Key Takeaways

- Premium LNG export access and low-cost assets position Antero to benefit from global and domestic demand growth, supporting strong revenue and production stability.

- Improved drilling efficiency, cost discipline, and rising NGL margins drive wider earnings and cash flow, enabling rapid deleveraging and increased shareholder returns.

- The company faces long-term earnings pressure from energy transition trends, market risks, operational constraints, and above-average leverage, threatening its financial resilience and growth.

Catalysts

About Antero Resources- An independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States.

- Antero’s premium access to LNG export infrastructure, highlighted by its firm transportation position and the ramp-up of new US LNG terminals such as Plaquemines, is set to significantly boost realized natural gas prices relative to NYMEX. As global LNG demand grows, especially in Europe and Asia, these export linkages should support sustained improvements in Antero’s revenue and free cash flow, justifying bullish projections for the next several years.

- Accelerating electrification trends, increased gas-fired power generation, and sustained coal-to-gas switching in the US and abroad are driving record ResComm and power burn natural gas demand. Antero’s low-cost, high-productivity Appalachian assets are well positioned to benefit from this enduring demand growth, creating a tailwind for both top-line production growth and long-term volume stability.

- Structural gains in drilling and completion efficiency—cycle times cut by 25% and drilling costs per foot declining year-over-year—allow Antero to maintain flat or growing production with significantly reduced maintenance capital. This ongoing cost discipline and productivity improvement is expected to widen EBITDA margins and deliver outsize earnings growth in future periods as commodity prices rise.

- High and rising NGL realizations, driven by a premium marketing strategy and robust domestic/export demand, have meaningfully increased the profit margin of Antero’s liquid-rich production. With C3+ NGLs selling at a sizable premium to Mont Belvieu and new domestic/external contracts at favorable rates, there is potential for sustained net margin expansion and incremental cash flow over the next several years.

- Rapid deleveraging due to outsized free cash flow, combined with a clear path to net debt zero and a committed capital return strategy, positions Antero for substantial shareholder returns through buybacks. As the company’s debt profile improves and cash generation accelerates, earnings per share growth is likely to be materially enhanced, aligning with the most optimistic projections for value creation.

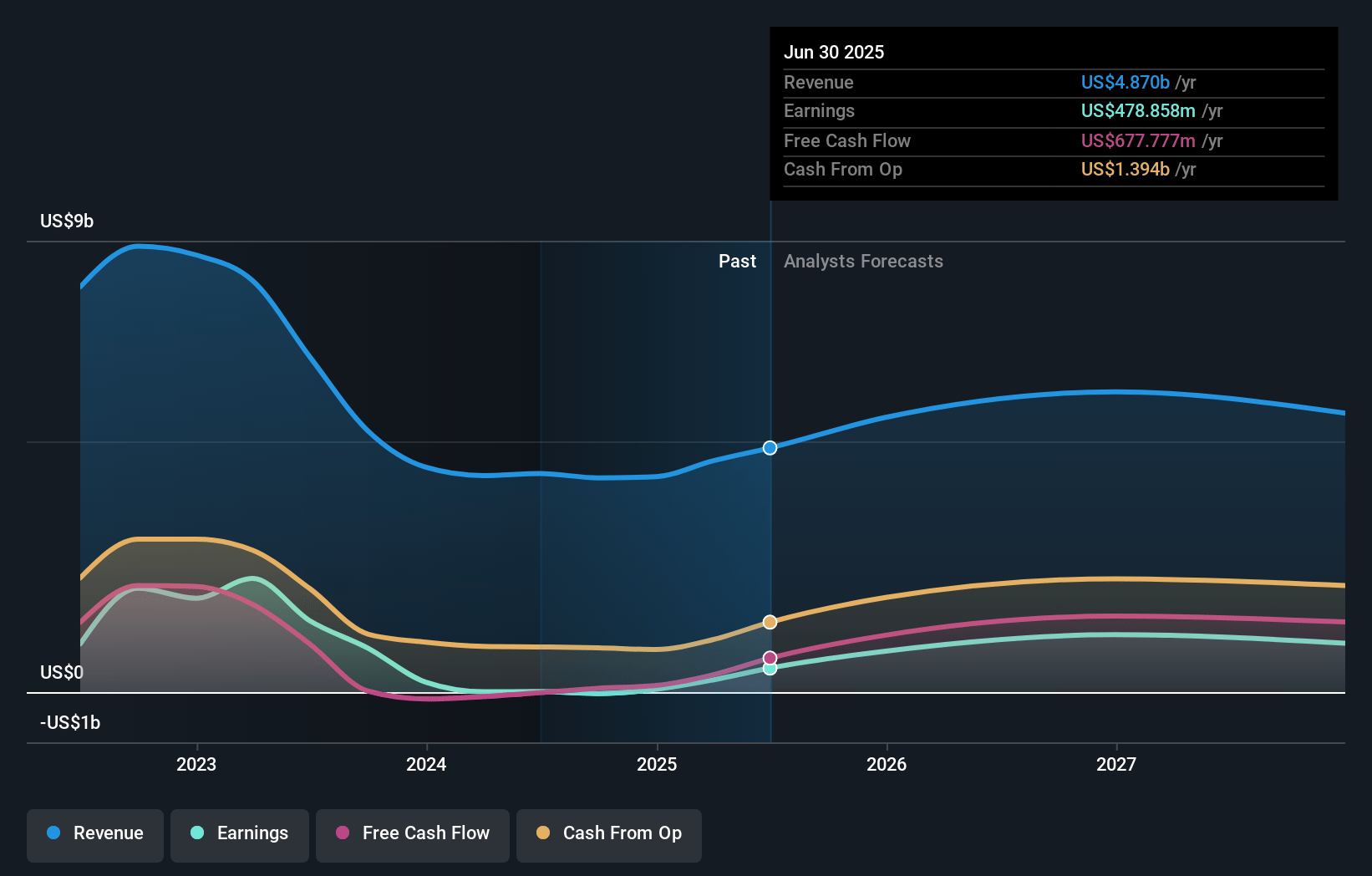

Antero Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Antero Resources compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Antero Resources's revenue will grow by 13.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.3% today to 20.3% in 3 years time.

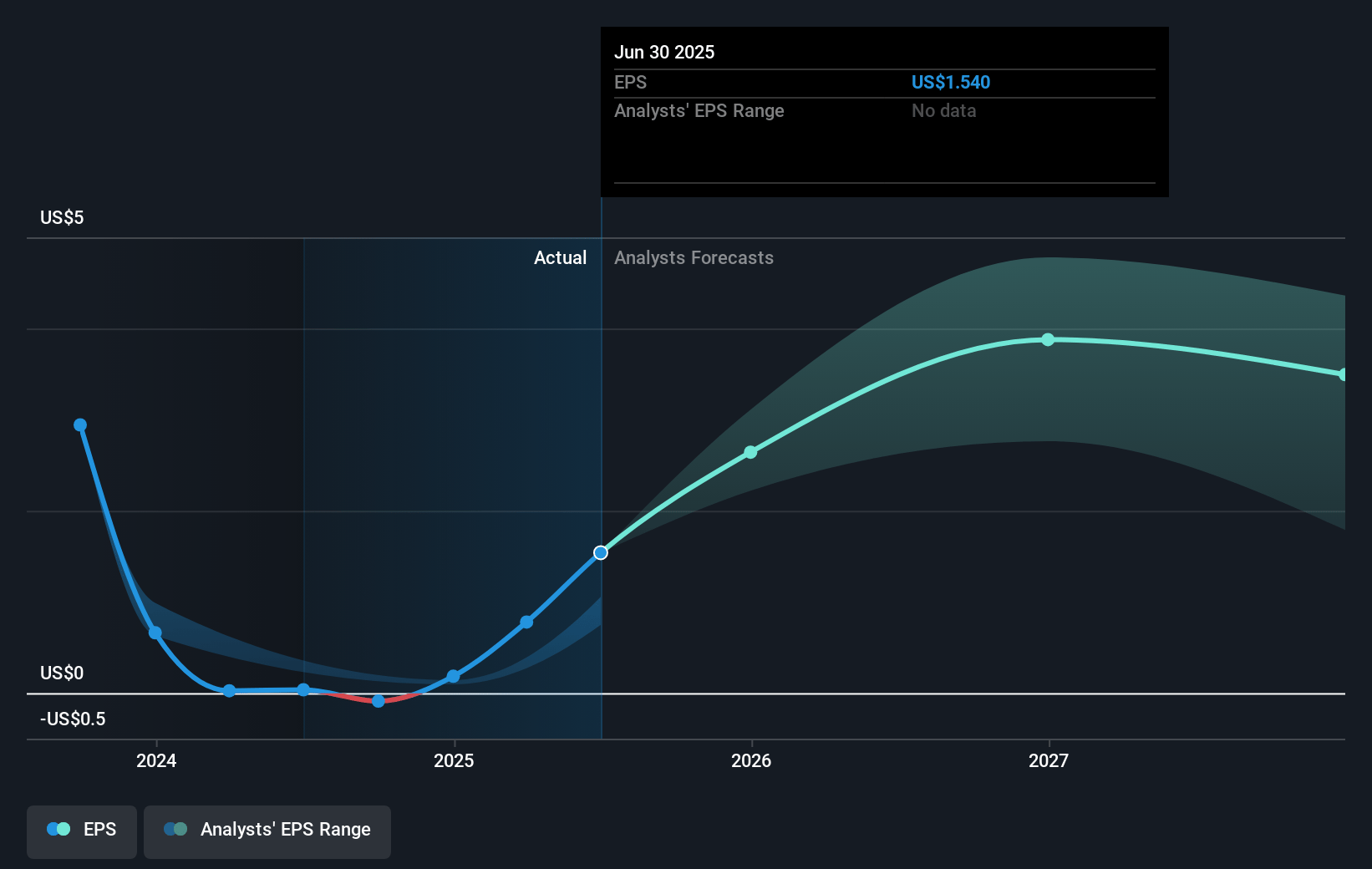

- The bullish analysts expect earnings to reach $1.3 billion (and earnings per share of $4.04) by about April 2028, up from $57.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.0x on those 2028 earnings, down from 178.5x today. This future PE is greater than the current PE for the US Oil and Gas industry at 11.4x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.21%, as per the Simply Wall St company report.

Antero Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating global transition toward renewables, combined with rising ESG and regulatory pressures, threatens long-term demand for natural gas and NGLs, potentially leading to structurally lower commodity prices and persistent revenue declines.

- Heavy reliance on high NGL and propane export premiums exposes Antero to risk if dock capacity outpaces global demand growth, export arbitrage narrows, or Mont Belvieu prices weaken, which could erode net margins and reduce free cash flow resilience.

- Above-peer leverage and the need for continuous drilling and capital expenditures to maintain flat production may constrain Antero’s ability to generate and retain free cash flow over the long term, especially if commodity prices face secular headwinds.

- Concentration in the Appalachian basin increases exposure to regional price differentials, infrastructure constraints, and potential adverse local or federal regulations, possibly creating volatility or pressure on realized pricing and operating margins.

- Technological changes such as improved renewables, battery storage, and increasing electrification could suppress future natural gas demand growth, leading to oversupply conditions and persistent commodity price weakness that would undermine long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Antero Resources is $56.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Antero Resources's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $56.0, and the most bearish reporting a price target of just $23.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $6.2 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 17.0x, assuming you use a discount rate of 7.2%.

- Given the current share price of $32.83, the bullish analyst price target of $56.0 is 41.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:AR. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.