocation through workovers and sidetracks, which can boost revenue and cash flows.

- The execution of $235 million in annual synergies from the Aera merger, with over 55% already implemented, will enhance returns and grow cash flows, improving net margins and earnings.

- California Resources' growing Carbon Management business, with projects such as Carbon TerraVault, positions the company to thrive in California's decarbonization efforts, which can increase future revenue streams.

- The ability to monetize excess power capacity from natural gas production and power generation capabilities allows California Resources to meet accelerating electricity demand, supporting revenue and earnings growth.

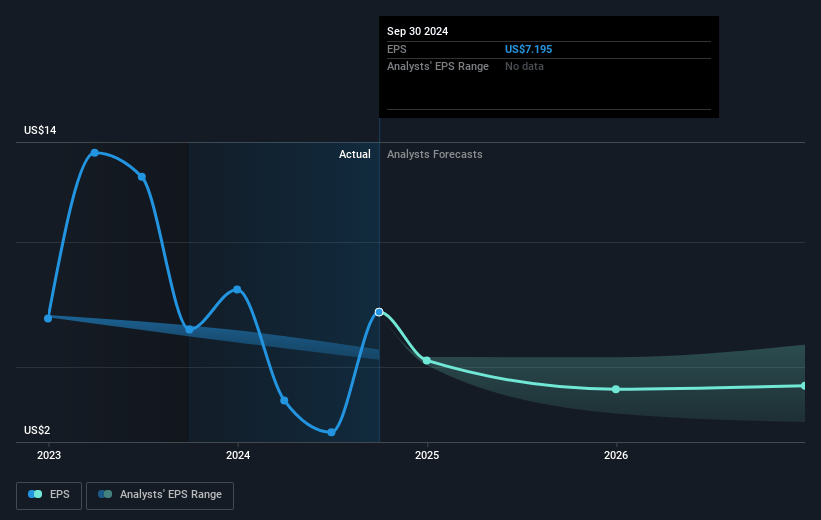

- California Resources' track record of returning cash to shareholders and capital discipline, with significant cash flow expected from hedges and synergies, supports continued shareholder returns through dividends and buybacks, positively impacting earnings per share (EPS).

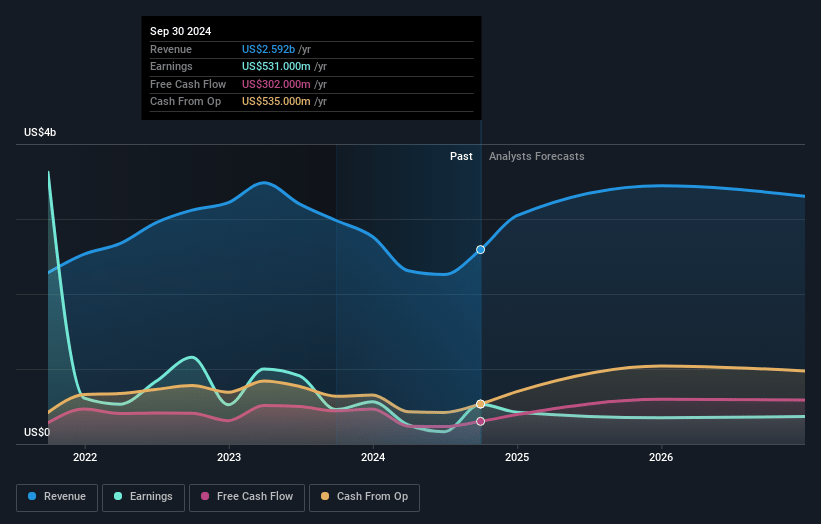

California Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming California Resources's revenue will grow by 9.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.5% today to 14.9% in 3 years time.

- Analysts expect earnings to reach $511.7 million (and earnings per share of $5.77) by about January 2028, down from $531.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.7x on those 2028 earnings, up from 8.8x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.53%, as per the Simply Wall St company report.

California Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Reliance on existing local infrastructure for carbon management projects is contingent on pending regulatory approvals, such as CO2 pipeline legislation, which if delayed or restricted, could impact project timelines and cash flow projections.

- Future revenue streams from their Carbon Capture and Storage (CCS) projects rely on federal incentives like the IRA bill, and any uncertainty or reduction in these incentives could affect the financial viability of these initiatives.

- Cash flow generation for shareholder returns heavily depends on current favorable market conditions, and any downturn in oil prices could reduce cash flow, affecting dividend and buyback capabilities.

- Progress in decarbonizing and capturing carbon emissions involves significant upfront investment and partnership dependencies, which introduces execution risk that could impact earnings if not realized efficiently.

- Continued reliance on hedging for oil price stability indicates exposure to market volatility, and a shift in market dynamics could negatively affect revenue if hedging strategies do not effectively align with commodity price fluctuations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $68.62 for California Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $57.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $511.7 million, and it would be trading on a PE ratio of 14.7x, assuming you use a discount rate of 7.5%.

- Given the current share price of $51.09, the analyst's price target of $68.62 is 25.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives