Last Update 10 Dec 25

Fair value Decreased 0.21%WFRD: Offshore Upside Will Emerge As Margins Strengthen Despite Soft Macro

Analysts have nudged their price target for Weatherford International slightly higher to the low $80s range, reflecting modestly improved fair value and profitability expectations, as recent earnings beats, margin gains and a tentative upturn in oil and gas activity support a cautiously constructive outlook despite a still soft macro backdrop.

Analyst Commentary

Bullish analysts highlight that Weatherford's recent Q3 earnings beat and raised Q4 outlook validate management's execution on margin expansion and cost discipline, supporting the case for a higher valuation multiple relative to historical norms.

They argue that the company is increasingly leveraged to an eventual recovery in international and offshore markets, positioning it to capture higher margin growth as activity normalizes from currently soft levels.

Bullish Takeaways

- Upward revisions to price targets into the high $70s to low $80s range reflect improving confidence in Weatherford's earnings power and cash generation over the next several quarters.

- Margin improvement in Q3 and a stronger Q4 outlook signal structural gains in profitability, which bullish analysts see as underappreciated in current valuation metrics.

- Exposure to international and offshore markets is viewed as a medium term growth driver, with potential for outsized operating leverage as spending cycles recover.

- Recent stabilization and modest improvement in oil and gas activity are seen as early signs that the trough in the cycle may be behind the company, supporting a more constructive growth trajectory.

Bearish Takeaways

- Bearish analysts remain focused on the soft macro backdrop, particularly renewed pressure on crude prices, arguing that this could cap near term multiple expansion despite recent operational outperformance.

- There is concern that any further weakening in commodity prices may prompt another round of activity cuts, tempering revenue growth assumptions embedded in higher price targets.

- U.S. land markets are still viewed as structurally challenged, with some analysts pushing out the timing of meaningful upside to as late as 2026, which could limit near term top line acceleration.

- Execution risk around sustaining recent margin gains through a choppy cycle leaves some investors hesitant to fully re rate the shares until visibility on demand and pricing improves.

What's in the News

- The Trump administration is reportedly drafting a plan to reopen California coastal waters to offshore drilling between 2027 and 2030, which could potentially increase long-term demand for offshore services providers including Weatherford (Washington Post).

- Weatherford has formed a strategic partnership with Maersk Training to deliver IADC-accredited Managed Pressure Drilling training programs globally, with the goal of setting a new standard in simulation-based MPD competency.

- The company has affirmed that it is on track to meet full-year 2025 guidance and is forecasting slightly higher fourth-quarter 2025 revenues of $1.245 billion to $1.28 billion, led by markets in the Middle East, North Africa, Asia and Latin America.

- Weatherford has completed a major tranche of its share repurchase program, buying back 2.8 million shares for $193.05 million since July 2024, representing roughly 3.9 percent of shares outstanding.

- The launch of the Weatherford Industrial Intelligence digital portfolio, which includes edge devices, autonomous surveillance, virtual flow metering and a unified data model, is expanding the company’s software and automation footprint across the energy value chain.

Valuation Changes

- The fair value estimate has edged down slightly to approximately $83.73 from $83.90, indicating a marginal reduction in modeled intrinsic value.

- The discount rate has fallen slightly to about 7.56 percent from 7.59 percent, reflecting a modestly lower required return in the valuation model.

- The revenue growth assumption has declined marginally to roughly 2.44 percent from 2.46 percent, signaling a slightly more conservative top line outlook.

- The net profit margin forecast has eased slightly to about 10.89 percent from 10.93 percent, implying a small downward adjustment to long term profitability expectations.

- The future P/E multiple has risen very slightly to around 12.18x from 12.16x, suggesting a minimally higher valuation applied to projected earnings.

Key Takeaways

- Advanced technology solutions and a shift to higher-margin services position the company for margin expansion amid rising industry complexity and evolving customer needs.

- Balance sheet strength and disciplined capital allocation enable investment in innovation, cost optimization, and attractive market opportunities, enhancing resilience and long-term returns.

- Prolonged market weakness, cash flow risks, pricing pressures, and operational divestitures could challenge Weatherford's margins, profitability, and long-term growth prospects.

Catalysts

About Weatherford International- An energy services company, provides equipment and services for the drilling, evaluation, completion, production, and intervention of oil, geothermal, and natural gas wells worldwide.

- Weatherford's expanding portfolio of advanced technologies (e.g., managed pressure drilling, TITAN RS for well abandonment, CO2 storage project contracts) is positioning the company to benefit as oilfield operations become more complex and customers seek solutions for challenging reservoirs, supporting future revenue and margin expansion as global energy producers prioritize efficiency.

- Stabilization or future growth in key emerging and international markets-such as Mexico (with PEMEX's anticipated payment improvements), the Middle East, and Asia Pacific-aligns with long-term global energy demand growth, setting the stage for revenue rebounds as regional activity bottoms out and investments resume.

- Ongoing company transformation-shifting from legacy, low-margin businesses (recent divestitures in Argentina and slimming down unprofitable offerings) toward higher-margin, technology-enabled services, digitalization, and integrated projects-should drive both net-margin expansion and earnings resilience through the cycle.

- Strong balance sheet, high liquidity, and disciplined capital allocation-including continued share repurchases, opportunistic debt reduction, and capacity for M&A-provide the flexibility to invest in innovation, enter attractive new markets, and enhance shareholder returns, with positive impacts on free cash flow and long-term EPS.

- Accelerated multiyear cost optimization-embedding automation, productivity gains, and lean process improvements-will yield ongoing structural reductions in operating costs, supporting free cash flow conversion and EBITDA margin improvement even if near-term volumes remain pressured.

Weatherford International Future Earnings and Revenue Growth

Assumptions

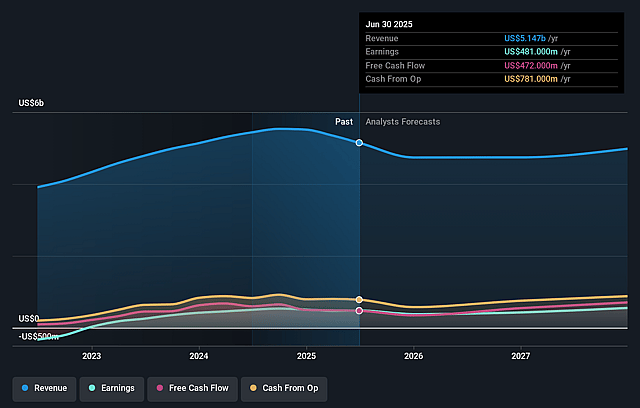

How have these above catalysts been quantified?- Analysts are assuming Weatherford International's revenue will decrease by 0.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.3% today to 10.1% in 3 years time.

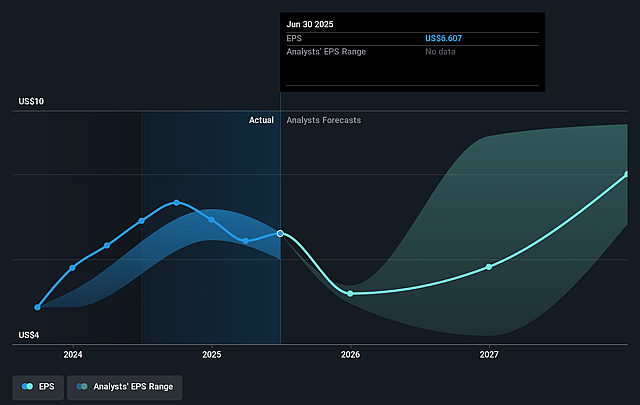

- Analysts expect earnings to reach $514.2 million (and earnings per share of $7.27) by about September 2028, up from $481.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.8x on those 2028 earnings, up from 9.2x today. This future PE is lower than the current PE for the US Energy Services industry at 15.0x.

- Analysts expect the number of shares outstanding to decline by 1.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.31%, as per the Simply Wall St company report.

Weatherford International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Weatherford is facing significant near-term and potentially prolonged international market softness (notably in Saudi Arabia and other key geographies) with expectations for suppressed activity and revenue through at least mid-to-late 2026, suggesting long-term revenue and earnings could underperform if global oilfield spending remains weak.

- The company remains heavily exposed to payment delays and volatility in markets like Mexico, where visibility on receivables and cash collections is low and dependency on government/Pemex funding introduces ongoing working capital and free cash flow risk.

- There is heightened pricing pressure in both North American and select international markets, particularly in service businesses with declining activity; this could drive continued margin compression and impact net earnings, especially if oversupply and industry competition intensify.

- Uncertainty surrounding tariffs and trade disruptions (including inventory timing in the U.S.) may lead to further margin dilution and demand reduction, creating unpredictable swings in cost structure and impacting overall profitability and cash generation.

- Continued divestitures and exits from unprofitable or capital-intensive businesses (e.g., Argentina), though intended to streamline operations, may reduce scale and impair long-term growth potential if not offset by organic or inorganic expansion, thereby possibly limiting top-line growth and sustained earnings improvement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $69.0 for Weatherford International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $74.0, and the most bearish reporting a price target of just $58.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.1 billion, earnings will come to $514.2 million, and it would be trading on a PE ratio of 11.8x, assuming you use a discount rate of 8.3%.

- Given the current share price of $61.92, the analyst price target of $69.0 is 10.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Weatherford International?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.